Australia’s August labour force survey had something for both the Australian dollar bulls and bears, but in the end the detail does not meaningfully change the outlook for interest rates: the RBA looks set to leave the cash rate on hold for the foreseeable future.

AUD/USD strength fades as jobs surge masks increased labour market slack

According to the Australian Bureau of Statistics (ABS), employment surged by 64,900, more than doubling the increase expected and easily offsetting the modest decline reported a month earlier. Impressively, the labour force participation rate climbed to 67%, indicating a record share of Australia’s working age population is now in or looking for work.

What’s not to like, right?

Well, one consequence of the increase in participation was the unemployment rate held at 3.7%, missing expectations for a decline to 3.6%. Most of the reported increase in employment came from part-time workers, contributing to a surprise fall in total hours worked. Importantly, unemployment and underutilisation increased by two-tenths apiece, signaling an increase in labour market slack.

The latter point is important.

These broader measures of labour market tightness have far stronger inverse relationship to wage pressures than unemployment, so the increase reported in August does not bode well for a continued acceleration in wage growth. For a central bank concerned about stronger wages growth pushing up services costs, this diminishes the risk of the RBA needing to add to monetary policy tightening already delivered.

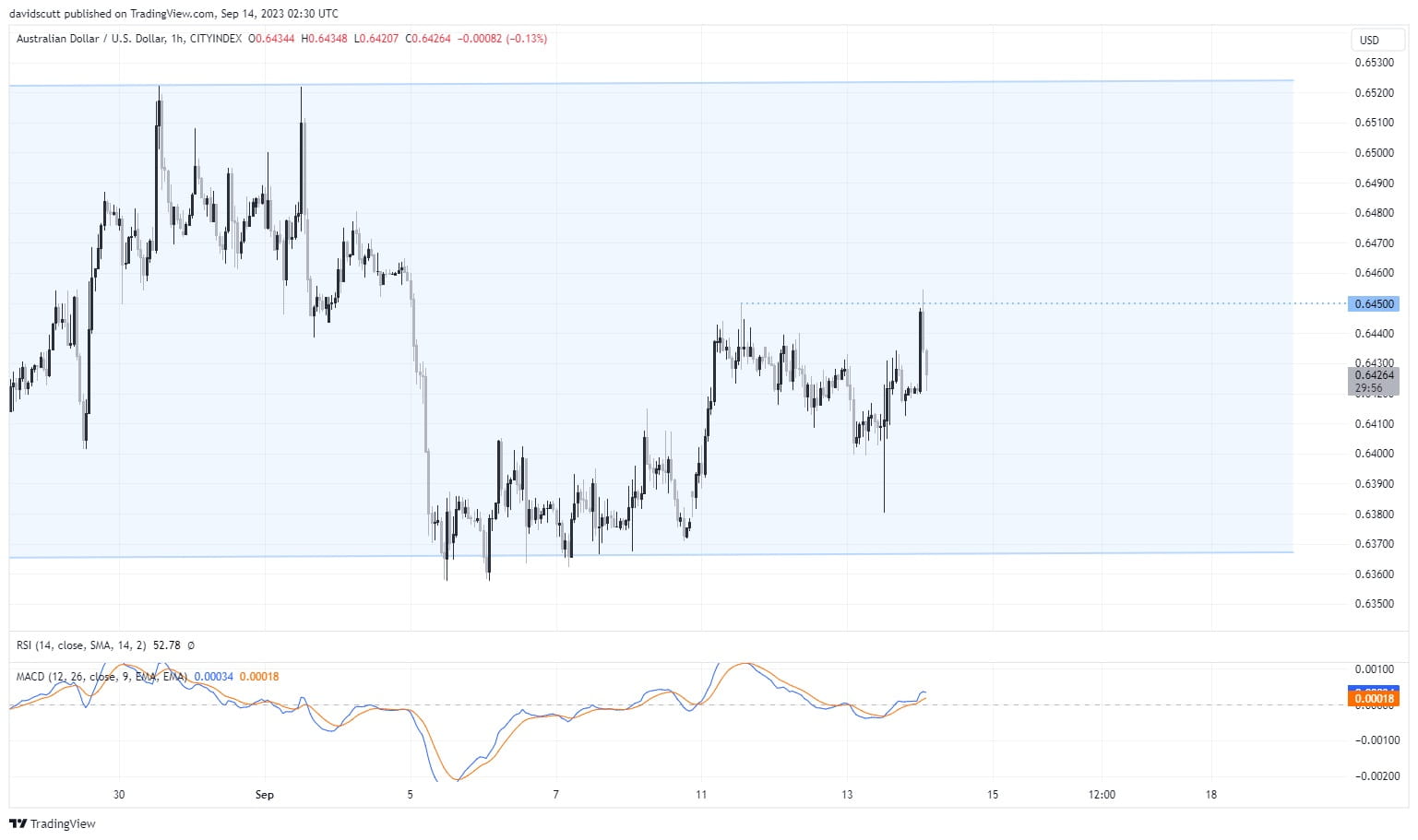

Three failures at .6450 for AUD/USD

After initially popping higher on the headline jobs number, the AUD/USD is now trading lower than before the data print, reflecting the data does not really move the needle on the outlook for interest rates.

Looking at the hourly chart, AUD/USD has now failed to clear .6450 on three occasions over the past week. That level needs to be overcome to see the pair move into the top of the recent trading range, opening the path for a potential test of the triple-top found at .6520.

Given upcoming risk events, the ECB’s September monetary policy meeting looms as the most likely catalyst to see the AUD/USD break out of its current range. With markets pricing in two-in-three chance of a 25 basis point being delivered, the ECB will likely have to hike and retain a hawkish rates bias in order to generate strength in the euro and place the US dollar under pressures.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade