It was a strong start to the week for WTI following reports that Saudi Arabia were raising the cost of their crude sales in July. This is at odds with OPEC’s recent decision to increase output – a move which was seen as potentially helping to tame inflation. But it is a sure sign that demand for oil remains high. China reopening, US driving season and ongoing tensions between Russia and the West remain supportive of higher prices, with OPEC’s price hikes helping oil gap $2 on Monday’s open and rise to a 13-week high. And if we take a look at market positioning, fund managers seemingly agree with these higher prices.

How to start oil trading

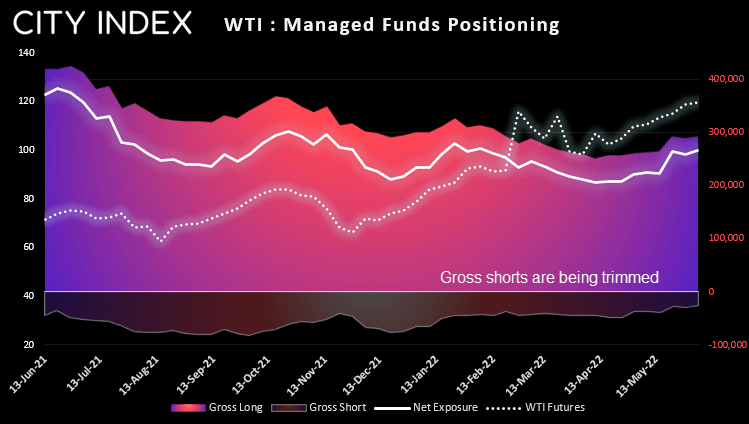

WTI market positioning:

Market positioning has seen bears trim their short exposure to the WTI futures contract. Managed funds have been reducing their short exposure to WTI since December, but more recently we’re seeing gross long exposure creep higher. This has pushed net-long exposure to 4-month high, and open interest – a proxy for volume – increased by 76k contracts last week alone.

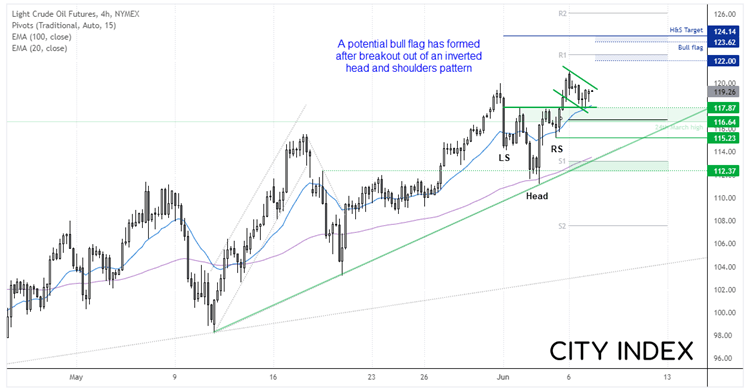

WTI (4-hour):

We can see on the four-hour chart the WTI remains in a strong bullish uptrend. Support on Friday was found at the 100-bar eMA and a bullish trendline and momentum has clearly turned higher, in line with that trend.

The late rally on Friday saw prices break out of an inverted head and shoulders (H&S) pattern, which projects a target around $124.0. To remain valid prices must hold above yesterday’s which respected the neckline as support. However, the 4-hour trend remains bullish above the 115.23 low, so we’d still consider bullish setups above 116 given the strength of the underlying trend.

Furthermore, a potential bull flag is also forming and holding above 117. Incidentally, it also projects a target near the inverted H&S pattern. From here, a direct break higher confirms the bull flag and our bias remains bullish above yesterday’s low, with the $122 and $124 resistance zones becoming its next target.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

- Open an account, or log in if you’re already a customer

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade