Asian Indices:

- Australia's ASX 200 index rose by 20.9 points (0.31%) and currently trades at 6,800.10

- Japan's Nikkei 225 index has risen by 166.06 points (0.61%) and currently trades at 27,322.20

- Hong Kong's Hang Seng index has fallen by -198.75 points (-1.18%) and currently trades at 16,715.83

- China's A50 Index has fallen by -150.68 points (-1.18%) and currently trades at 12,586.11

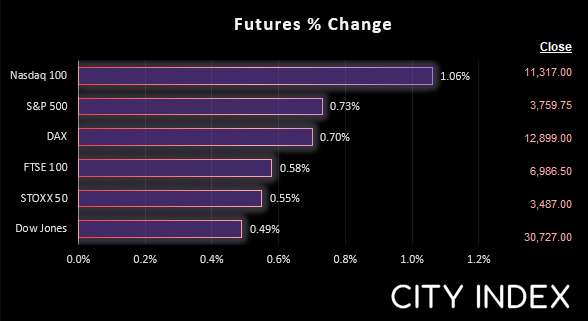

UK and Europe:

- UK's FTSE 100 futures are currently up 39 points (0.56%), the cash market is currently estimated to open at 6,975.74

- Euro STOXX 50 futures are currently up 18 points (0.52%), the cash market is currently estimated to open at 3,481.83

- Germany's DAX futures are currently up 89 points (0.69%), the cash market is currently estimated to open at 12,854.61

US Futures:

- DJI futures are currently up 144 points (0.47%)

- S&P 500 futures are currently up 114.5 points (1.02%)

- Nasdaq 100 futures are currently up 26 points (0.7%)

The positive sentiment from Wall Street thank to corporate earnings spilled over to Asia, with the majority of benchmark indices across Asia trading higher. Share markets related to China were in the red as they traded cautiously around the CCP congress and news that parts of China had re-entered lockdowns.

Futures markets for Europe and the US are currently pointing higher, so the question is whether sentiment can be sustained with more earnings reports from the US set to follow. UK inflation is up shortly and expected to rise to 10% - just below its peak set in July.

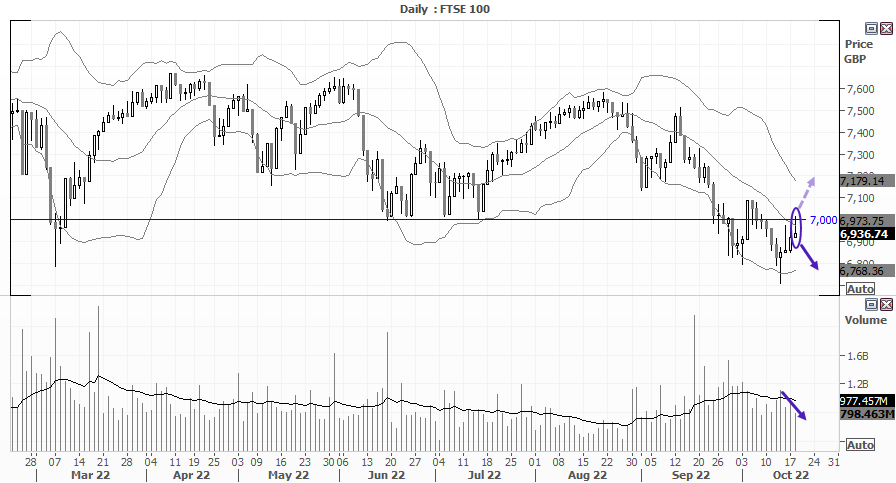

FTSE 100 daily chart:

The FTSE 100 has completed a 5-wave move lower from the August high and, after printing a bullish hammer near the lower Bollinger band, has retraced against that trend. Yet volumes were lower during the move higher, so perhaps it is simply corrective against the bearish trend. Resistance has been met around the 7,000 handle and the 20-day EMA, and a bearish hammer formed yesterday – so perhaps a swing high is in place.

From here we are seeking an eventual break beneath 6900, and the bias remains bearish below yesterday’s high. Keep in mind that futures point to a higher open so we may see an early run for 7,000 – and UK inflation data is out shortly so the market will react after it opens.

Bears could seek intraday setups below yesterday’s high, or traders of the daily chart could wait for a break of yesterday’s low to assume a swing high has been seen. A decent break of yesterday’s high brings 7100 info focus.

FTSE 100 trading guide>

FTSE 350 – Market Internals:

FTSE 350: 3828.81 (0.24%) 18 October 2022

- 196 (56.00%) stocks advanced and 146 (41.71%) declined

- 1 stocks rose to a new 52-week high, 1 fell to new lows

- 15.43% of stocks closed above their 200-day average

- 78.57% of stocks closed above their 50-day average

- 19.71% of stocks closed above their 20-day average

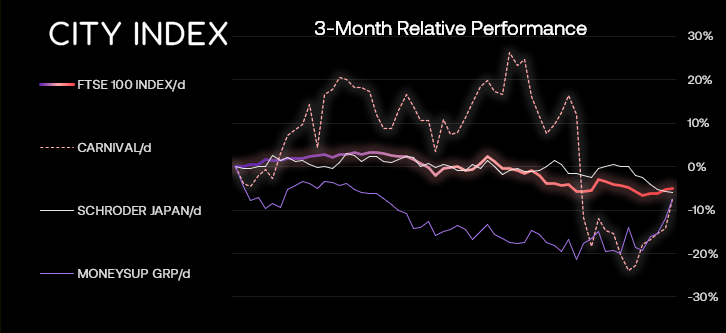

Outperformers:

- +8.1% - Carnival PLC (CCL.L)

- +6.4% - Smurfit Kappa Group PLC (SKG.L)

- +5.4% - Moneysupermarket.Com Group PLC (MONY.L)

Underperformers:

- -7.68% - Syncona Ltd (SYNCS.L)

- -5.41% - ASOS PLC (ASOS.L)

- -4.77% - Ninety One PLC (N91.L)

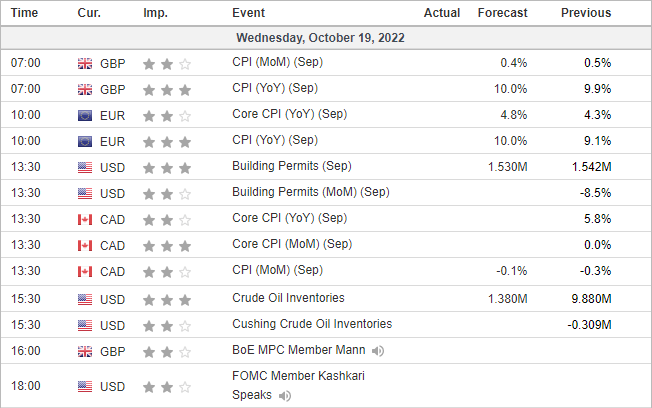

Economic events up next (Times in BST)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade