In this note, we argue why the AUDUSD has likely bottomed and how to position for further upside.

FOMC (Thursday): Higher inflation and a tight labour market will likely see the Federal Reserve deliver on its recent hawkish pivot and accelerate the taper pace to $30bn per month beginning in January, which would see the taper end in Mid-March.

A faster taper would clear the way for the Federal Reserve to start raising rates in the June Quarter 2022, in line with market expectations but faster than Fed officials expected.

RBA: As noted last Tuesday here the last paragraph of the RBA's statement was a truncated version of the November version that provides more scope and optionality for the RBA to raise interest rates earlier if needed.

Less we forget, monetary policy divergence has been a critical reason for the recent fall in the AUDUSD to .7000c.

The OIS curve in Australia and the U.S. are now similarly priced for an interest rate hike by mid-2022 and almost fully priced for three hikes by the end of 2022.

China Policy Easing: Last week, Beijing announced stabilising growth is a crucial priority in 2022, reducing tail risks for the Chinese economy and, by extension, the AUDUSD.

Improved Risk Sentiment: Last week, the S&P500 had its best week since February, closing 3.82% higher. The AUDUSD tends to outperform when the market is in a risk-seeking mode.

Short Positioning: According to the latest IMM data, the market remains extremely short the AUDUSD.

Australian Labour Force Report (Thursday): Driven by the reopening of NSW, Victoria, and the ACT, employment is expected to rise by 190,000 in November and the unemployment rate to fall from 5.2% to 5%.

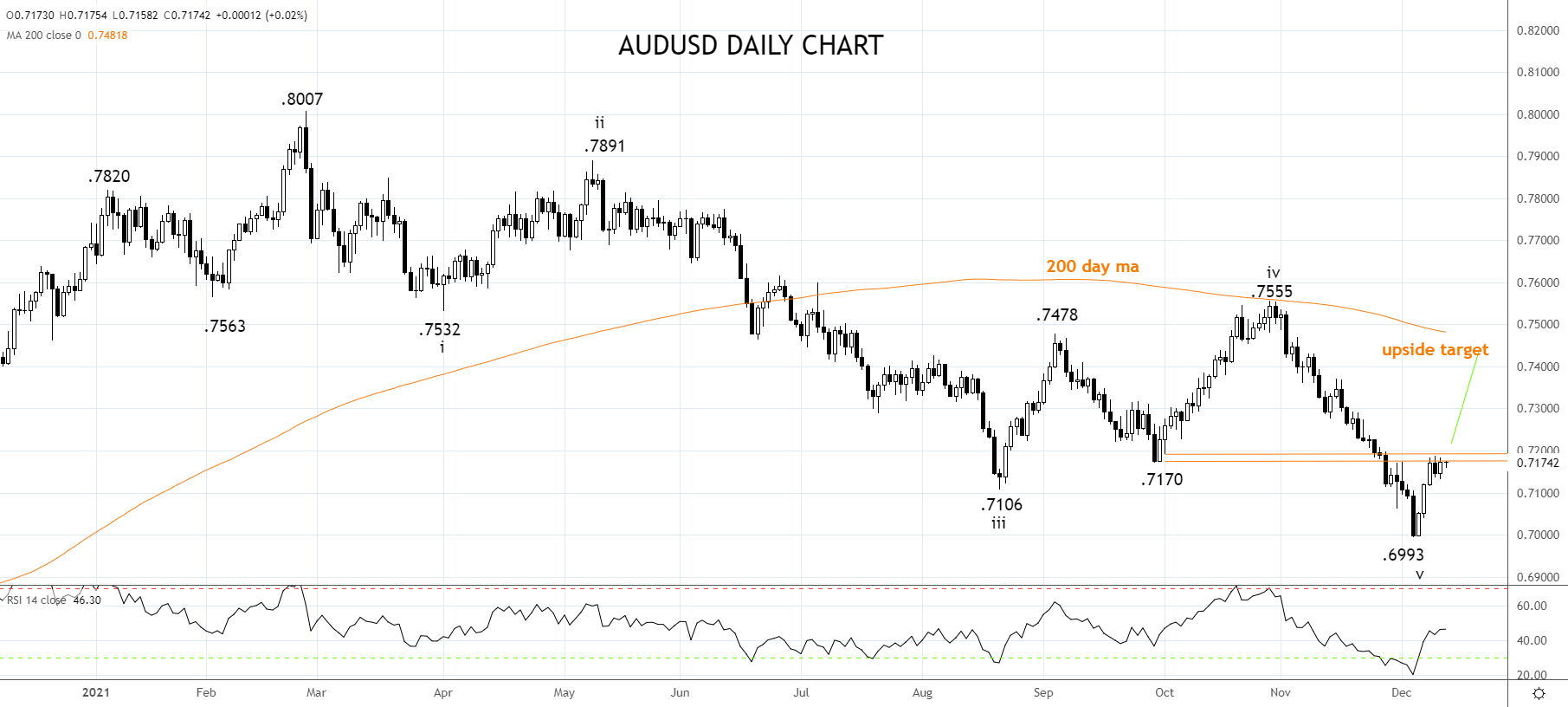

Technicals: The view is the AUDUSD completed a textbook Elliott Wave five-wave decline from the February .8007 high to last week’s .6993 low. Should the AUDUSD break and post a daily close above resistance at .7185/95, the rally would extend towards .7320/40 before .7430/50.

Trade Idea: Buy the AUDUSD on a stop entry at .7201, leaving room to add to the long position on a daily close above .7201 (limit .7211). The protective stop loss will be placed at .7105, and the initial target is .7340, before .7450 providing an attractive 2:1 risk-reward trade.

Source Tradingview. The figures stated areas of December 13th, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade