- EUR/USD analysis: All ayes on US data with ADP and ISM services PMI up next

- US dollar remains largely on front-foot as June Fed cut probability declines

- Eurozone CPI eased to 2.4% in June, with Core CPI falling to 2.9%

EUR/USD analysis video and insights on USD/JPY and commodities

EUR/USD analysis: All ayes on US data with ADP and ISM services PMI up next

Following the weaker German inflation print on Tuesday, today’s Eurozone CPI was always going to miss expectations and so it proved. The EUR/USD or the DAX hardly reacted, however. The weaker inflation print means investors are fully pricing the first European Central Bank rate cut in June. With rate spreads remaining in favour of the dollar, for the EUR/USD to find support it will need a sharp deterioration in US data now, causing investors to reprice US interest rates lower. Otherwise, expect moderate further weakness or consolidation at best. Indeed, if this week’s US data were to surprise to the upside, then the EUR/USD could potentially drop to 1.07 handle.

US dollar remains largely on front-foot as June Fed cut probability declines

The direction of the US dollar in the short term will hinge on whether upcoming data leads to a reduction in the Fed's projected 2024 interest rate cuts to only two or remain at 3. Currently, the market is pricing in around 68 basis points of cuts for 2024, i.e., closer to 3, although some questions marks have been raised about whether the Fed will cut at all in June. The probability of a cut in June has fallen to just 63%, following the release of stronger ISM manufacturing PMI data earlier this week.

If we see any sharp weakness in economic activity or inflation data moving forward, this will further strengthen the case for 75 basis points as the minimum anticipated number of rate cuts for this year, and potentially more.

Looking forward, focus will be on the US ISM services PMI, forecasted to increase to 52.7 from 52.6. Ahead of that, the ADP private payrolls data will be released first, with expectations of a rise to 148K from 140K. Not many people take the ADP data seriously anymore, so much of the focus will be on the ISM Services PMI. As well as the headline print, the focus will also be on prices paid and the employment sub-components. If it follows the lead of the manufacturing PMI and we see modest improvements across the board then this could provide the dollar with some support, causing the EUR/USD to decline.

Eurozone inflation underscores need for a June ECB rate cut

As mentioned, Eurozone CPI surprised to the downside with a headline print of 2.4% year-on-year in March vs. 2.6% in February and 2.5% expected. Core CPI also weakened more than expect to 2.9% from 3.1% in February.

The latest data shows consumer prices in the region are continuing to ease towards the ECB's 2% goal. The day before saw German inflation come in at 2.2%, also down sharply from 2.5% the month before.

Cooling inflation signs and indications of ongoing struggles in the eurozone economy are likely to bolster expectations for an interest rate cut by the ECB in the upcoming June meeting. More data on wage growth is still needed, and will be available in May. The ECB wants to ensure that wages are coming down before starting the rate-cutting cycle.

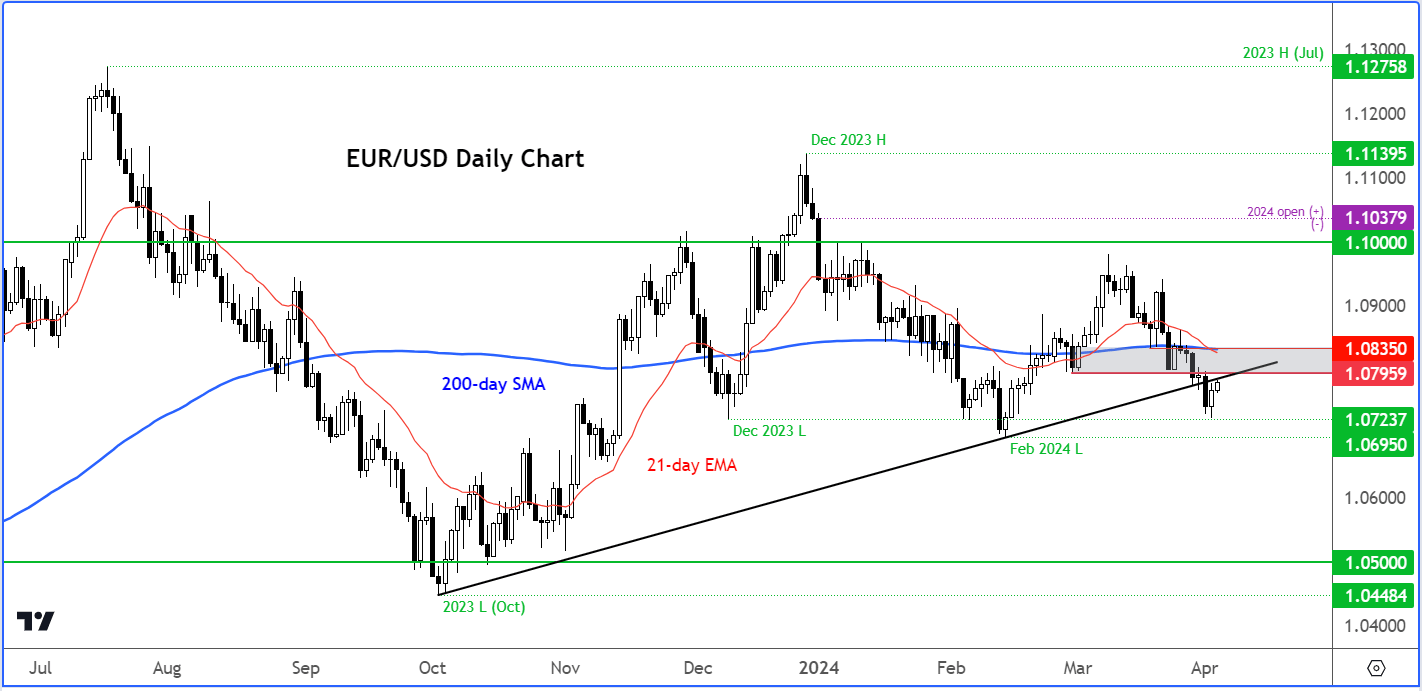

EUR/USD technical analysis

Source: TradingView.com

The EUR/USD found some mild support around the technically-important 1.0725 area on Tuesday, where rates haven’t stayed below for too long ever since the breakout we saw in November. In December, the EUR/USD formed a low at 1.0723, a level that was revisited early in February and again later in that month, when we saw a brief dip below it. The low from mid-February was made at 1.0695. So, moving forward keep a close eye on the 1.0695-1.0725 area to see whether the bulls are still in town or whether they have thrown in the towel following the break of the bullish trend line that had been in place since October.

On the upside, key resistance is seen around 1.0795 to 1.0835 area now, where the EUR/USD had previously found support until the breakdown last week. In the upper end of this range, we also have the 21-day exponential and 200-day simple moving averages come into play. Thus, a break above 1.0835 is needed now to re-establish the bullish bias again. If that doesn’t happen, the path of least resistance would remain to the downside even if we see modest further gains in the interim.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade