Traders hoping for bold stimulus measures from Chinese policymakers have been left disappointed again, amplifying concerns regarding the trajectory for the Chinese economy. And that makes it difficult to get excited about a meaningful recovery in mainland stocks or the Chinese yuan.

Property market support lacking

The People’s Bank of China’s (PBOC) Loan Prime Rate (LPR) – the benchmark rate new and existing loans within China are priced off – was lowered by 10 basis points to 3.45% for August, below the 15 basis point reduction expected. The 5-year LPR -- which influences mortgage rates – was surprisingly left unchanged at 4.2%, delivering another hit to sentiment towards China’s property sector.

Markets were looking for a decline in both LPS tenors of at least 15 basis points, the same degree wholesale funding costs were reduced when the PBOC cut its 1-year medium-term lending facility rate to 2.5% last week, the largest decline since the early stages of the pandemic.

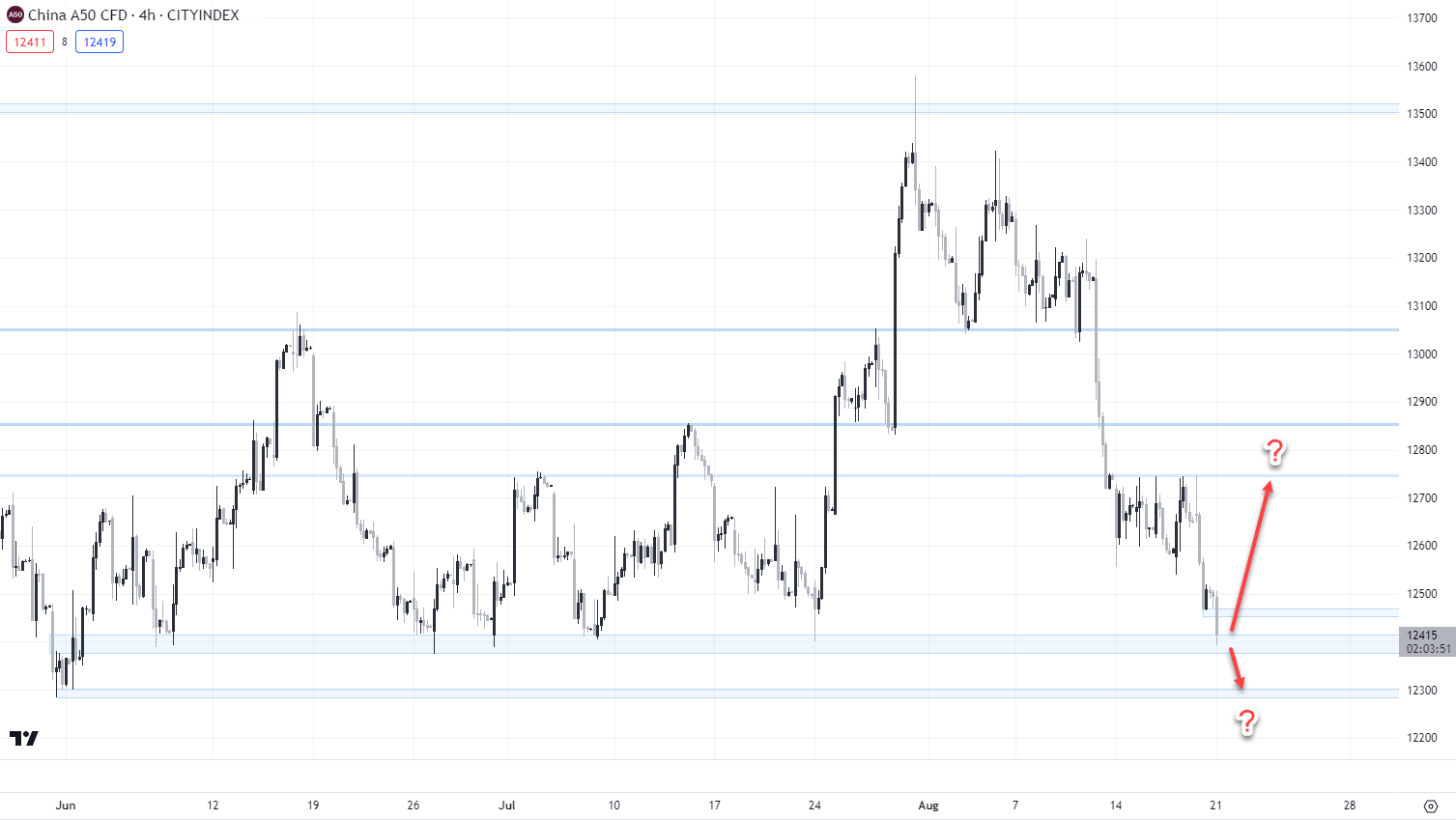

China A50 remains a sell-on-rallies play

With traders growing increasingly desperate for a stimulus “bazooka” from either the government or PBOC, today’s underwhelming measures underscores why Chinese markets remain on the nose with investors.

The China A50 added to losses following the LPR announcement, testing solid support below 12,400 which has held firm over the past two months. A break of that support zone may open see a test of the June lows below 12,300. There’s little in the way of major support beyond that level until 12,000.

Should the support zone below 12,400 continue to hold, gains to the topside are likely to be capped around 12,750 in the absence of a meaningful change in sentiment towards the prospects for the Chinese economy.

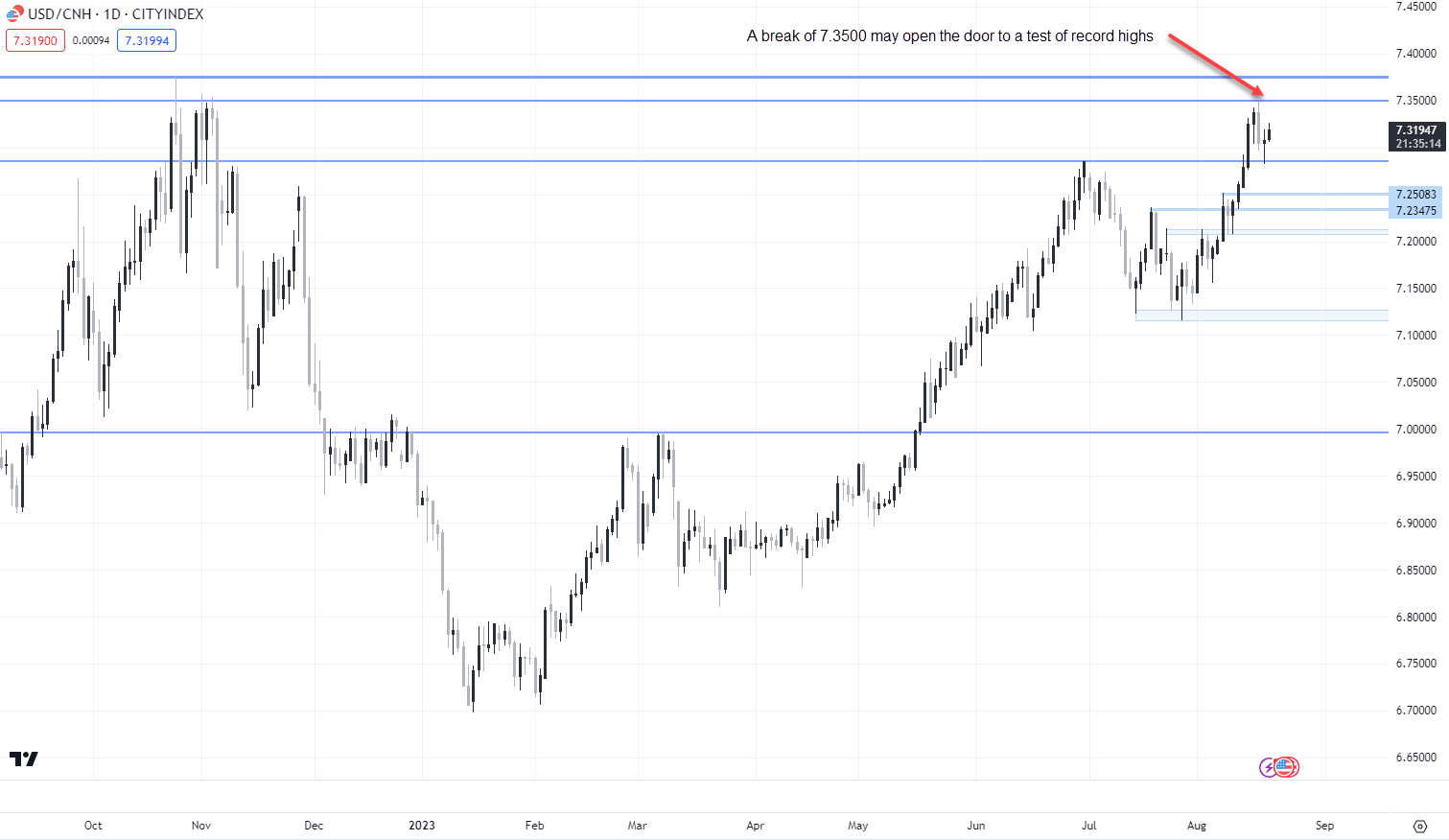

Fresh highs for USD/CNH on the cards?

USD/CNH reacted immediately to the LPR announcement, shifting back towards the middle of the trading range it’s been stuck in since the start of last week. On the topside, a break of 7.3500 opens the door to a potential test of the record high set in October last year. On the downside, bids may emerge around 7.2850, 7.2500 and again at 7.2350.

In the advent of a more sizeable reversal – something that remains a possibility given reports of regular intervention in the FX market by state-controlled Chinese banks and stronger daily fixings from PBOC -- a support zone below 7.1300 looms as a possible first port of call.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade