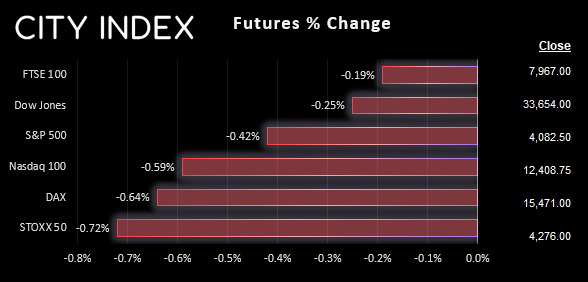

Asian Indices:

- Australia's ASX 200 index fell by -60.2 points (-0.81%) and currently trades at 7,350.10

- Japan's Nikkei 225 index has fallen by -192.43 points (-0.69%) and currently trades at 27,504.01

- Hong Kong's Hang Seng index has fallen by -121.37 points (-0.58%) and currently trades at 20,866.30

- China's A50 Index has fallen by -30.85 points (-0.23%) and currently trades at 13,560.33

UK and Europe:

- UK's FTSE 100 futures are currently down -14.5 points (-0.18%), the cash market is currently estimated to open at 7,998.03

- Euro STOXX 50 futures are currently down -31 points (-0.72%), the cash market is currently estimated to open at 4,266.24

- Germany's DAX futures are currently down -97 points (-0.62%), the cash market is currently estimated to open at 15,436.64

US Futures:

- DJI futures are currently down -85 points (-0.25%)

- S&P 500 futures are currently down -73.5 points (-0.59%)

- Nasdaq 100 futures are currently down -17 points (-0.41%)

The US dollar has continued to strengthen following yet more hawkish comments form Fed members. Although it is James Bullard who has turned up the heat with talk of backing a 50bp hike in March. Fed fund futures currently favour three 25bp hike in March, May and June – but the implied probability of a 50bp hike in March has now risen to ~18 from 12~ the day prior. It is clear that the Fed were not impressed with markets trying to price in cuts this year – and their message is clear; the Fed are hawkish, nowhere near a pause so forget about cuts for now and get inflation (and expectations) lower.

- And this weighed on sentiment across Asian equities markets, which took Wall Street’s bearish lead with open arms and tracked futures markets lower.

- S&P 500 E-mins have touched a 25-day low, Nasdaq futures are at a 3-week low.

- Talk of a 50bp Fed hike in March saw the dollar extend its lead late in the US session and maintain its trajectory during Asian trade.

- USD/JPY is on the cusp of printing a fresh YTD high and trades around 134.70 as widening yield differentials come back into play, in favour of dollar bulls

- GBP/USD has fallen to its lowest level since January 6th, due to the combination of the stronger dollar and the UK’s softer-than-expected inflation report on Wednesday

- NZD/USD has continued lower and just 18 pips from testing out 62c target, outline earlier this week

- Gold and oil continue to feel the strain of higher US yields, the dollar and odds of a higher terminal Fed rate.

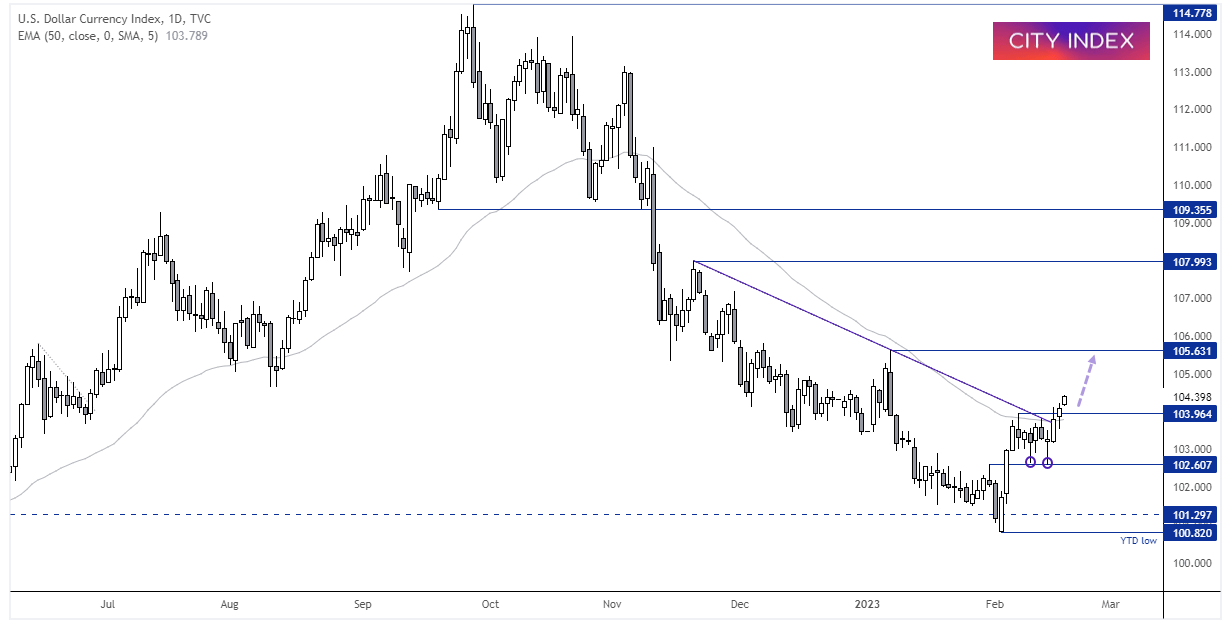

US dollar index (DXY) daily chart:

We were ringing the alarm bell late January of a potential oversold US dollar, and markets now appear to agree. The false break below 101 earlier this month marked a key low and, after a 7-day consolidation, DXY has broken above the 50-day EMA and 104 handle. I suspect the only thing holding DXY back for now ius that EUR/USD holding above its ‘pandemic low’, although that key level is being tested as we speak. But I suspect we’ll be seeing a higher dollar next week, as DXY makes its way towards the 105.63 high.

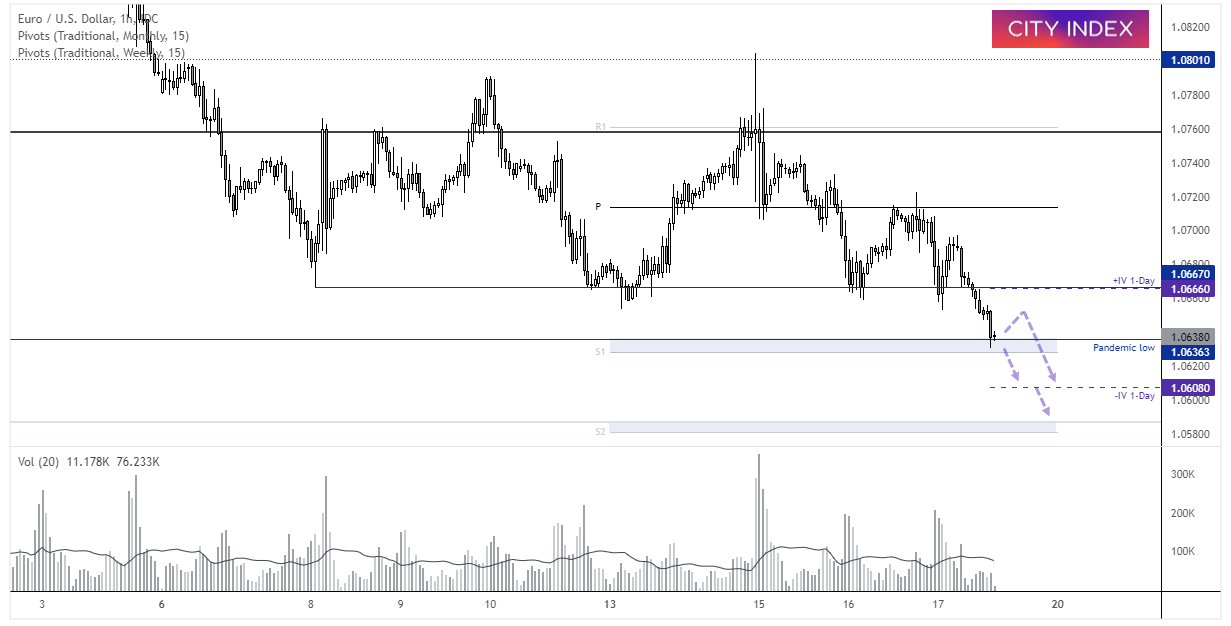

EUR/USD 1-hour chart

Euro is teasing a break of its pandemic low, but the weekly S1 pivot is also nearby (and marks the overnight low) so perhaps we’ll see a rebound before this key support zone breaks. But momentum and sentiment likely favours continued dollar strength heading into the weekend, so bears may want to see evidence of a lower high if prices retrace higher, or wait for a break of the overnight low to assume bearish continuation. Note that the downside overnight volatility band sits just above the 1.0600 handle.

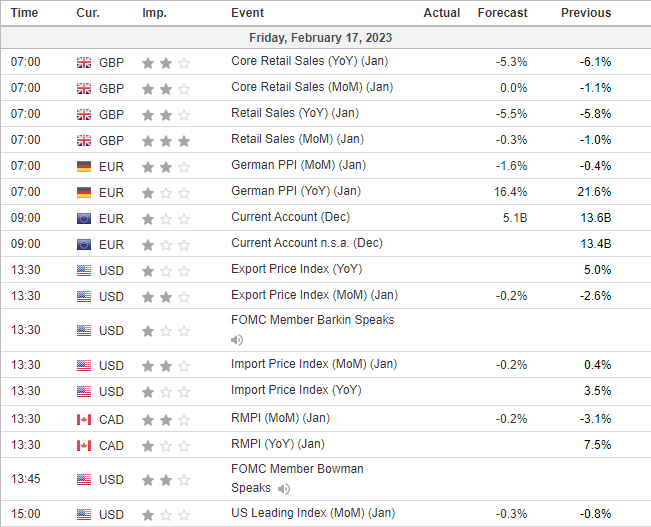

Economic events up next (Times in GMT)