Asian Indices:

- Australia's ASX 200 index fell by -10.3 points (-0.14%) and currently trades at 7,423.90

- Japan's Nikkei 225 index has fallen by -156.95 points (-0.55%) and currently trades at 29,125.11

- Hong Kong's Hang Seng index has fallen by -254.07 points (-1.02%) and currently trades at 24,559.06

- China's A50 Index has fallen by -286.24 points (-1.85%) and currently trades at 15,217.09

UK and Europe:

- UK's FTSE 100 futures are currently down -15 points (-0.21%), the cash market is currently estimated to open at 7,259.04

- Euro STOXX 50 futures are currently down -9 points (-0.21%), the cash market is currently estimated to open at 4,335.63

- Germany's DAX futures are currently down -41 points (-0.26%), the cash market is currently estimated to open at 15,999.47

US Futures:

- DJI futures are currently down -112.24 points (-0.31%)

- S&P 500 futures are currently down -51 points (-0.31%)

- Nasdaq 100 futures are currently down -16.5 points (-0.35%)

Indices

Asian equities continued lower following another strong inflation set from China. Over the past 24-hours we’ve seen US producer prices rise 8.6% to match its 10-year high, China’s producer prices reach a new record of 13.5% y/y and consumer prices turn higher to hit a 1-year high. Now, if this trend is to shed any light on today’s CPI report from at 13:30 today it could one should be prepared for inflation in the US to move higher.

Forecasts have pencilled in core inflation to 0.3% m/m, up from 0.2% whilst the y/y rate is to fall to 5.3% from 5.4%. CPI (including energy and food) is also expected to rise by 0.5% compared with 0.4% previously. As Wall Street moved lower following strong producer prices it is difficult to say whether these numbers are priced in. But if inflation is to overshoot then it could weigh on the stock market against today, with tech stocks likely to be the hardest hit.

All major benchmarks across Asia are in the red, along with US and European futures markets which point to a soft open today.

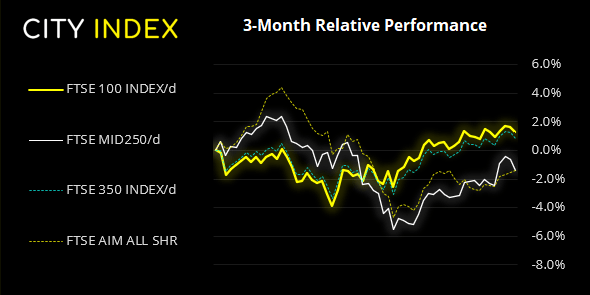

FTSE 350: Market Internals

FTSE 350: 4173 (-0.36%) 09 November 2021

- 88 (25.07%) stocks advanced and 251 (71.51%) declined

- 15 stocks rose to a new 52-week high, 2 fell to new lows

- 60.68% of stocks closed above their 200-day average

- 82.34% of stocks closed above their 50-day average

- 20.23% of stocks closed above their 20-day average

Outperformers:

- + 14.99%-Watches of Switzerland Group PLC(WOSG.L)

- + 7.99%-Associated British Foods PLC(ABF.L)

- + 4.68%-Sirius Real Estate Ltd(SRET.L)

Underperformers:

- -6.08%-Darktrace PLC(DARK.L)

- -5.57%-TI Fluid Systems PLC(TIFS.L)

- -5.46%-Beazley PLC(BEZG.L)

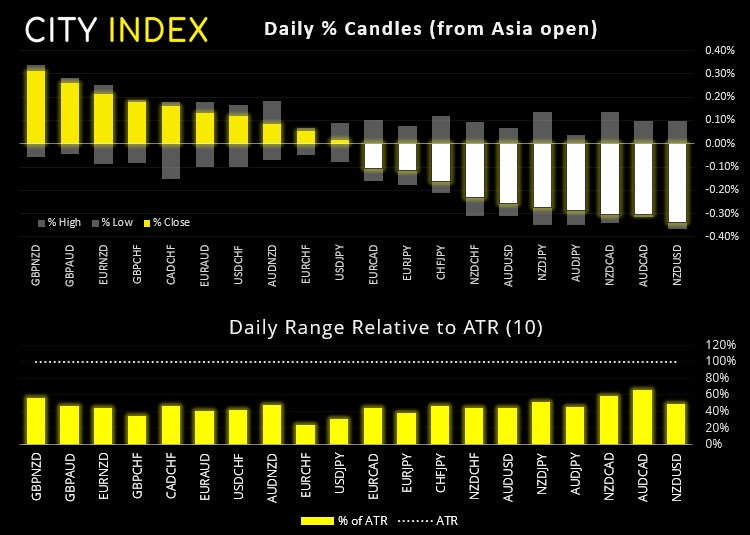

Forex:

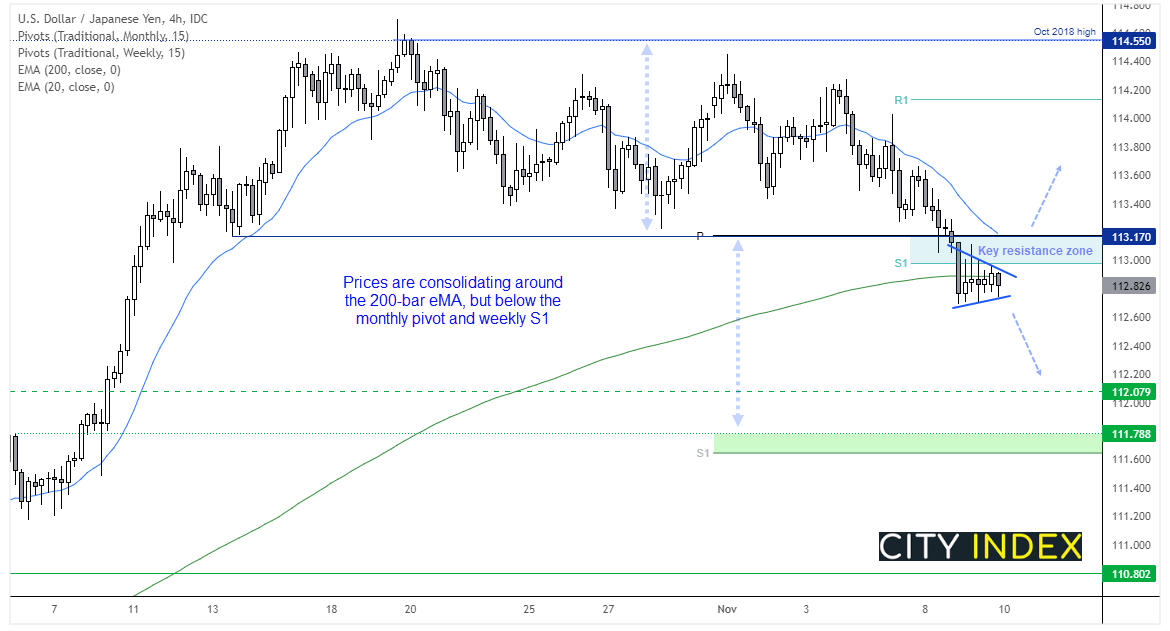

A notable pattern yesterday was the inflow into yen and Swiss franc after the strong PPI print. USD/JPY broke below 113 for the first time in a month and could see further selling pressure if inflation rises more than expected. So, perhaps we can see further downside if today’s inflation print excels, although logic would suggest that higher inflation requires an earlier hike (and therefore US dollar). We therefore suggest using price action as a guide and focussing on how it interacts with the resistance zone around 1130 – 113.70.

We can see on the four-hour chart that prices are hugging the 200-bar eMA, and trade just below the weekly S1 pivot. Also note the importance of 113.70 as it marks a swing low and where the monthly pivot point resides. Should this area hold and prices hit new lows then 112 comes into view, which is just above the channel target projection. However, if prices break above 113.70 then the initial downside break is deemed a ‘fakeout’ and we will switch to a long bias.

Commodities:

Gold has held below 1834.14 resistance overnight as traders squared up ahead of today’s inflation report. The key level mares the September and July highs and will likely be a pivotal level around today’s report, where a strong number could send it higher (or lower, should inflation surprise to the downside).

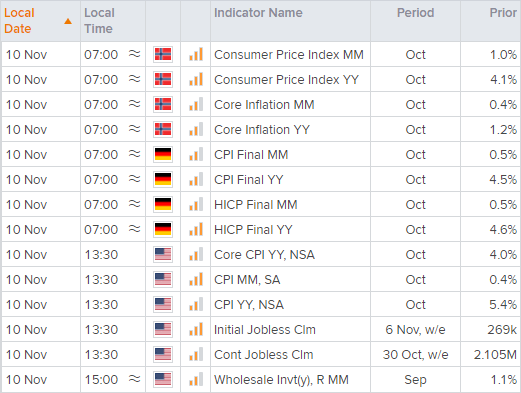

Up Next (Times in BST)

How to trade with City Index

You can trade easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade