Tuesday US cash market close:

- The Dow Jones Industrial rose 67.29 points (0.2%) to close at 33,128.79

- The S&P 500 index rose 20.1 points (2.51%) to close at 34,058.75

- The Nasdaq 100 index rose 14.052 points (0.11%) to close at 13,089.90

Asian futures:

- Australia's ASX 200 futures are down 0 points (-0.65%), the cash market is currently estimated to open at 7,316.20

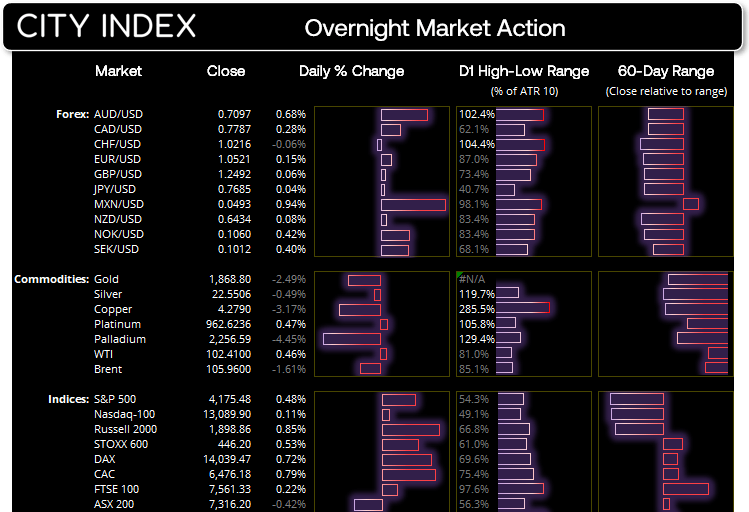

The Federal reserve began their 2-day meeting overnight which concludes on Thursday, and that’s resulted in choppy trading conditions for Wall Street. With money markets pricing in a 99.9% chance of a 50-bps hike, the bigger question is whether it will be a 50-bps or 75-bps hike.

The S&P 500 flirted with a test of 4200 before closing at 4175 with a small bearish hammer on the daily chart. Whilst 10 of its 11 sectors traded higher (led by energy and financials) its upside lacked conviction, although its downtrend on the daily chart has found support at the May 2021 low of 4056. Basically, we suspect volatility may be limited leading up to the conclusion of the FOMC meeting on Thursday.

Exchanges for mainland China, Hong Kong and Japan remain closed today due to public holidays.

ASX 200:

ASX 200: 7316.2 (-0.42%), 02 May 2022

- Materials (-1.04%) was the strongest sector and Telecomms (-0.16%) was the weakest

- 3 out of the 11 sectors closed higher

- 8 out of the 11 sectors closed lower

- 8 out of the 11 sectors outperformed the index

- 64 (32.00%) stocks advanced, 124 (62.00%) stocks declined

Outperformers:

- +5.03% - Magellan Financial Group Ltd (MFG.AX)

- +4.56% - Block Inc (SQ2.AX)

- +4.32% - GQG Partners Inc (GQG.AX)

Underperformers:

- -6.68% - Lake Resources NL (LKE.AX)

- -5.55% - Premier Investments Ltd (PMV.AX)

- -4.90% - Bapcor Ltd (BAP.AX)

AUD off to a good start thanks to the RBA

Mid-way through the first week of May, the Australian dollar is the strongest major and risen 0.53% against the greenback. RBA raised rates ahead of this month’s federal election, but the bigger surprise was that it was by 25-bps and not the 15-bps we (and many others) had expected. The meeting helped the Aussie break an 8-day losing streak and close bac above 0.7050. Whether it can produce a meaningful bounce from here is likely down to whether the Fed ‘only’ hike by 50-bps instead of the 75 that some now expect.

The US dollar index hovers just below its 2017 high and we suspect it will remain in a choppy range around these levels up to Thursday’s Fed meeting. That should also be factored in for gold traders, who would be wise to remain nimble and seek smaller targets.

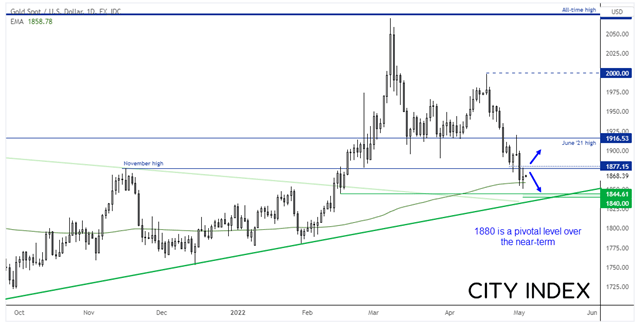

Gold finds support at its 200-day eMA

Gold initially fell to a 5-week low as it teased a break of its 200-day eMA for a second day on a row. Yet it managed to close back above it and form an elongated Doji, or a spinning top. Momentum has clearly favoured bears over the past few weeks, and it could still move down to the 1840 area. Yet the 200-day eMA is not always an easy nut to crack.

To make any use of this contrasting information, bears may want to look for signs of weakness with intraday rallies up to 1877 resistance to then target yesterday’s low or the 1840 area. Whereas a break (or daily close) above 1880 raising the odds that we have finally seen an important swing low. Of course, traders would do well to keep an eye on the US dollar index which is perched near multi-year highs ahead of the FOMC.

Natural gas taps a record high

Colder temperatures in the US and tensions over ‘Russian gas for roubles’ stand-off saw natural gas futures rise to their highest levels since 2008, before settling around 7.815. With some reports suggesting the EU will reject Russia’s proposal then it is hard to envisage a scenario where we do not see natural gas break higher from here.

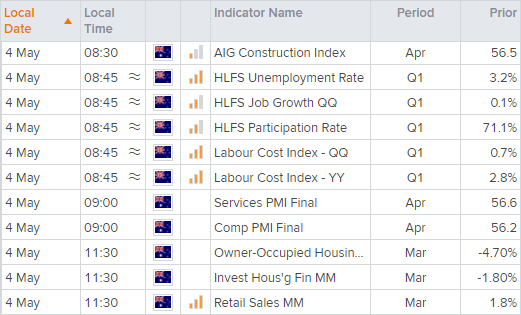

Up Next (Times in AEST)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

- Open an account, or log in if you’re already a customer

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade