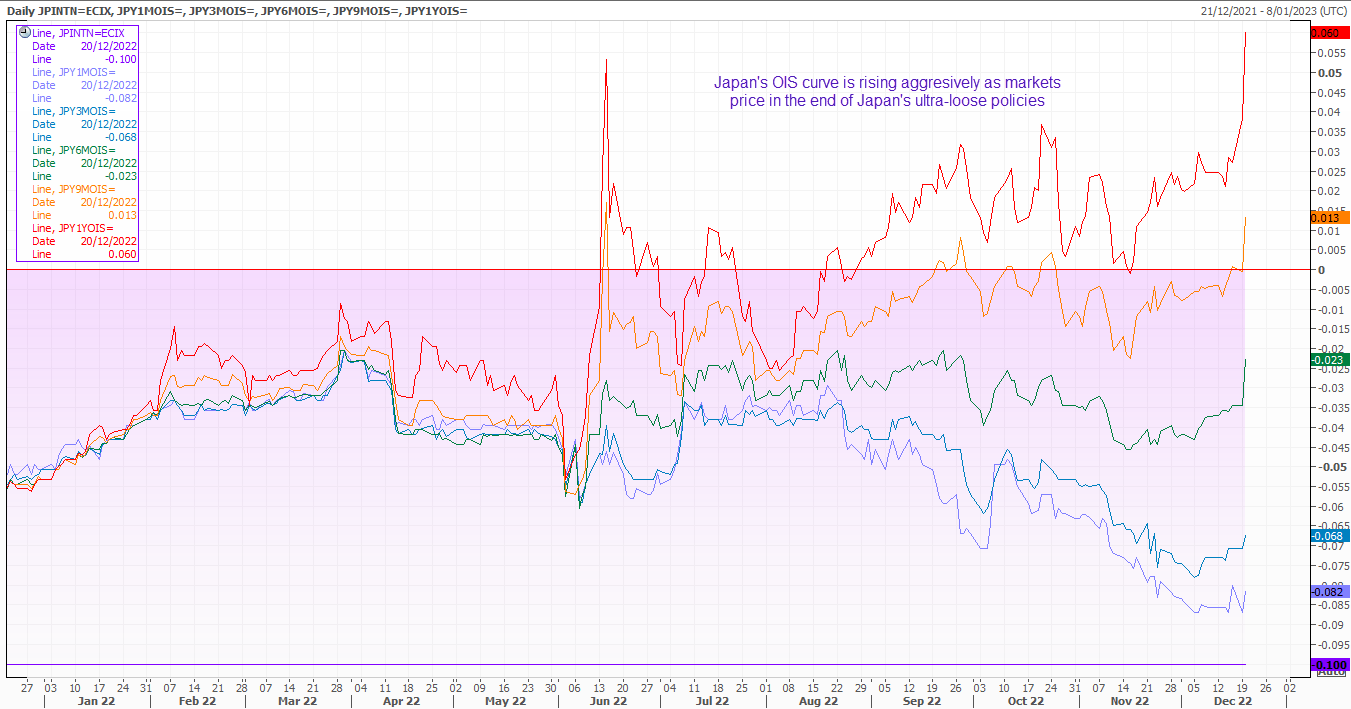

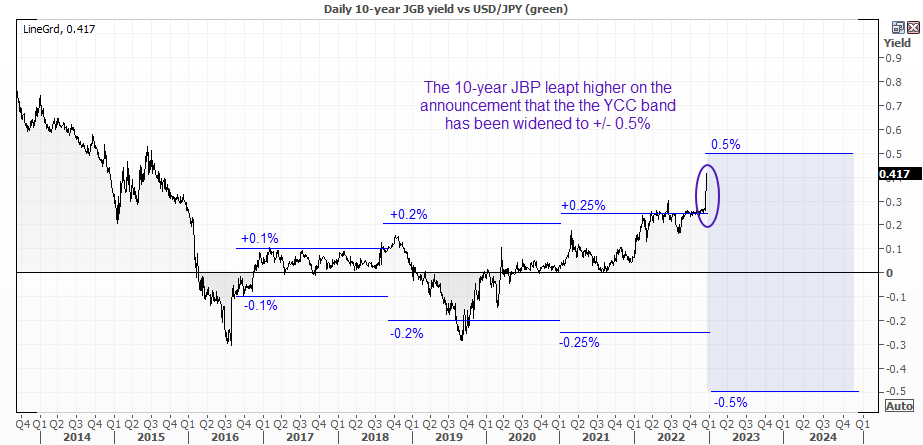

The BOJ (Bank of Japan) have increased their upper limit of their yield target to 0.5% and will allow it to move freely between -0.5% to 0.5%. Markets were quick to react with the 10-year JGB rising to 4.3% - it’s highest level since 2015. The OIS curve is also rising aggressively as markets price in the end of the BOJ's ultra-loose policy.

No action was expected from today’s meeting – and the bank of Japan once again teach us that complacency is the devil. It’s almost as if they wait until nobody is watching before announcing any change of policy. And this is arguably the biggest surprise they have handed markets since moving to negative interest rates in January 2016.

Still, the winds of change are growing stronger with Japan’s financial regulator recently looking into risks for the bond market ‘if’ the BOJ were to remove their ultra-loose policy. And Japan’s PM now looking for flexibility with the inflation target with his review of the 10-year accord with the BOJ. So the move from the BOJ has not come without warning, it’s just few were paying attention ahead of the holiday period.

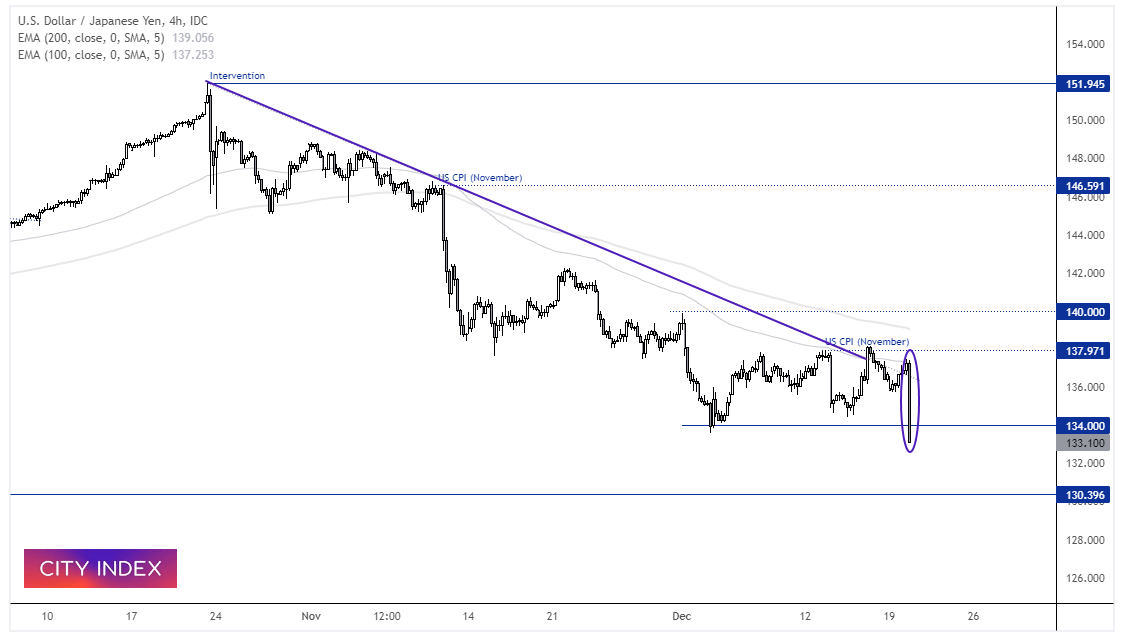

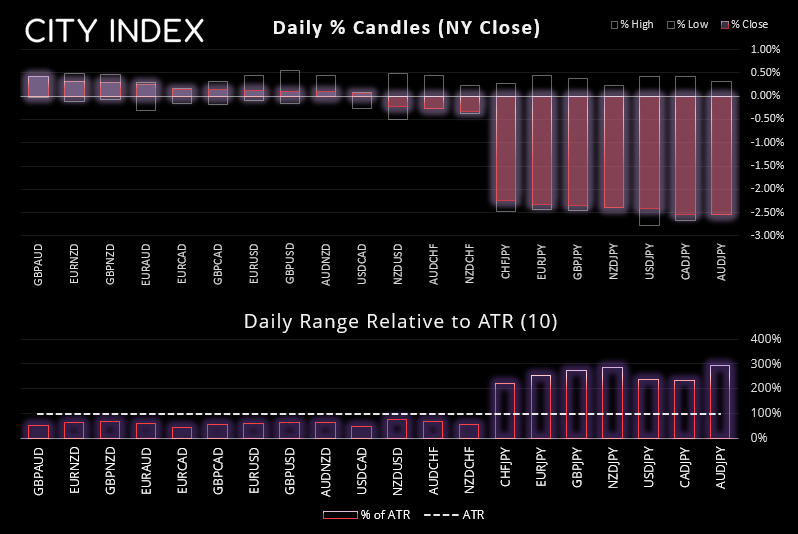

USD/JPY is currently down around -2.6% for the day, which is its worst session since the November US inflation report which came in much softer than expected. But you can look across any yen pair and they look very similar – strength to the yen to the detriment to the currency you trade it against. And whilst volatility is significantly high for an Asian session, take note that European and US markets are yet to react. From here is looks as though USD/JPY could be headed for 130 now that it has broken to a new cycle low.