US dollar index on track for its worst week of the year: The Week Ahead

With Fed Chair Jerome Powell effectively delivering a dovish pivot during his testimony to the house Committee, traders will no doubt jump onto weaker US economic data to reprice multiple rate cuts - and that could weigh further on the US dollar.

The week that was:

- Jerome Powell effectively delivered a dovish pivot during his testimony the House Committee, saying the Fed was “not far” from gaining the confidence to cut rates

- The US dollar was broadly lower alongside US yields, and Fed fund futures are now pricing in a 25bp cut in June with a 56.7% probability

- Tokyo CPI was above expectations and wages are on the rise, which bolstered bets that the BOJ could finally ditch negative interest rates and sent USD/JPY to a 5-week low

- The services sector in the US is softening according to the latest survey, with the headline index slowing to a 2-month low, employment contracting and prices paid only rising gradually (unlike the prior month where it screamed higher)

- The Bank of Canada held rates at 5% and poured cold water on any hopes of a cut arriving soon

- The ECB held rates but markets are now betting on four 25bp cuts this year

- USD/CAD fell nearly 1% to mark its worst 2-day run of the year

- China set their annual growth rate target to be ‘around’ 5% for a second consecutive year, a 5.5% unemployment rate, CPI ~3% and the creating of 12 million new urban jobs according to the “Government Work Report” released at the annual National People’s Congress meeting

- Gold and Bitcoin reached record highs early in the week, yet Bitcoin’s sharp reversal lower weighed on risk on Tuesday to topple gold, see Wall Street retrace further form record highs and safe-haven flows towards the Japanese yen

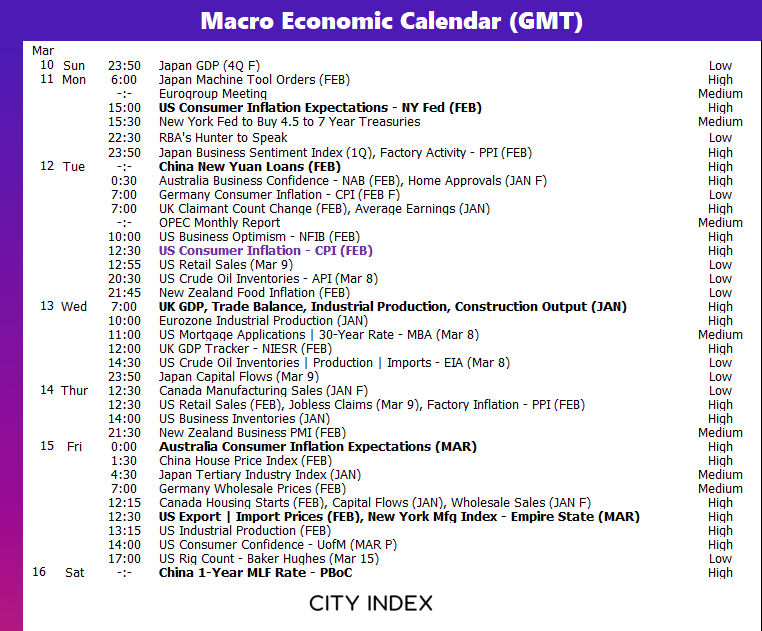

The week ahead (calendar):

The week ahead (key events and themes):

- US inflation, CPI expectations

- UK data dump

- China’s data (new loans, loan prime rate)

US inflation, CPI expectations, consumer sentiment

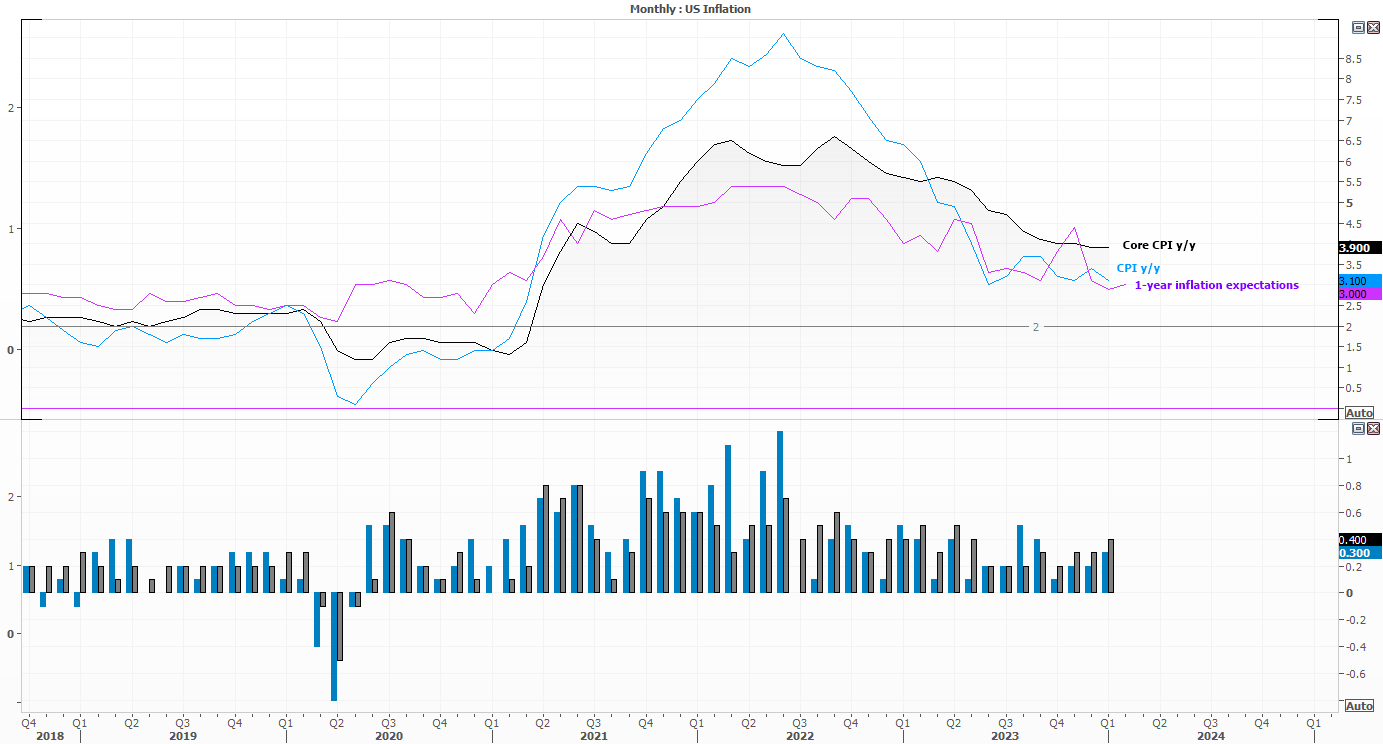

As always, the US inflation report will be the highlight of the week. Over the past month, the headline CPI report rose and came in above expectations whilst PCE inflation rose but met expectations. The main issue of course is that inflation is rising. And if it continues to do so in next week’s figures, the Fed may need to walk back Powell’s dovish pivot he delivered to the House Committee this week.

There are also two doses of inflation expectations; one from the New York Fed on Monday and another within the University of Michigan consumer sentiment report. Inflation expectations are a lot lower than they were, so as long as they remain suppressed then the case for a Fed cut remains alive.

Trader’s watchlist: EURUSD, USD/JPY, WTI Crude Oil, Gold, S&P 500, Nasdaq 100, Dow Jones

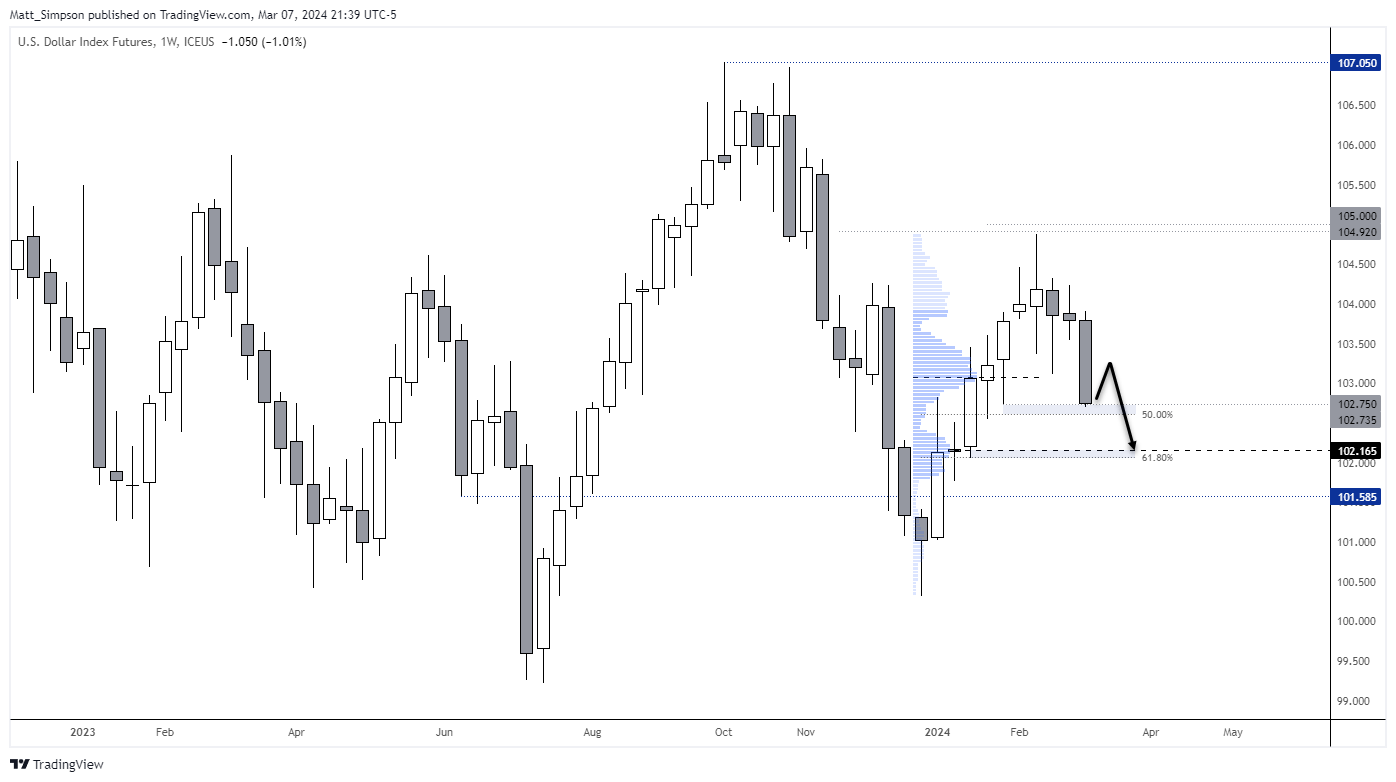

US dollar index technical analysis:

The US dollar index (DXY0 is on track for its worst month of the year. And there could be further losses ahead should US data back up Powell’s dovish pivot. The weekly chart shows that prices have fallen beneath the VPOC (volume point of control) around 103, which now brings the next highest volume node into focus.

For now, the US dollar index has found stability around 102.75, just above the 50% retracement level. Therefore, a retracement higher is expected. But the bias is to fade into USD strength next week, in anticipation of a move towards 102, near the high-volume node and 61.8% Fibonacci retracement level.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade