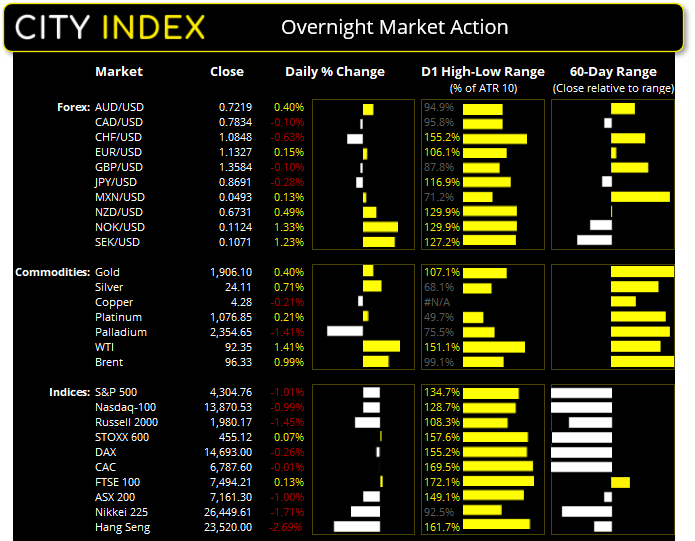

ASX 200: 7161.3 (-1.00%), 22 February 2022

- Energy (1.94%) was the strongest sector and Information Technology (-3.2%) was the weakest

- 3 out of the 11 sectors closed higher

- 8 out of the 11 sectors closed lower

- 4 out of the 11 sectors outperformed the index

- 31 (15.50%) stocks advanced, 160 (80.00%) stocks declined

Outperformers:

- +9% - Cochlear Ltd (COH.AX)

- +4.63% - Northern Star Resources Ltd (NST.AX)

- +4.46% - LendLease Group (LLC.AX)

Underperformers:

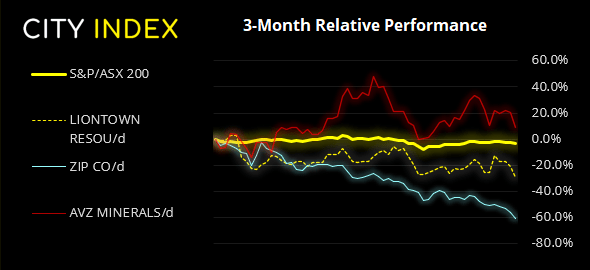

- -10.77% - Liontown Resources Ltd (LTR.AX)

- -9.7% - Zip Co Ltd (Z1P.AX)

- -9.43% - AVZ Minerals Ltd (AVZ.AX)

Wall Street continued lower with all major US benchmarks falling over -1% again. Sanctions have been announced but, on a side note, suspect Russia would have surely known sanctions would be the response for an invasion. And that would imply they’re more than prepared to weather the ‘hands-off’ approach from the West. So whilst we’re going through the ‘ugly bit’, any conflict will be contained to parts of Ukraine. In a sense this could be seen as a de-escalation of tensions, even if market pricing is not fully reflecting that yet. Although we note that the S&P 500 E-mini contract is on track to close on or around the January ‘close’ low which shows there is still strong demand around the 4250 – 4300 region – an area which sparked a rally on January the 28th.

Wall Street continued lower with all major US benchmarks falling over -1% again. Sanctions have been announced but, on a side note, suspect Russia would have surely known sanctions would be the response for an invasion. And that would imply they’re more than prepared to weather the ‘hands-off’ approach from the West. So whilst we’re going through the ‘ugly bit’, any conflict will be contained to parts of Ukraine. In a sense this could be seen as a de-escalation of tensions, even if market pricing is not fully reflecting that yet. Although we note that the S&P 500 E-mini contract is on track to close on or around the January ‘close’ low which shows there is still strong demand around the 4250 – 4300 region – an area which sparked a rally on January the 28th.

Read our Dow Jones trading guide

ASX 200:

80% of the ASX 200 stocks were lower yesterday as it fell to a 9-month low, yet it closed back above 7145 support and Wall Street has recouped some losses heading into the close. So markets may still be bleeding, but the bleeding is slowing. And considering how US markets have fared of late, we continue to lean in the fact that the ASX has been among the better performers of a bad bunch. From here we’d need to see a bullish day or two on above-average volume to be more confident of a turnaround.

ASX 200: 7161.3 (-1.00%), 22 February 2022

- Energy (1.94%) was the strongest sector and Information Technology (-3.2%) was the weakest

- 3 out of the 11 sectors closed higher

- 8 out of the 11 sectors closed lower

- 4 out of the 11 sectors outperformed the index

- 31 (15.50%) stocks advanced, 160 (80.00%) stocks declined

Outperformers:

- +9% - Cochlear Ltd (COH.AX)

- +4.63% - Northern Star Resources Ltd (NST.AX)

- +4.46% - LendLease Group (LLC.AX)

Underperformers:

- -10.77% - Liontown Resources Ltd (LTR.AX)

- -9.7% - Zip Co Ltd (Z1P.AX)

- -9.43% - AVZ Minerals Ltd (AVZ.AX)

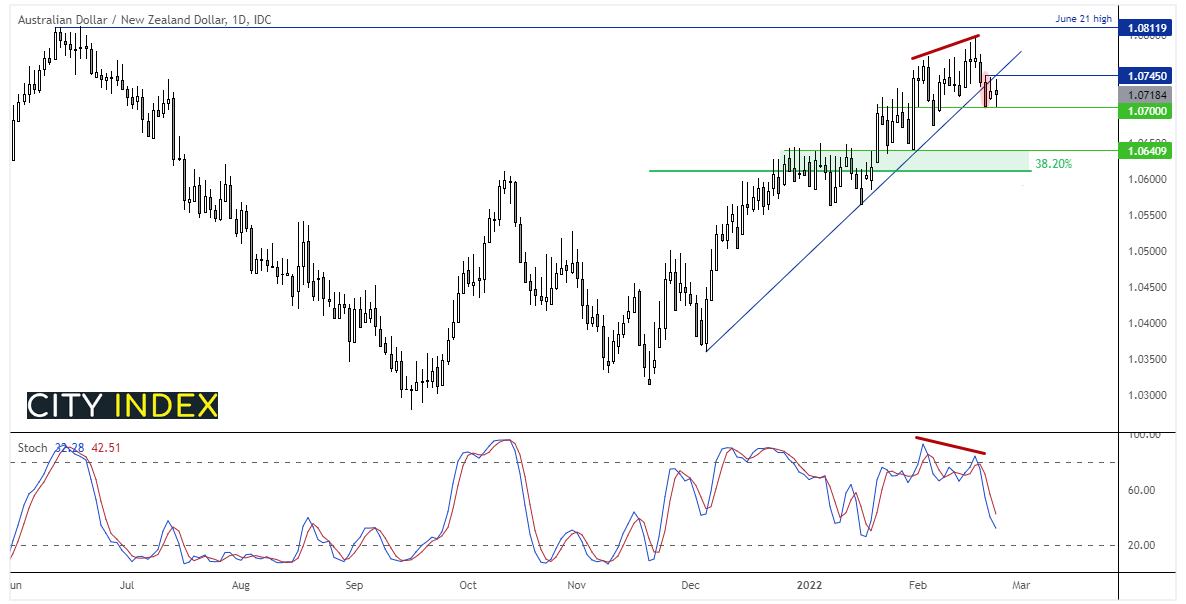

25 bps RBNZ hike fully priced in

RBNZ announce their OCR (overnight cash rate) at 12:00 AEDT and a hike of 25 bps if sully priced in, according to the OIS (overnight index swap). Therefore, to see any meaningful bullish follow-through for #NZD pairs today we would either require a hawkish hike, where they strongly hint at another 25 bps hike coming very soon, or a good old 50 bps hike. As much as we would like to see a 50-bps hike (and something we’d happily take) we’re mindful of the fact that central banks tend to cut more aggressively than they hike. But then this is the RBNZ, so be prepared for anything and everything.

On Monday we flagged the trendline break on AUD/NZD and princes have since consolidated within the breakout-day’s range. With RBNZ meeting up shortly we’re hopeful of a bullish hike or a 50 bps to knock this below 1.0700 and head towards the support zone near 1.060 / 1.065 over the coming days. An immediate break above 1.0745 suggests something has gone wrong, although whilst prices remain below last week’s high then the potential for it to roll over remains.

Oil and gold falter at their highs

Gold couldn’t quite tap the November high around 1916 overnight despite geopolitical tensions only intensifying. That it closed lower for the first day in five, it’s the first real sign of fatigue, and an obvious and tempting level for some to book a profit. We’re not looking for a trend reversal, but every move needs to catch its breath once in a while.

The trouble oil traders face right now is that it is so volatile. Its daily range yesterday spanned just under 7% from high to low yet is on track to close flat for the day. That’s the kind of day where few make money as both longs and shorts get sucked into trades that ultimately reverse against them.

How to start gold trading

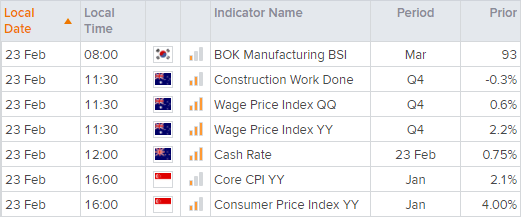

Up Next (Times in AEDT)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade