- Crude oil analysis: Investors eye clues about demand outlook ahead of busy week

- OPEC+ cuts and reduced fears about Eurozone economy keep oil prices supported

- WTI technical analysis suggests trend still bullish

Crude oil analysis: Oil makes come back after weakness earlier in April

Until pulling back a little from its highs on Friday, crude oil had been trending higher for much of the week, making back a good chunk of the losses suffered in the previous week. The 4-month rally stalled earlier this month as investors worried about demand from the US, where hot inflation continues to push back the implied probability of interest rate cuts. We have seen stronger than expected CPI, GDP deflator and Core PCE index in the last couple of weeks. However, this has been offset to some degree by signs of an economic recovery in Europe, while ongoing supply cuts by the OPEC+ group continued in the background, limiting any bearish moves.

Oil investors eye clues about demand outlook ahead of busy week

Despite diminishing concerns about a potential conflict involving major oil producer Iran and Israel, crude oil continues to maintain its strength relatively well. It has sustained a year-to-date increase of approximately 17%, which is notable. While there remains some premium built into oil prices due to tensions in the Middle East, the primary driver behind oil's gains is largely attributed to the OPEC+ supply cuts.

Attention will be on the demand outlook in the week ahead, particularly with the release of crucial manufacturing PMI data from the US and China, along with the US non-farm payrolls report on Friday. On a more granular level, the earnings reports from companies such as Apple, Amazon, and AMD will offer an alternative perspective on the state of the US and global economies, following the predominantly positive results from the likes of Alphabet and Microsoft last week.

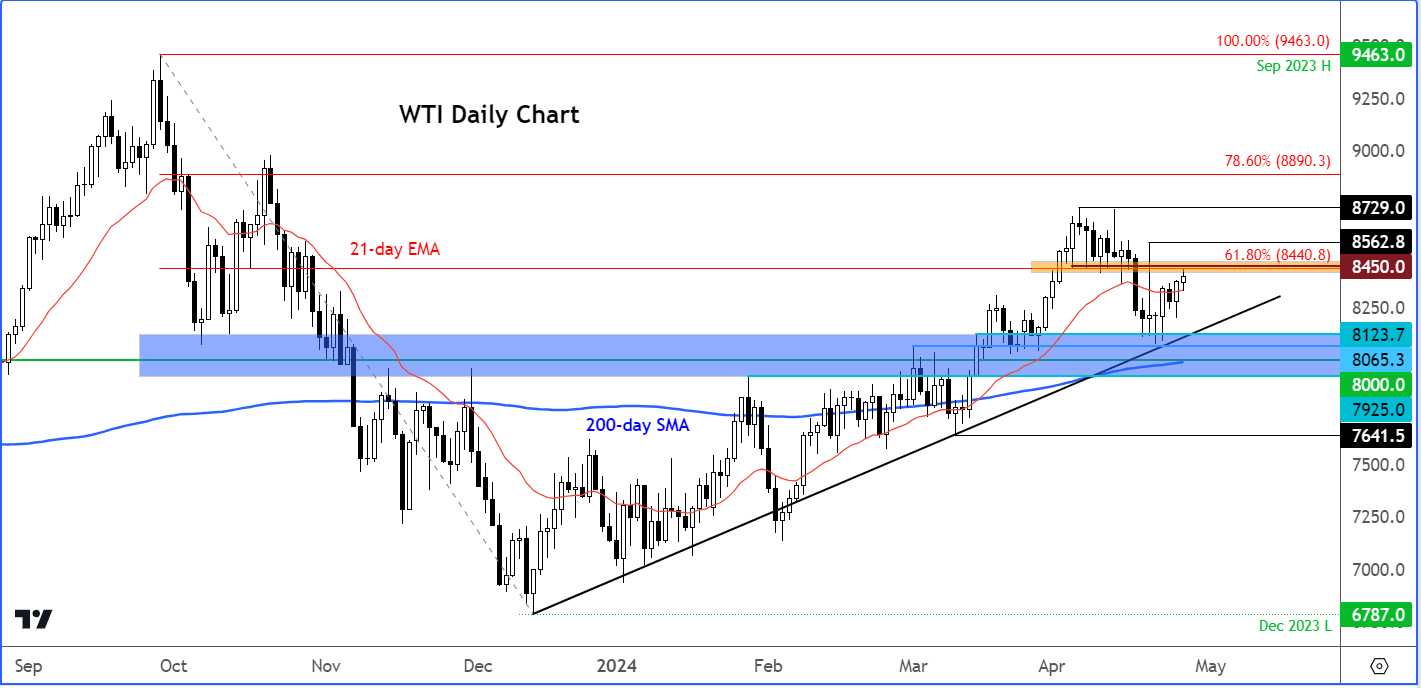

Crude oil analysis: WTI technical analysis suggests trend still bullish

Source: TradingView.com

The long-term path of least resistance on crude oil remains to the upside, given the fact that prices have been making higher highs and higher lows ever since bottoming out in the middle of December.

With crude oil above both the 21-day exponential and 200-day simple moving averages, and the slopes of theses average being positive, the trend is objectively bullish on both the short- and long-term horizons. Complementing these technical indications, we have a bullish trend line in place since mid-December. Until and unless the series of higher lows and higher highs breaks, the bears must remain patient.

In terms of levels to watch, key support comes in the area between $80.65 to $81.25 zone, where the bullish trend line and recent lows comes into play.

Below this area, the $80 level will come into focus, which had been significant resistance before the breakout in in mid-March. The 200-day moving average also comes in around this area.

On the upside, the area around $84.50 is pivotal, where WTI has found both support and resistance in recent weeks. A potential move above here, and ideally las Friday's high at $85.62, would be a strong bullish technical signal. If breached, we could see the onset of a rally towards a new 2024 high above this month earlier high of $87.29.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade