The Fed hiked rates by 75bps to bring the Fed Funds rate to the 3.75%-4.00% range, as expected. For a complete rundown and FOMC recap, see my colleague Matt Weller’s article here.

Everything you wanted to know about the Federal Reserve

Why was it dovish? It was due only to a few words: The Fed “will consider cumulative tightening and policy lags”. Does that mean that the Fed is done hiking rates? No. Does it mean that the Fed may want to take a meeting to see how the lagging effects of rate hikes are working? Yes. As a result, the S&P 500 rose by 50 handles to just above 3900, while the US Dollar Index fell to near 110.50.

However, in the press conference that followed, Powell said (among other hawkish comments) that it is “very premature to take about pausing rate hikes”. As a result, the S&P 500 dropped 110 handles to near 3782, while the DXY bounced back to near 112.00.

On a 15-minute timeframe, we can see how EUR/USD acted upon the release of the FOMC statement, as well as the price action during the press conference:

Source: Tradingview, Stone X

Trade EUR/USD now: Login or Open a new account!

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

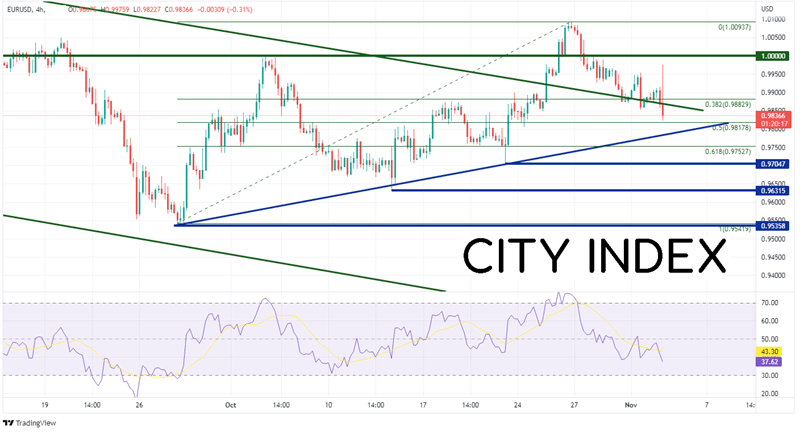

On a 240-minute timeframe, the latest bar shows that EUR/USD went bid and reversed, heading towards the lows of the day. First support is at the 50% retracement level from the lows of September 28th to the highs of October 26th near 0.9818. Below there, price can fall to the upward sloping trendline from the September 28th lows near 0.9783, then the 61.8% Fibonacci retracement level from the above-mentioned timeframe near 0.9753. Previous lows offer some support at 0.9705 and 0.9632, before the September 28th lows of 0.9536. Resistance is back at today’s highs of 0.9976.

Source: Tradingview, Stone X

To summarize, the statement was read as dovish, while Powell’s press conference was taken as hawkish. With the Fed not even thinking or discussing the possibility of pausing, markets may be realizing that lowering inflation, in line with the Fed’s 2% goal, may take a lot longer than most had anticipated!

Learn more about forex trading opportunities.