EUR/USD slips ahead of the ECB rate decision & US GDP data

EURUSD is edging lower after five consecutive days of gains. The EUR has been capitalising on the weaker USD.

The USD has fallen steeply across the week amid growing signs that the economy is slowing following the Fed’s aggressive rate hikes, fueling bets that the Fed could slow the pace at which it hikes rates from December.

Today is all about the ECB. The central bank is expected o hike rates by 75 basis points, the third straight rate hike and the second of this magnitude.

The meeting comes as inflation flirts with double digits at a record 9.9%, and core inflation is at 4.8%, showing few signs of slowing. Yet, with the economy on the brink of recession, is=f it isn’t already in recession, the ECB are unlikely to want to sound too hawkish.

In addition to rate hikes, questions over QT are also growing, although this is likely to start next year.

Looking ahead, US GDP data is due in the US session and is expected to show that the US economy grew 2.4% in Q3 annualised, after two consecutive quarters of declines.

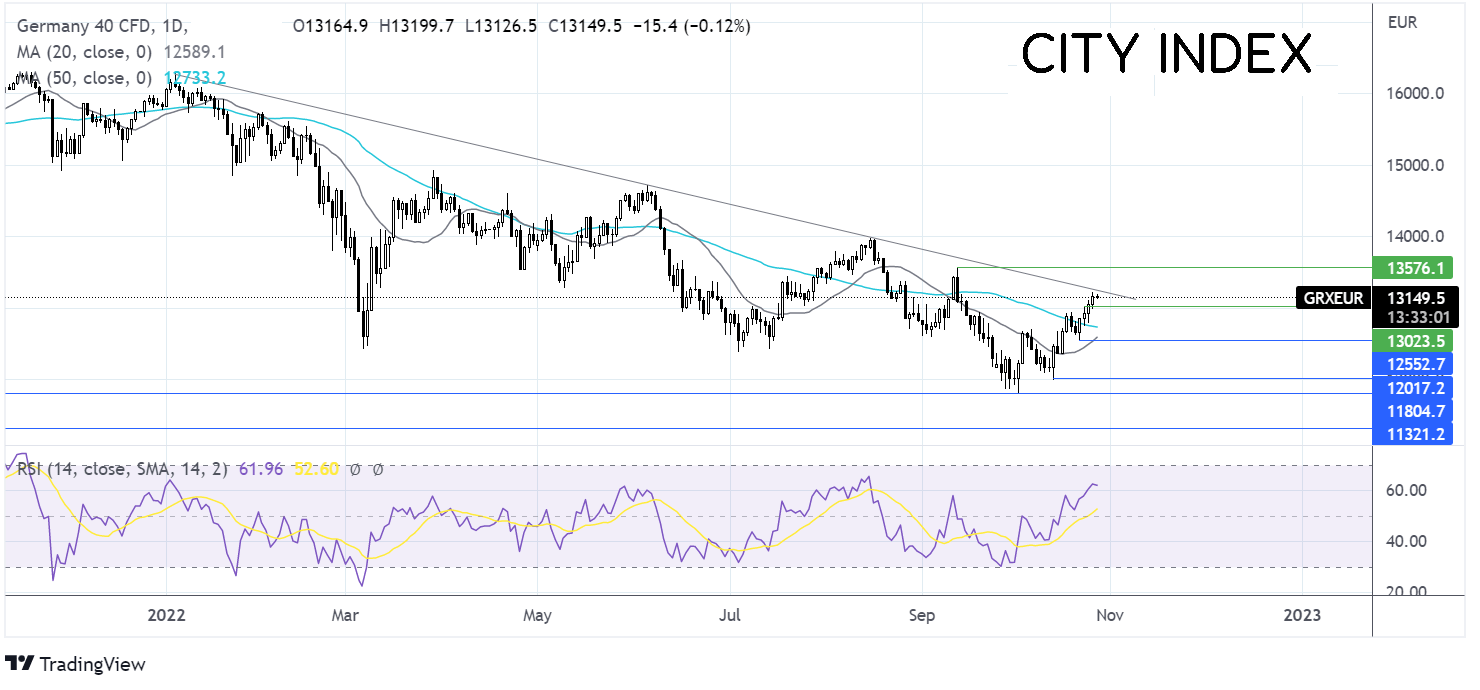

Where next for EUR/USD?

After breaking out above the multi-month falling trendline, EUR/USD ran into resistance just shy of 1.01 and is consolidating those gains. The RSI is over 50, supportive of further upside. Buyers need to break over 1.01 to bring 1.02, the September high, into target ahead of 1.0360, the August high.

On the flip side, sellers will look for a break below parity ahead of testing support at 0.9920, the falling trendline resistance. From here, support can be seen at 0.9849 the 20 sma.

DAX slips despite GFK consumer confidence improving slightly

The DAX ended yesterday 1% higher, its third straight session of gains, boosted by hopes of a less hawkish Federal Reserve.

Today the index is set to open mildly lower after investors digest the latest GFK consumer confidence data.

Consumer sentiment is set for a small recovery in November after hitting an all-time low in October. The GFK index rose to -41.9, up from -42.8; this was ahead of estimates of -42.

It is still far too premature to talk of a change in trend, particularly given the ongoing energy crisis and high inflation. Whether this stabilization continues remains to be seen.

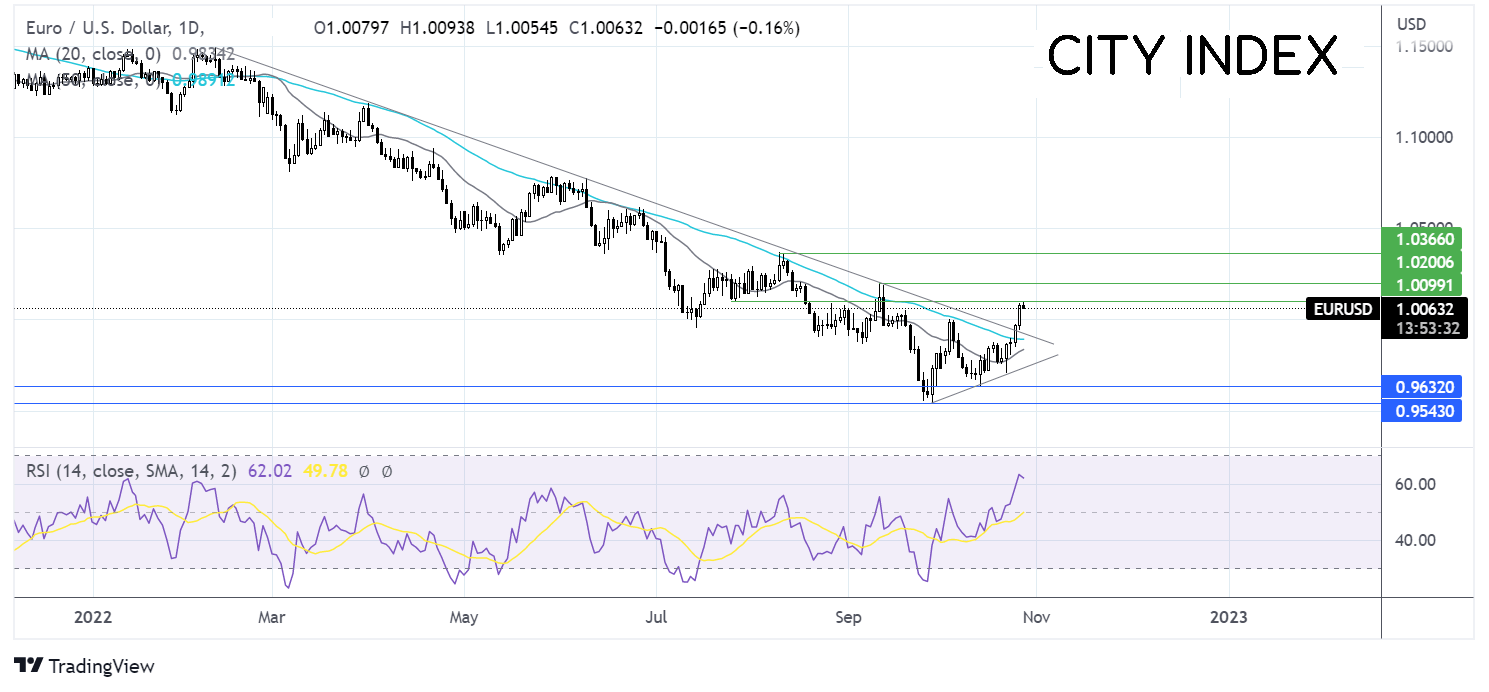

Where next for the DAX?

The DAX is extending its rebound from 11800, the October low, recapturing the 20 & 50 sma, and is looking to rest the multi-month falling trendline. A meaningful break above here would be significant, given that the price has traded below this trendline across 2022. Above the trendline resistance brings 13500 the September high, into focus.

Failure to break above the trendline support could see the price slip back to the 50 sma at 12730 and a break below here exposes the 20 sma at 12580, negating the near-term uptrend.