As has been the case for the longest time, markets and economists were expecting the BOJ to keep monetary policy unchanged when it met on Tuesday at the December Interest Rate Decision meeting. However, markets were caught off guard as the BOJ adjusted its Yield Curve Control (YCC) by widening the band for the 10-year JGB. Yields can now fluctuate between +/- 0.50% vs a previous band of +/- 0.25%. Although BOJ Governor Kuroda denied that this was QT, markets were quick to take this as a message that this could be the “beginning” of QT. For complete analysis of the BOJ meeting, see my colleague Matt Simpson’s recap here. As mentioned in the Currency Pair of the Week, there have been hints over the last week that there may be a review of monetary policy in the coming months. Indeed, just yesterday, Japanese PM Kishida said that he would look to revise the 10-year-old statement that commits the BOJ to achieve its 2% inflation at the earliest possible date. However, it was also mentioned that this wouldn’t be addressed until after BOJ Governor Kuroda’s term ended in April. Traders will be watching to see how markets will react over the coming months as a Kuroda’s term comes to an end on April 8th.

Everything you need to know about the Bank of Japan

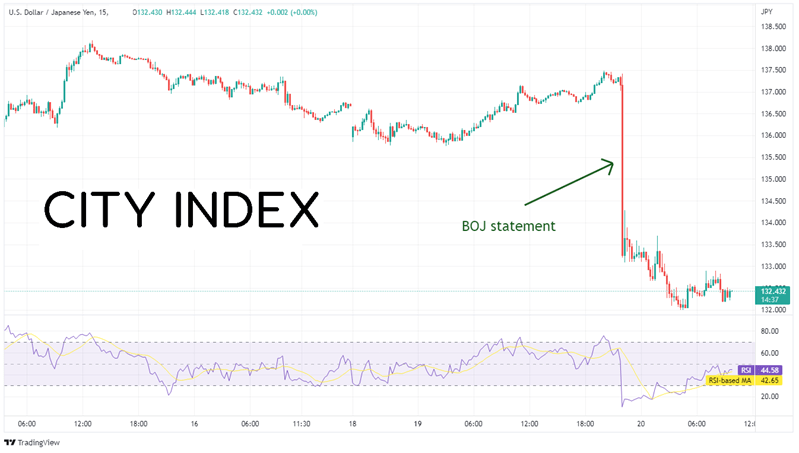

Upon the release of the statement, USD/JPY sold off aggressively from 137.41 down to 133.19, a move of nearly 3%.

Source: Tradingview, Stone X

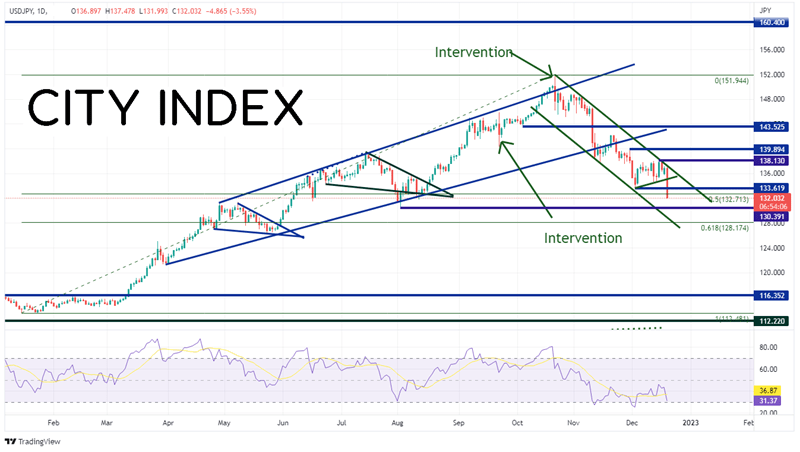

This has been big second biggest selloff of the year thus far for USD/JPY, only surpassed by the move on November 10th when the pair sold off after the weaker than expected US CPI. Today, selloff broke through an upward sloping trendline dating to December 5th near 135.25, the lows of December 5th at 133.61, and the 50% retracement from the lows of the year to the highs of the year at 132.71. These are all resistance levels now. Keep in mind that price broke lower today after testing the top trendline of a long-term downward sloping channel. USD/JPY still remains well in that channel. Support below is at the lows of August 2nd at 130.39 and the bottom trendline of the channel near 128.75. Below there, price can fall to the 61.8% Fibonacci retracement from the previously mentioned timeframe at 128.17.

Source: Tradingview, Stone X

Trade USD/JPY now: Login or Open a new account!

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

However, USD/JPY wasn’t the only one on the more after the BOJ announcement, the yields on the 10-year JGB jumped aggressively higher. The key JGB yield had been trading in a relatively tight band for most of the year between 0.19% and 0.28%. However, with the BOJ statement today, the key yield moved from 0.22% to an intraday high of 0.43%!

Source: Tradingview, Stone X

In addition, Japan’s Nikkei 225 also sold off roughly 2.5% on the day. Although a pullback may have been anticipated given yesterday’s selloff in US equities, the less dovish BOJ helped contribute to the decline! The Nikkei 225 opened at 27209 and made an intra-day low of 26132. As with JGB’s, the Nikkei 225 has been confined to a range for much of the year. After today’s announcement, price still remains within the range between 25524 an 29410.

Source: Tradingview, Stone X

Trade Nikkei 225 now: Login or Open a new account!

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

The BOJ will release CPI for November on Friday. Expectations are for a headline print of 3.9% YoY vs 3.7% YoY prior and a core rate (ex-fresh food) to be 3.8% YoY vs 3.6% YoY prior. However, Kuroda continues to say that inflation will fall over the course of next year and that the BOJ will continue to buy bonds as necessary to ensure easy monetary policy. The question traders need to be asking themselves now is: was this a one-off move or was this the beginning of something more to come down the road?

Learn more about forex trading opportunities.