The war in Europe threatens crops in vital grain-growing regions, prompting governments worldwide to scramble to secure food supplies and curtail food exports. Last week panic buying sent wheat futures to a record high while corn and soybeans trade near multi-year highs. The UN's benchmark index of world food and agricultural prices is at a multi-decade high.

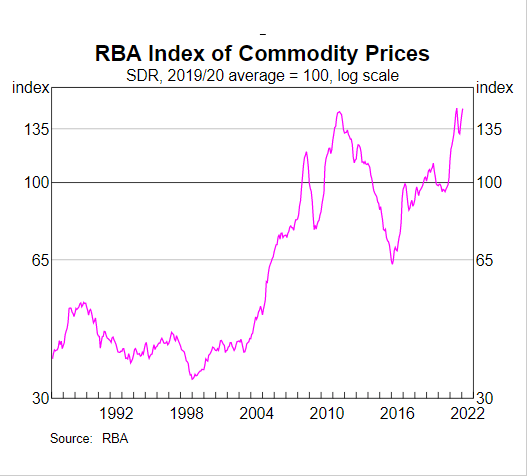

Locally the RBA Index of Commodity prices is approaching the record levels last seen after a massive wave of Chinese stimulus crashed ashore here post the Global Financial Crisis. The Chinese fiscal fueled demand for commodities, was behind the AUDUSD's meteoric rise to 1.1081 in July 2011.

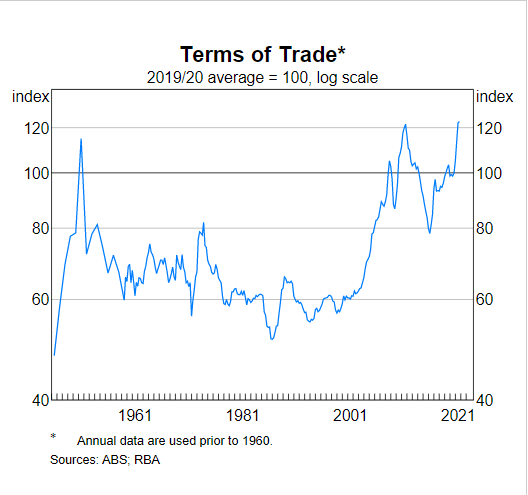

Roughly 11 years later, Australia's Terms of Trade have surpassed the post GCF peak to trade at a record high. In December 2021, the Department of Industry, Science, Energy and Resources forecasted resource and energy exports would reach a record $379 billion in 2021-2022, up from $310 billion a year earlier. After the strong surge higher in commodity prices in recent weeks, those estimates are now way too conservative.

Monetary policy and interest rate differentials

At last week's AFR Business Summit, Governor Lowe's comments indicate the bank is pivoting towards a more hawkish stance, concerned more about upside risks to inflation than the negative impact on growth from higher petrol prices.

The Australian interest rate market is fully priced for a first RBA rate hike in June, followed by another four hikes before the end of 2022. This means that interest rate differentials will continue to provide a headwind, but not to the same extent had the RBA stuck to its previous forward guidance of no interest rate hikes before 2024.

AUDUSD a risk currency no more?

The AUDUSD has traditionally been referred to as a risk currency, which means that it tracked other risk assets, including U.S equities. However, the correlation between the AUDUSD and the S&P500 has fallen from 0.3 over the long term to around 0.1 currently. When equities rise and fall, the AUDUSD is now less inclined to follow slavishly.

Conclusion

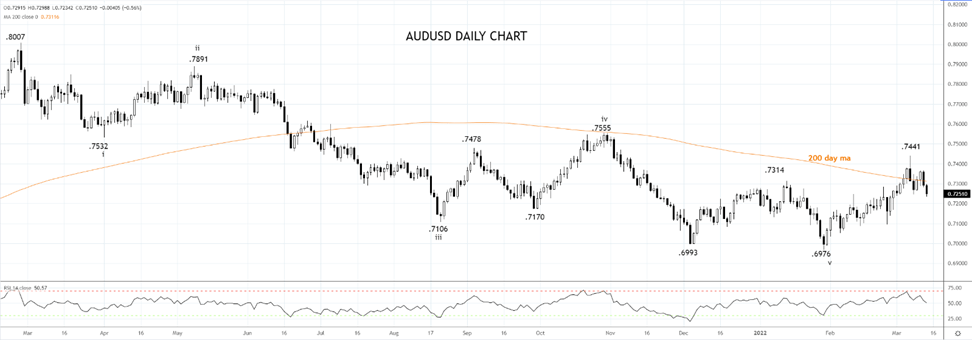

Based on all the factors mentioned above, we favour buying weakness in the AUDUSD into the .7180/.7170 support region with a stop loss placed below .6975. The target would be the .7555 high from October 2021.

Source Tradingview. The figures stated areas of March 14th, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade