Oil's bull run continues

Oil prices are on the rise again today, recouping some of the 3.5% losses from the previous session. Oil moves back towards the fresh 7-year high reached on Monday and is set to book its ninth weekly gain this week. Oil has rallied 20% so far this year and could soon hit the much hyped $100 per barrel.

Here we look at what has been driving oil prices and where they could go from here.

Russia – Ukraine conflict

The price of oil has been the clearest example of the markets pricing in the risk of Russia invading Ukraine. This is for two reasons:

- Ukraine is a key transit hub for oil from Russia to Europe, fears that Russia could slow supplies or even supply disruption are keeping the price of oil supported.

- Should Russia invade Ukraine the West would likely apply sanctions on Russian oil.

Russia saying that it was pulling some troops back from the Ukraine border, raised optimism that armed conflict would be avoided and pulled oil prices sharply lower yesterday. However today NATO has raised doubts over Russia’s efforts to deescalate, lifting oil prices once again.

Russian, Ukraine headlines are a key driver for oil prices and given that we don’t know what Putin plans to do next, volatility is likely to remain high. What is clear is that if Russia does invade oil prices will quickly scale to $100.

US-Iran nuclear deal talks

Talks between US and Iran over reviving the nuclear deal have been making progress in fits and starts over recent weeks. Should the deal be revived then sanctions on Iranian oil could be lifted and Iranian oil released back into the market. However, progress has slowed in the later stages of discussions and there are doubts over whether a deal will actually be pushed over the line.

Tight supply & OPEC+

As economies reopen, demand has ramped up, but supply has failed to keep up. Whilst OPEC+ have increased production quotas, by 400k bpd a month, in an attempt to address this higher demand, they have failed to follow through and meet those targets, leaving a gap between oil supply and demand, which is lifting the price. The International Energy Agency have called on OPEC+ to close this 1 million barrel per day gap in order to lower the price of oil and reduce volatility. Unless OPEC+ countries take action to address

A hawkish Fed

It's worth pointing out that aggressive moves by the Fed to hike interest rates could see the oil rally stall. Not only would tighter monetary policy slow growth and therefore demand, but the Fed's actions could also boost the value of the USD. A stronger USD can have the effect of pulling on oil prices, as the commodity which is priced in USD becomes more expensive for buyers with foreign currencies.

Learn more about trading oilWhere next for WTI oil prices?

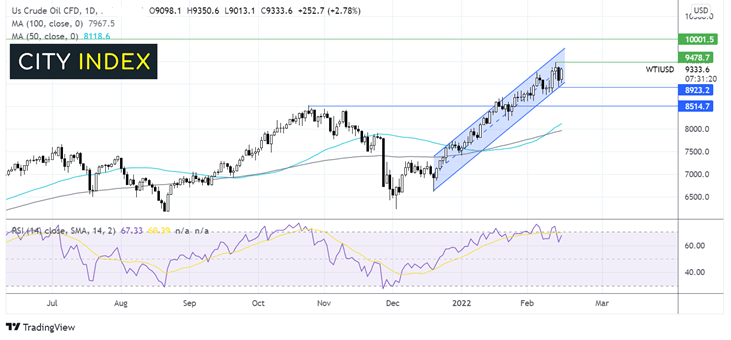

Oil has been trading within a rising channel since December 20, with yesterday’s pullback once again testing the rising support line of the channel, whilst also bringing prices out of overbought territory. The 50 sma has also crossed above the 100 sma in another bullish signal.

Buyers will need to break above this week’s high and the 7-year high of 94.70 in order to attack 96.40 the upper band of the channel, in order to target 100.

Sellers will look for a move below 89.34 yesterday’s low, opening the door to 85.10 the late October high. A move below here could negate the uptrend.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.