Gold Key Points

- The bullish case for gold hinges on expectations for a global central bank “pivot” to interest rate cuts early next year.

- After a big dovish shift in market expectations last week, there’s potential for the pendulum to swing back toward a more balanced outlook for central banks.

- A break below last Thursday’s low and the near-term bullish channel in the $2030 zone could open the door for a deeper pullback toward $2000.

Gold Fundamental Analysis

If I described the current market environment, with a weakening US dollar, falling yields, geopolitical tensions, and an historically strong season period for gold, you probably wouldn’t be surprised to hear that the yellow metal is rallying.

However, if I told you that gold spiked roughly 3.5% in less than an hour to hit record highs in low liquidity Asian session trade, you’d probably be a bit skeptical of the move.

As it turns out, all of the above statements are true... and the market clearly expressed skepticism with today’s early spike as gold is now trading lower on the day.

Outside of unpredictable geopolitical developments, the bullish case for gold hinges on expectations for a global central bank “pivot” to interest rate cuts early next year, and while that policy shift looks increasingly likely, markets may be overestimating the speed and extent of the shift.

In the US for example, traders were pricing in as many as six 25bps interest rate cuts from the Federal Reserve next year, starting as soon as the central bank’s March meeting. Even if inflation continues to moderate and the labor market slows, March seems like the absolute earliest that Jerome Powell and Company could conceivably start cutting interest rates, so we may be approaching a scenario where the most dovish possible outcome is already almost fully discounted.

Time will tell, but after a big dovish shift in market expectations last week, there’s potential for the pendulum to swing back toward a more balanced outlook for central banks as we head into the holiday period.

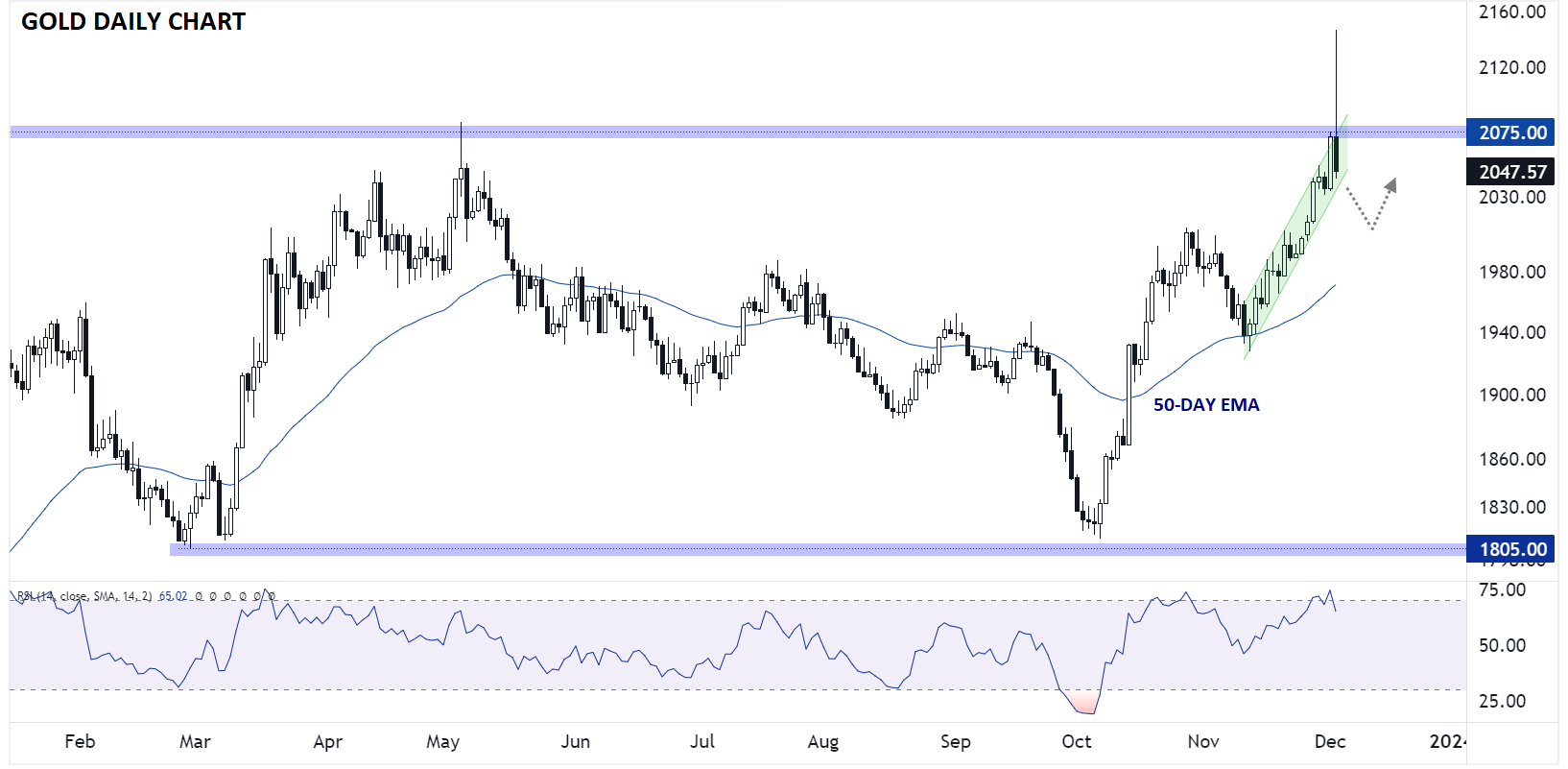

Gold Technical Analysis – XAU/USD Daily Chart

Source: TradingView, StoneX

Looking at the chart, we can see today’s dramatic reversal in gold more clearly. As we go to press, the yellow metal is trading down nearly 5% from its intraday high near $2150. The massive daily range is suggestive of a significant candle with high trading volume, so assuming we close today below the $2075 level, it could mark a near-term top for the yellow metal.

Moving forward, a break below last Thursday’s low and the near-term bullish channel in the $2030 zone could open the door for a deeper pullback toward $2000, near the rising 50-day EMA before the longer-term bullish trend reasserts itself.

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter: @MWellerFX