Takeaways

- Overall, the ASX tends to perform well in the three days either side of Australia day

- T+3 has generated the strongest positive returns (average and median)

- T+3 has poste positive returns on 10 of the past 11 years, and over the past four

- T-1 has posted negative average returns over the past 31 years (which could be this Thursday) but with positive median returns

- I see the potential for further gains over the near-term, but due to the ASX 200’s tendency to fall following failed attempts to reach 7700, I’m also on the lookout for a swing high to form on the daily chart

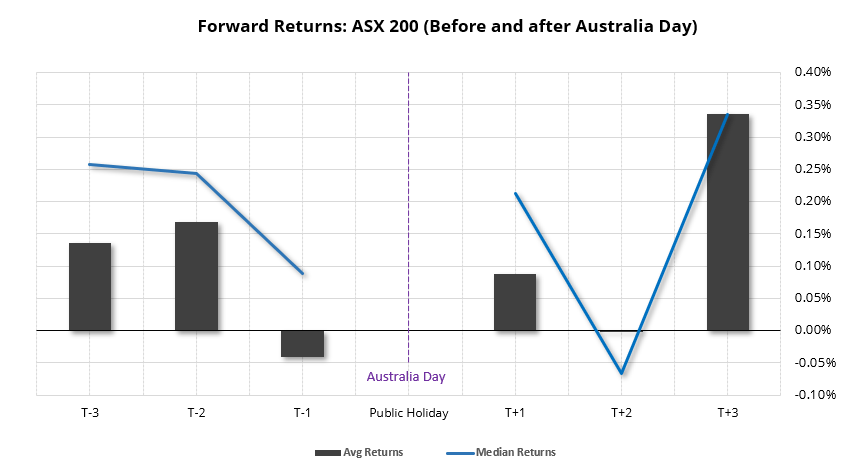

ASX 200 forward returns:

Forward returns look at the historical performance of an asset around key dates or times. In this article, we look at how the ASX 200 has performed in the three days before and after Australia day.

The basic takeaway is that the ASX tends to benefit more often than not either side of Australia day, which lands on January 26th. The cash market of the ASX 200 is always closed on this day, and on the years that Australia Day lands on a weekend, the following Monday becomes the public holiday.

Australia day lands on Friday this year, which means T-3 refers to Tuesday 23rd January, T-2 is Wednesday 24th and T-1 is Thursday 25th. T+1 then becomes next Monday, T+2 is Tuesday and T+3 is Wednesday.

If the ASX is to follow its average returns, it suggests next Wednesday could provide the best returns. Its average and media returns have been around 0.34%, and interesting to note that T+3 has posted positive returns in 10 of the past 11 years, and the past four in a row.

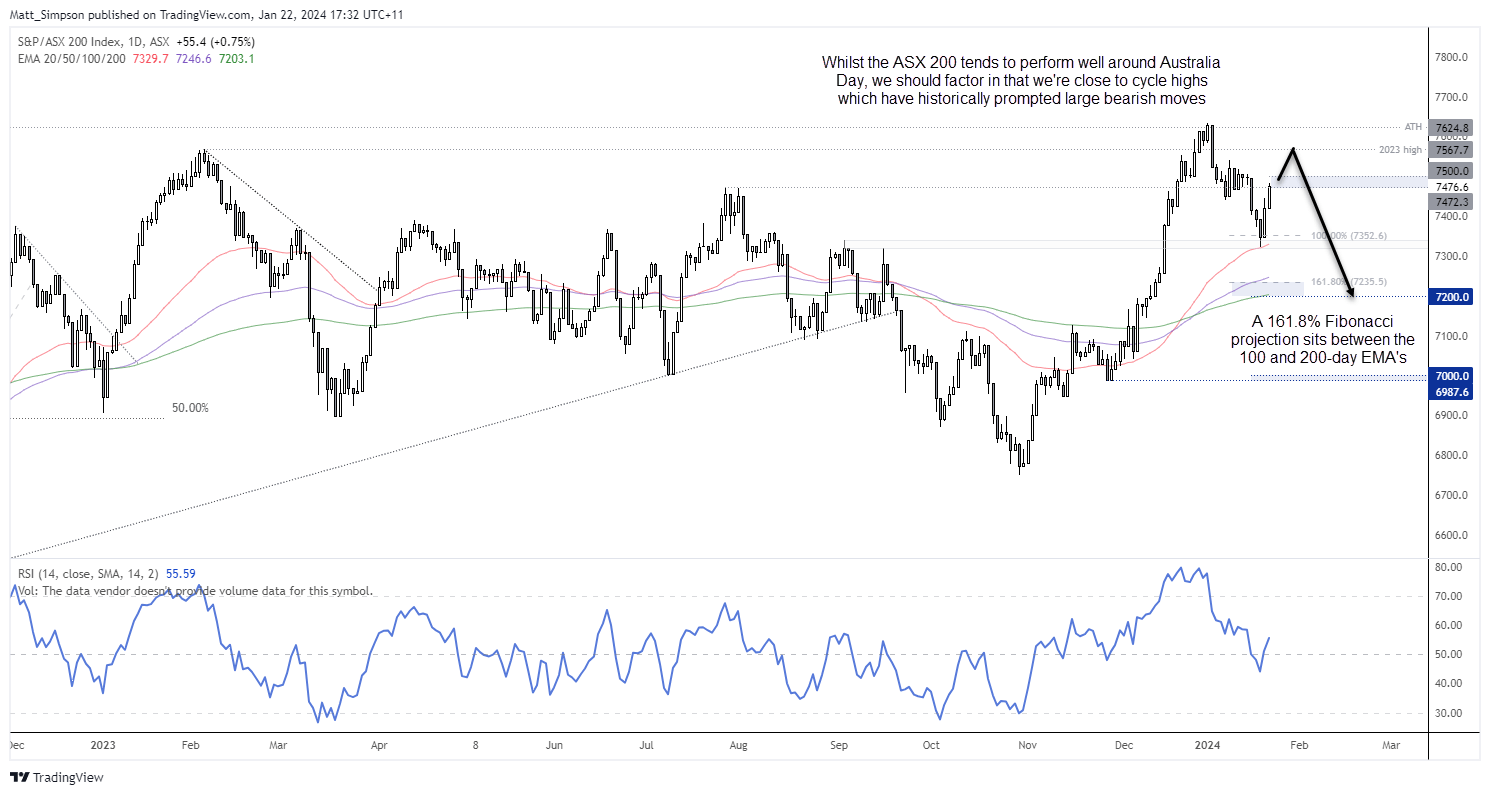

ASX 200 technical analysis (daily chart):

The ASX 200 pulled back from its early January highs as anticipated. I’ve not lost view of the bigger picture, in that the ASX 200 has generally fallen in the months following a failed attempt to reach 7700. Yet we’ve now seen two strong days after it found support just above 7300.

If the ASX is to follow its ‘Australia Day’ seasonal tendency, it suggests upside potential over the next coupe of days. But I also suspect volatility will be lower than we’ve seen over the past two sessions. And as we’re approaching the infamous highs, I currently doubt we’ll simply see the ASX 200 retest the January high and breakout. So whilst I see the potential for further upside this week, gains bay be on the cautious side and I’;; be seeking evidence of a top next week.

Furthermore, a 161.8% Fibonacci projection sits between the 100 and 200-week EMA’s, with the latter effectively on the 7200 handle – which makes a viable target for bears to keep in mind should momentum turn lower.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade