Last week the inflation rate rose to 5.1% year on year, higher than the 4.4% expected and much higher than the ECB’s most recent staff forecasts of 3.2%. For a central bank with a strong pedigree as inflation hawks, it was the straw that broke the camel’s back.

President Lagarde acknowledged “universal concern around inflation data” and indicated a policy recalibration in March, leading to a mass revision of forecasts. The expectation is for the ECB’s QE program to end in June, and for 50bp of tightening by year-end, that would take the deposit rate back to…….zero.

For the beleaguered European Banking sector, the prospect of zero or possibly even a positive deposit rate has been irresistible. The share price of German banking giants Deutsche Bank and Commerzbank both finished the week ~14% higher.

A reminder that the DAX and other European stock markets have a good representation of banks and commodities that will benefit if interest rates continue to rise ahead of, say, the tech-heavy interest rate sensitive Nasdaq, for example.

In contrast to the U.S., where Joe Bidens Build Back Better stimulus plan was declared “dead” last week, continued fiscal support in the Euro Area has forecasts for GDP growth in the Euro Area exceeding that of the U.S. for the first time in a decade.

The factors outlined above have helped the DAX remain within a multi month range despite weakness in other global equity markets

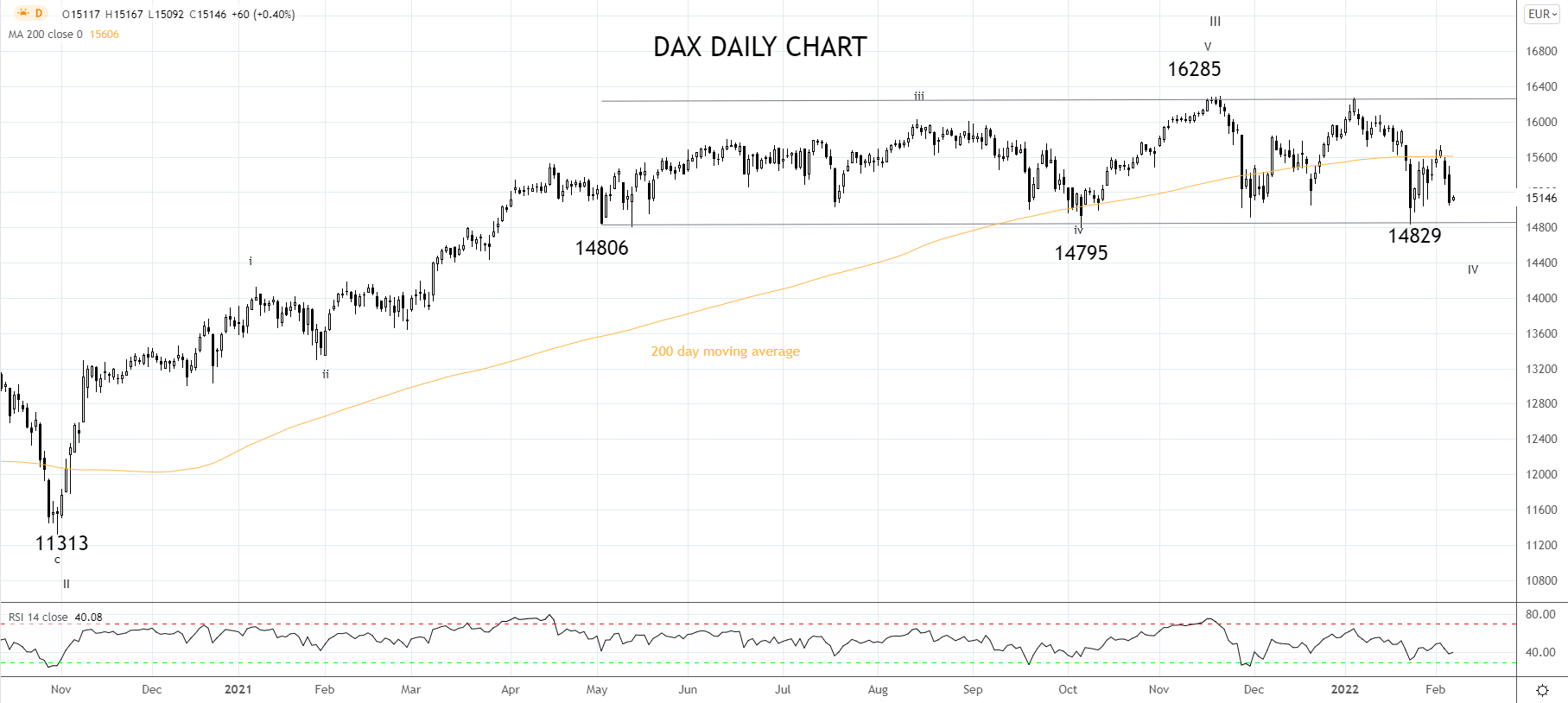

DAX Daily Chart

As viewed on the chart below, the DAX has been trading in a range between 14800 and 16300ish since May 2021.

Based on an expectation for the range trading to continue, we would wait for the DAX to retest support from the bottom of the range 14900/14800ish.

If a “loss of momentum” type “Doji” type candle were to form at or near the support zone above, we would buy the DAX on a break 20 points above the loss of momentum candles daily high, looking for rotation back towards 16,000 before 16,250.

If the trade entry is triggered, place a stop at 14750 to trail the stop loss higher. Aware that a sustained break below range lows 14800 would indicate a deeper decline is underway.

Source Tradingview. The figures stated areas of February 7th, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade