The US dollar is continuing to show potential bottoming signs. Tuesday’s release of hotter-than-expected US inflation data, combined with weaker CPI data from the UK and a drop in Eurozone industrial production today, have all helped to boost the appeal of the US dollar in favour of the euro and pound. We have also seen the USD/JPY take out 133.00 resistance, while gold and silver have been trending lower on the back of rising bond yields.

But whether or not the recovery for the dollar will hold remains to be seen. The greenback has absorbed a lot of hawkish Fed speak and above-forecast US data. Yet it has bounced only modestly off its lows. Investors have repeatedly shown preference to racier equities, which has weighed on the appetite for haven US dollar. But is the tide turning? Will the dollar index start trending higher again? The immediate focus will be on US retail sales due for release shortly.

Support for the dollar this morning came from weakening foreign currencies.

EUR/USD undermined by EZ industrial production drop

This morning saw the EUR/USD fall back to 1.07 after its two-day recovery. Traders have boosted their expectations the Fed will hike rates by 25 basis points in March and probably one more time at the next meeting, before pausing, after US inflation eased less than expected to 6.4% y/y in January and this was followed by even more hawkish comments from the Fed, this time from Lorie Logan. Meanwhile, in the Eurozone, while the economy has narrowly avoided a recession, today’s release of industrial output, which showed a bigger-than-expected drop of 1.1% m/m, points to continued weakness. Nevertheless, the EUR/GBP has rebounded, and Eurozone indices are holding their own relatively well as economists have been impressed with the resilience of the Eurozone economy. Indeed, the European Commission now sees the eurozone avoiding a recession this year altogether.

UK CPI eases but remains in double-digits

In the UK, annual CPI remained above 10% for the 7th consecutive month in January, though at 10.1% it eased more than expected (10.3%) from 10.5% in the previous month. Core inflation eased even more to 5.8% from 6.3% previously, providing the Bank of England some breathing space after they raised borrowing costs for the 10th consecutive time earlier this month. However, the BoE still cannot relax, and BoE Governor Bailey has expressed concerns about the persistence of inflation: “I am very uncertain particularly about price-setting and wage-setting in this country. We have got the largest upside skew in our forecasts that we have ever had on inflation." The slight easing of CPI comes on the back of hot employment and wages data released the day before.

Together, the stronger UK wages and double-digit CPI data certainly suggest more needs to be done to bring inflation back to the 2% target. If CPI were to remain elevated around current levels of 10% or so, this would further encourage workers to bid up wages, and in turn companies may have to keep raising prices to cover their salary costs. So, it is possible that the tightness in the labour market will remain a key source of domestic inflationary pressure for a while. Thus, the BoE could be forced to hike rates by one or two more times before pausing.

Coming up

Later in the session, attention will turn back to the US where retail sales will be the highlight of the upcoming data releases, at 13:30 GMT. Sales are expected to rebound by 1.9% m/m after their 1.1% m/m decline in December. Strong retail sales could lift the USD further, as it would boost the sticky inflation narrative. We will also have the latest Empire State Manufacturing Index at the same time, followed at 14:15 by US industrial production and 15:00 by NAHB Housing Market Index. ECB President Lagarde is also due to speak, at 14:00 GMT.

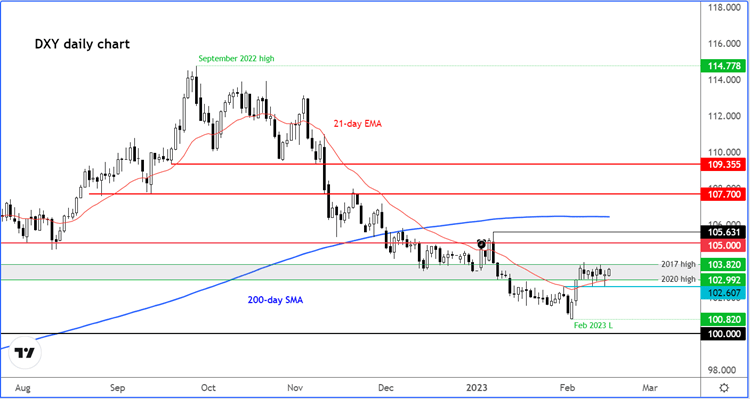

Dollar index technical analysis

The technical picture on the dollar index has improved with the index breaking and holding above the 21-day exponential moving average. The bulls would now want to see a clean move north of 103.80, which was the high back in 2017. If this condition is fulfilled, then there are no other obvious resistance levels until 105.00. Even if we see a small dip, for as long as 102.60 support holds, the bulls will be happy now. However, a clean break below this level would put the bears back in control.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade