Key takeaways

- The Consumer Price Index (CPI) in the US increased 0.4% in February, in-line with expectations and slightly lower than the January's figure of 0.5%.

- The annual CPI gain of 6.0% in February was the smallest increase since September 2021, from the 6.4% recorded in January.

- Excluding the volatile food and energy components, core CPI rose 0.5% in February, compared to expectations (and last month’s reading) of 0.4% m/m.

- Despite above-target inflation, markets are uncertain if the Fed will raise interest rates due to recent banking turmoil and financial stability risks.

The latest US CPI report released by the Labor Department saw a slight slowdown in price pressures, down to 0.4% m/m from January's 0.5%. That said, the report still printed in line with expectations at 6.0% y/y, the smallest annualized gain since September 2021. It is worth noting that the CPI peaked in June last year, where the annual gain was at 9.1%, the biggest increase since November 1981.

Excluding the volatile food and energy components, core CPI rose 0.5% in February compared to January's 0.4%. The year-on-year core CPI gain of 5.5% is slightly lower than January's 5.6%. This result suggests that underlying inflation is stickier than many policymakers would prefer.

The rise in rental housing costs has been a significant contributor to the overall price increase. According to the report, 70% of the overall CPI gain in February was due to the housing sector, which tends to lag other price changes. In contrast, food and energy costs remained relatively stable, contributing to only 15% of the increase.

CPI impact on the Fed

While inflation continues to rise, traders aren’t 100% convinced that the Fed will increase interest rates at its meeting next week. The recent banking turmoil and growing financial stability risks have left the Fed in a challenging position – central bankers must weigh the still-rapid inflation against these risks in their upcoming interest-rate decision.

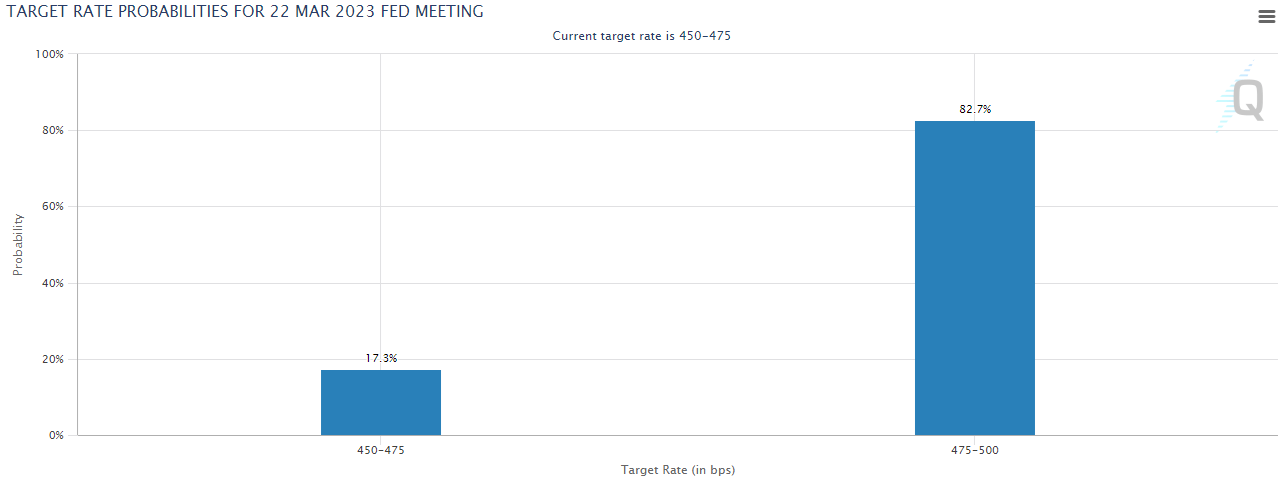

Many economists expect the central bank to either stick with a smaller increase or pause entirely when it meets next week (some even believe that a rate cut could be in store!), but markets are currently pricing in about an 80% probability of a 25bps rate hike next week, up slightly from the pre-CPI figures:

Source: CME FedWatch

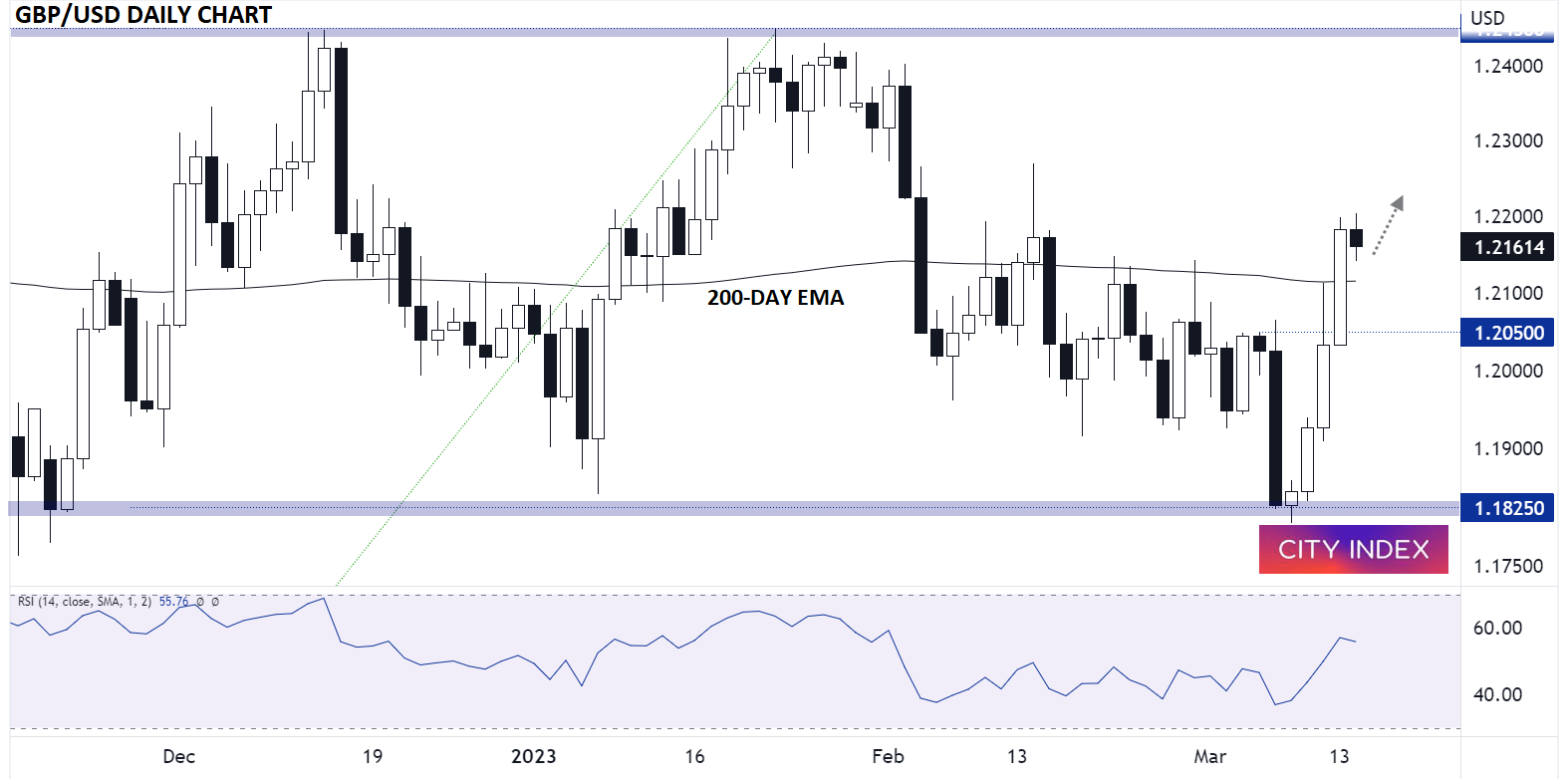

British pound technical analysis – GBP/USD hold near 1-month highs at 1.22

After a solid UK employment report and ahead of tomorrow’s highly-anticipated spring budget, the British pound is among the strongest major currency pairs today.

As the chart below shows, GBP/USD is holding steady on the day as we go to press. The pair rallied back above its 200-day EMA yesterday for the first time since Valentine’s Day, and looking at the recent price action, there’s relatively little in the way of previous resistance until closer to 1.2300.

Therefore, if we see any hiccups in US economic data over the next week or hints that the Fed may opt to hold interest rates steady, GBP/USD could extend its rally further. Meanwhile, a break back below the 200-day EMA near 1.2115 would erase the near-term bullish bias.

Source: StoneX, TradingView

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter @MWellerFX

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade