- US economic exceptionalism is being questioned

- US data delivering the largest share of negative surprises since early 2023

- Markets are starting to price in the risk of several Fed rate cuts this year

- Be it fundamentals or technicals, signs point to growing downside risks for USD/JPY

The game for USD/JPY changed last week. The likely intervention from the Bank of Japan (BOJ) on at least one occasion to support the Japanese yen, coupled with a large reversal in US bond yields, means the successful strategy of buying dips may have run its course near-term. Downside risks look to be building. And based on the ugly reversal on the weekly USD/JPY chart, and how quickly US economic data looks to be deteriorating, those risks could easily materialise into something far more significant than that already seen.

US economic exceptionalism questioned

Traders have become accustomed to being impressed by the resilience of the US economy, continuing to power ahead while the rest of the developed world struggles to avoid recession. It’s been that way for years, assisted by stimulatory fiscal policy and dynamism the US economy is renowned for. However, the weight of expectation and sustained tighter financial conditions may be finally starting to take its toll on the world’s largest economy. Long before Friday’s soft non-farm payrolls report and ISM non-manufacturing PMI survey for April, there were sign US economy was starting to come back to the chasing pack.

Even though it’s largely comprised of assumptions and estimates and therefore prone to large revisions, the advanced Q1 GDP report undershot even the most pessimistic market forecast, printing at 1.6% annualised after seasonal adjustments. The separate flash S&P Global US services PMI – released ahead of the ISM survey – was also soft, providing a decent signal of what was to come.

US economic data coming off fast

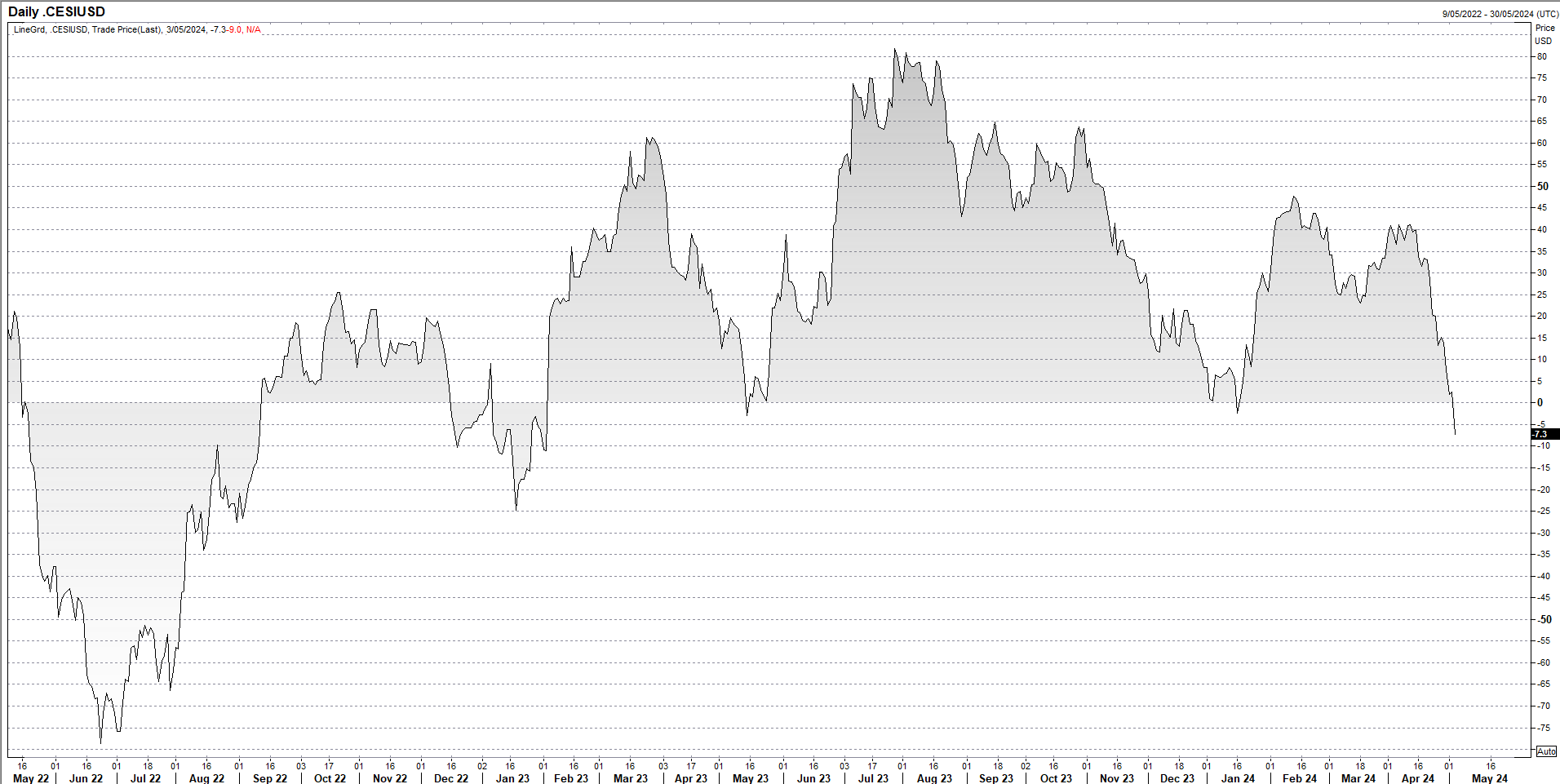

Combined with other data misses and economist views remain optimistic, it’s seen Citi’s US economic surprise index fall into negative territory for the first time since early January, hitting levels not seen since February 2023.

Source: Refinitiv

While the reading implies only a small majority of releases are missing relative to consensus, it’s the speed of decline since the middle of April that is eye-catching, exceeding what was seen in the final quarter of last year when the Federal Reserve pivoted from rate hikes to cuts.

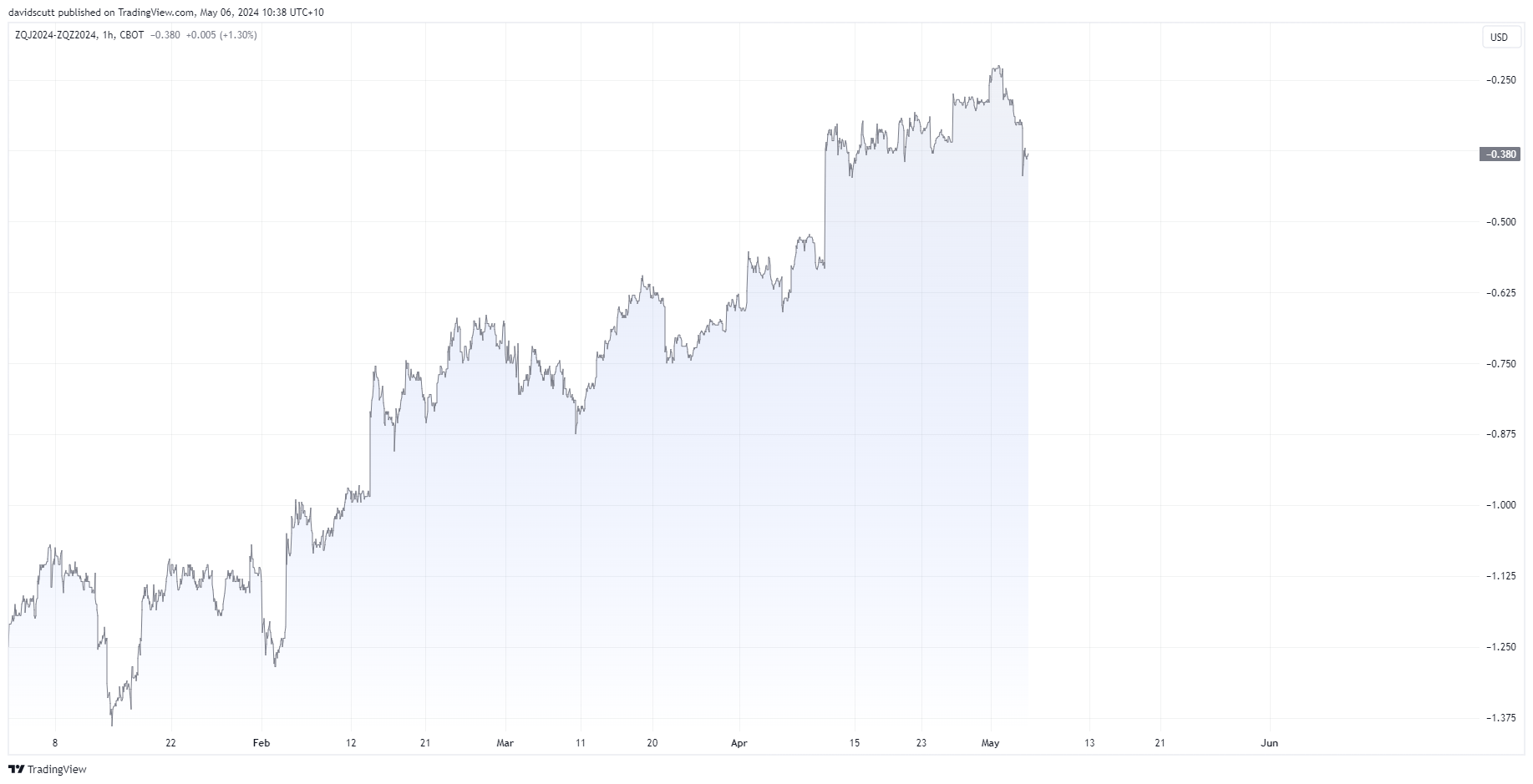

Markets now favour two Fed rate cuts in 2024

As the data has started to rollover, market pricing for rate cuts in 2024 has built again, reversing some of the significant hawkish repricing seen since the start of the year. You can see the Fed funds futures curve between May and December now has 38 basis points of cuts priced this year, up from 22.5 at the start of May.

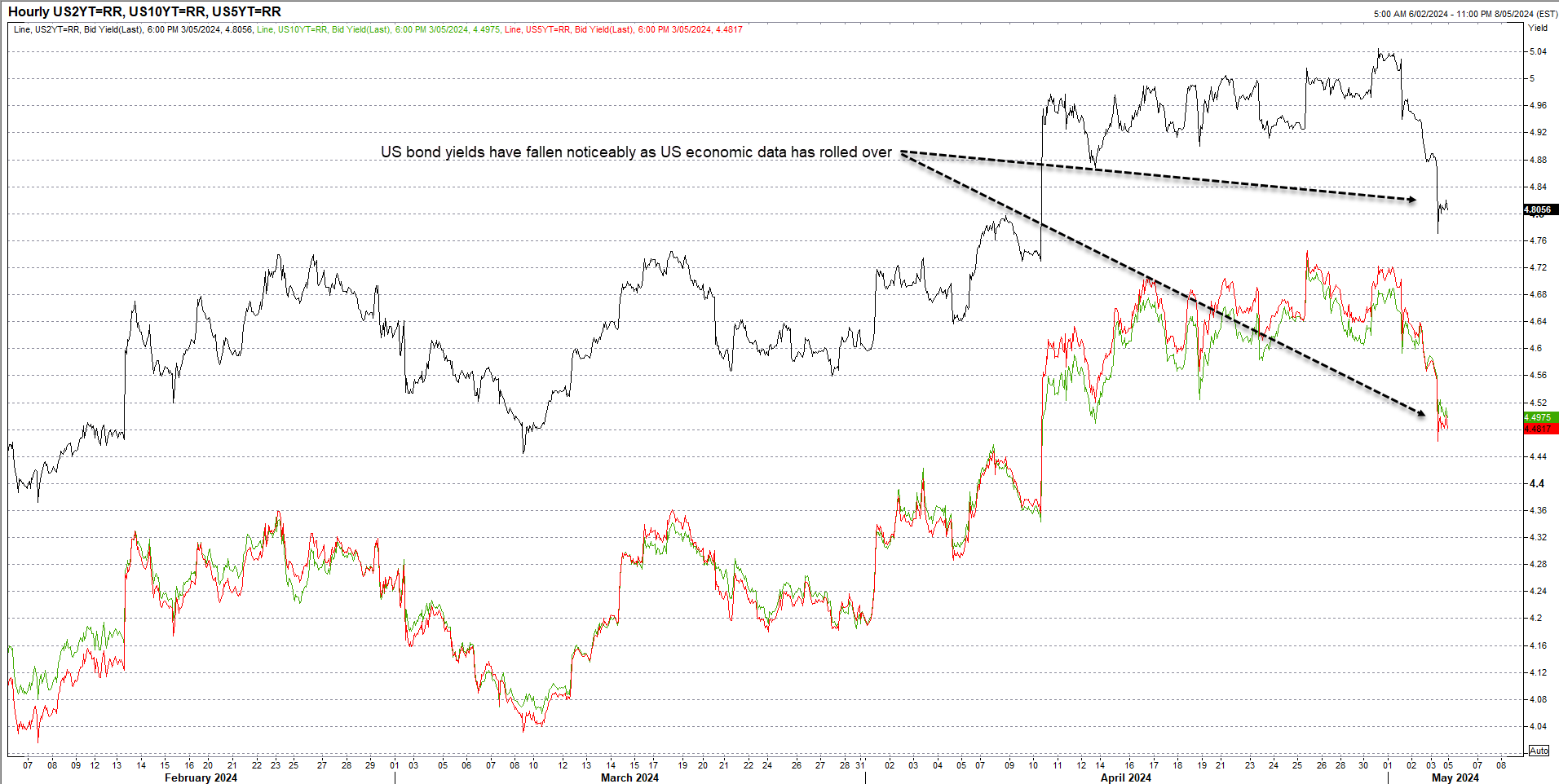

US bond yields decline

The decline in US short-end rates has mechanically dragged US bond yields lower with two, five and 10-year Treasuries down around 24, 27 and 23 basis points respectively from the recent highs.

Source: Refinitiv

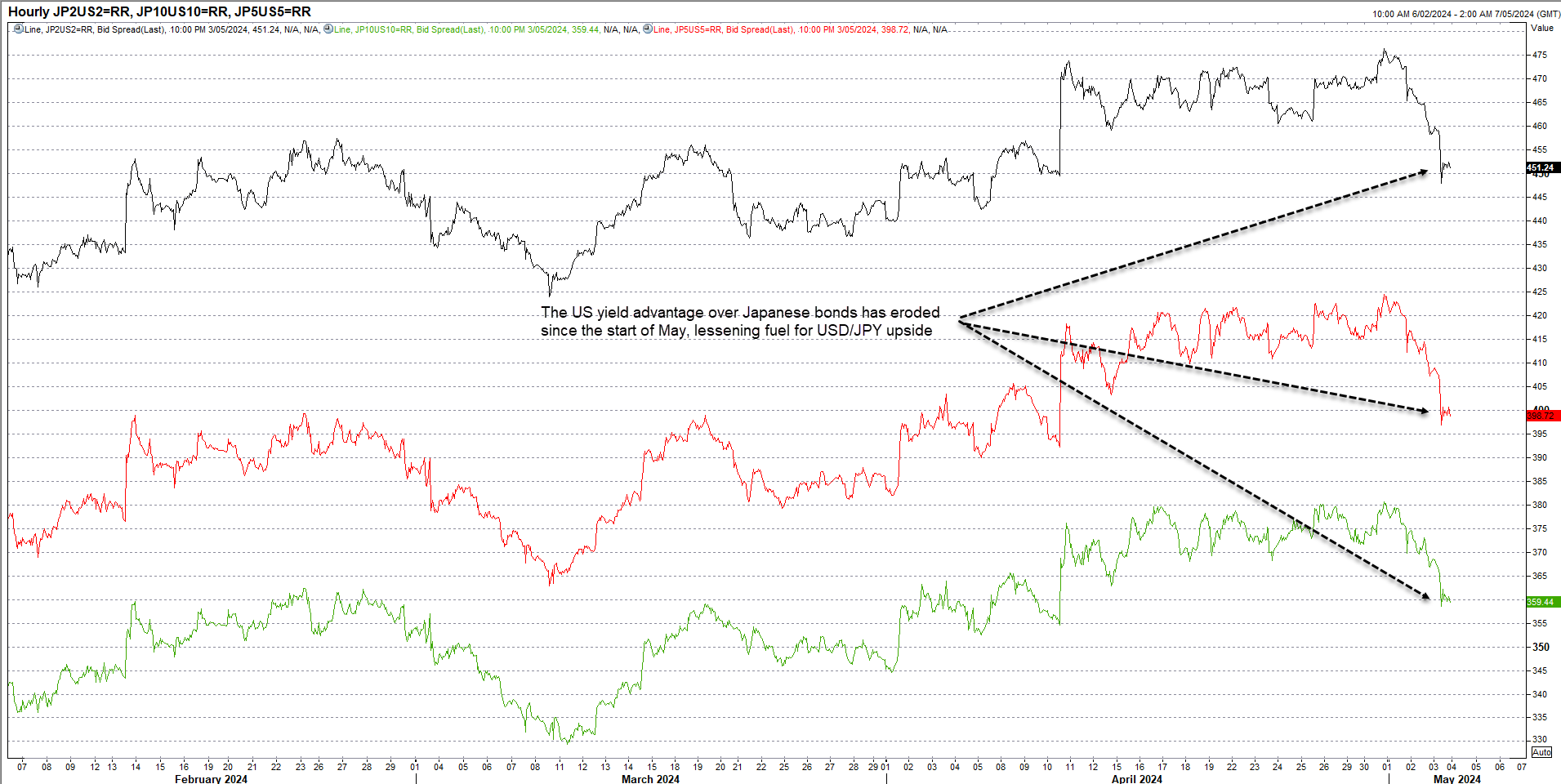

Yields spreads between the US and Japan compress

That’s important for USD/JPY given how influential US bond yields can be on its overall direction, seeing spreads between the US and Japan for those tenors compress since the start of May.

Source: Refinitiv

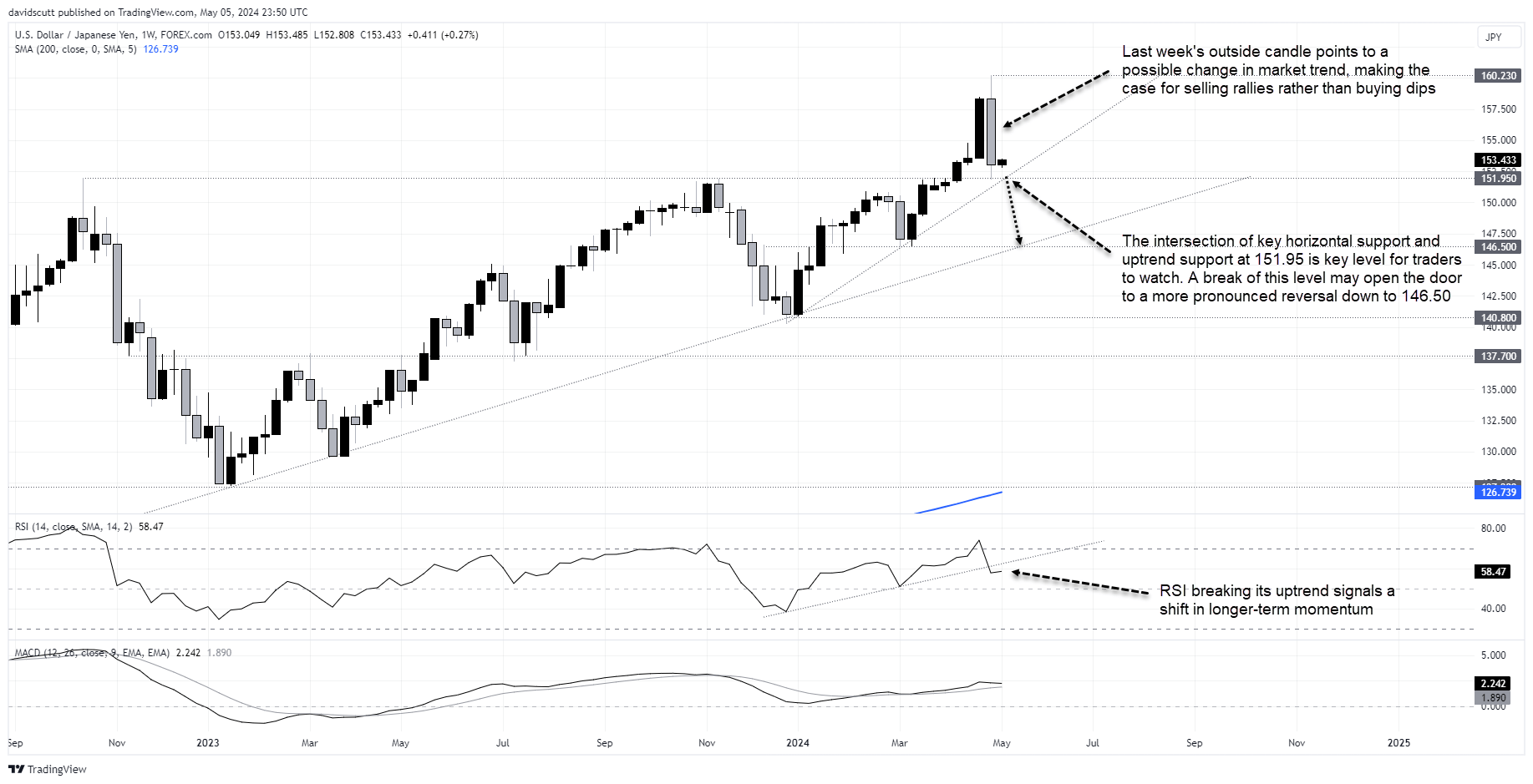

USD/JPY weekly chart warns of trend reversal

Much like the near-term fundamental picture even before the threat of BOJ intervention is considered, the technical picture for USD/JPY is also one of growing downside risks.

The outside candle on the weekly chart was only marginally away from printing a key outside week, seeing the pair tumble from highs above 160 to key support just below 152.

With the uptrend in RSI broken, you get the sense this week is important for the longer-term trajectory for USD/JPY: not only is a retest of 151.95 on the cards, but a break would also take the price through uptrend support dating back to December last year, opening the door to a far larger downside flush below 150.

There’s also no top-tier US economic data to move the pair around, leaving only Fedspeak along with three and 10-year Treasury note auctions as the main events for traders to consider.

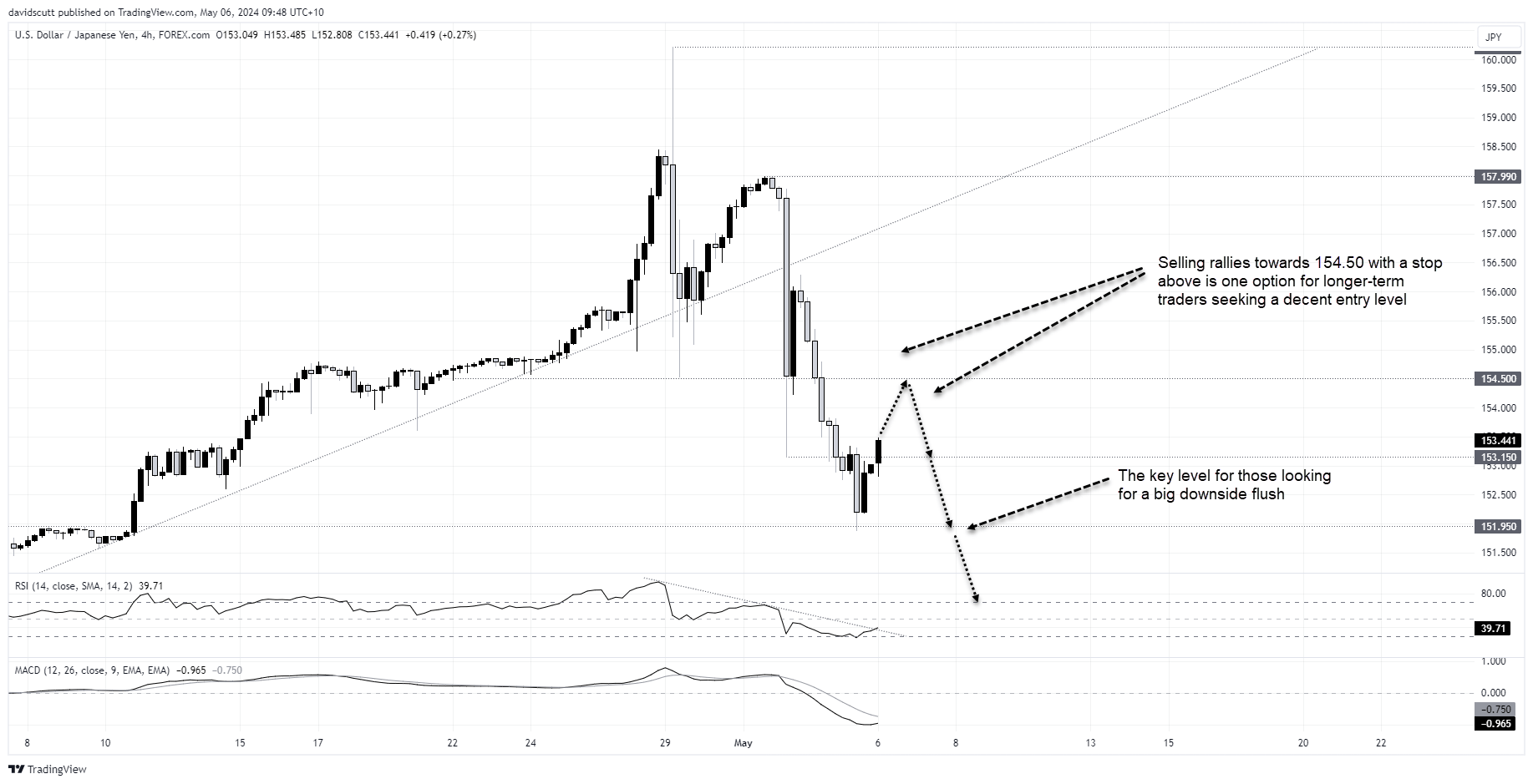

Selling USD/JPY rallies preferred

The risk-reward for going short around these levels is not compelling despite the darkening fundamentals and technical picture, making a break of downside support or selling rallies at higher levels a higher probability play this week.

Those with patience could wait for a possible push back towards 154.50, a level USD/JPY did plenty of work either side of post the suspected BOJ intervention episode last Monday. Entry around this level with a stop above for protection offers decent risk-reward for those favouring downside.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade