Given that the UK economy is struggling with high inflation and an energy crunch, it is difficult to see an end in the cable’s bear trend just yet. This morning saw UK consumer prices come in an annual pace of +9.9% in August. Although it was down from 10.1% YoY in July and below the 10.2% expected, inflation remains far too high to talk about peak inflation just yet, or for the BoE to ease off the hiking cycle. UK PM Liz Truss’ energy support package is designed to keep inflation contained, although any sort of government spending should in theory be inflationary anyway. So, it is difficult to see how the support package will help bring inflation under control.

In the US meanwhile, inflation is continuing to remain hot, underscoring the view that the Fed is going to continue front-loading interest rate hikes in order to tame prices. Following yesterday’s higher than expected CPI data, the latest US Producer Price Index came in roughly in line. The headline printed +8.7% YoY vs +9.8% YoY in July, but the core measure of PPI was higher-than-expected at +7.3% vs. 7.1% eyed, although down from +7.6% in July.

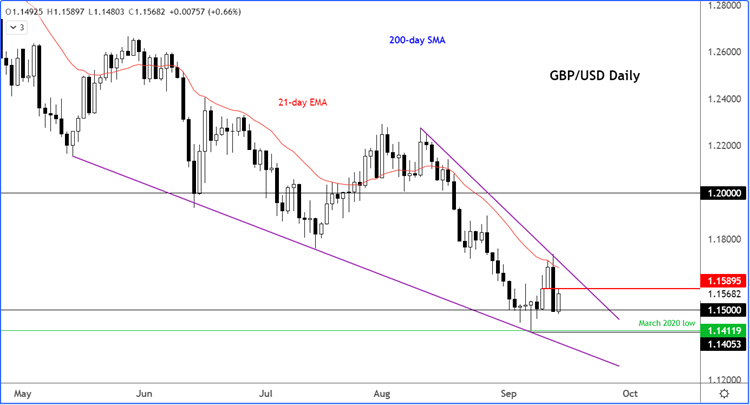

The GBP/USD was testing resistance around 1.1590, the low from Monday, at the time of writing. This level was previously support but after Tuesday’s breakdown, it may turn into resistance. If the sellers step in here, then a push back down to the 1.15 handle would become likely. The March 2020 low at just above the 1.14 handle was tested last week. That level would be our extended objective in the event of a sell-off.

Although the GBP/USD has bounced back, it has done so inside a larger bear trend. The lower lows and lower highs mean the trend is still bearish and any bounce back should be taken with a pinch of salt until we see a key reversal. As a minimum, I would like to see the GBP/USD break outside of the falling wedge pattern before turning bullish.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade