EUR/GBP rises after a hawkish ECB & as UK retail sales fall

EUR/GBP is rising, building on gains of 1.5% from yesterday as investors continue to digest the ECB and BoE interest rate decisions as well as UK retail sales data.

Both the BoE and the ECB raised interest rates, as expected, by 50 basis points. However, the Bank of England vote was more dovish than expected, with two policymakers voting to leave rates on hold. Meanwhile, the ECB upwardly revised its inflation forecasts suggesting that inflation will be stickier than initially expected and take longer to cool. The ECB warned of many more rate hikes to come, in a more hawkish stance.

Today UK data have been disappointing as retail sales unexpectedly fell 0.4% MoM in November after rising 0.9% in October.

The weak sales data comes following the GfK consumer confidence survey, which remains near a record low for the eighth month. The cost-of-living crisis sees households expecting their finances to deteriorate over the coming year.

Looking ahead UK and eurozone PMI data as expected to show weakness in both economies In December, as the PMIs remain firmly below level 50 which separates expansion from contraction.

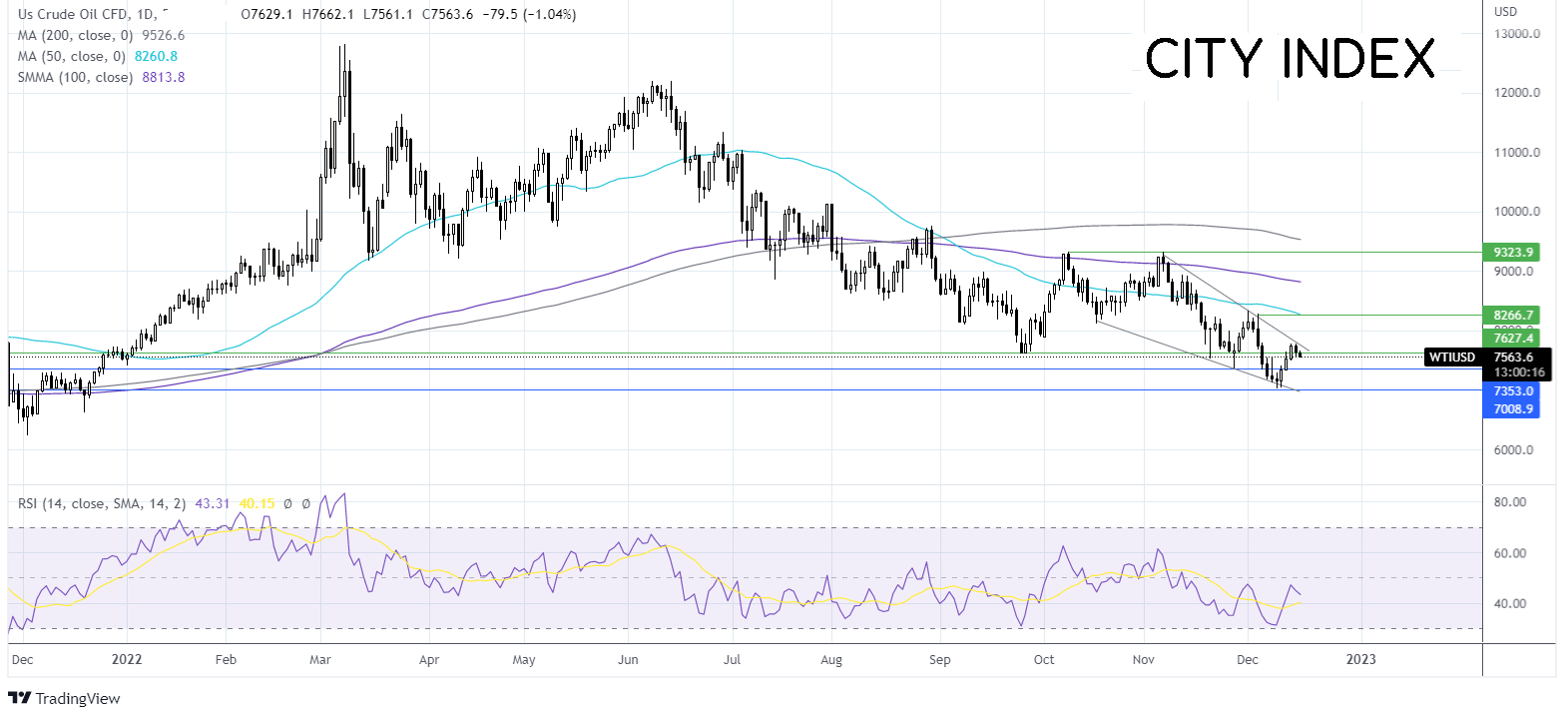

Where next for EUR/GBP?

After Rebounding from the 100 sma the EUR/GBP has recaptured the 50 sma and the Rising trend line dating back to early August. The RSI is over 50, keeping buyers optimistic about further gains.

Buyers will look for a rise above 0.8820, the November high, to bring 0.8870, the October high, into target.

Support can be seen at 0.87, the rising trendline, with a break below here opening the door to 0.8675, the 50 sma. Below here, further support can be seen at 0.8650 the 8 December high.

Oil falls but is set for a weekly gain

Oil prices are holding steady on Friday as investors continue to digest the hawkish central bank signals and the partial reopening of the Keystone Pipeline. However, the black stuff is set for strong weekly gains thanks to the improved demand outlook for the coming year.

A more hawkish than expected ECB and Federal Reserve means that borrowing costs are expected to continue rising next year by more than expected, raising recession fears. Slower growth means lower oil demand.

Meanwhile, the key U S Canada Keystone Pipeline has partially reopened, putting pressure on prices after the pipeline, which carries over 600k bps shut earlier this month.

Still, oil is set to book gains of over 6% this week after the International Energy Agency forecasted robust crude oil demand in 2023 helped by a re-opening in China.

Looking ahead, the focus will be on business activity readings from the US and the eurozone later today. Slowing economic activity could weigh on oil demand expectations, pulling the price lower.

The Baker Hughes rig count is also due later.

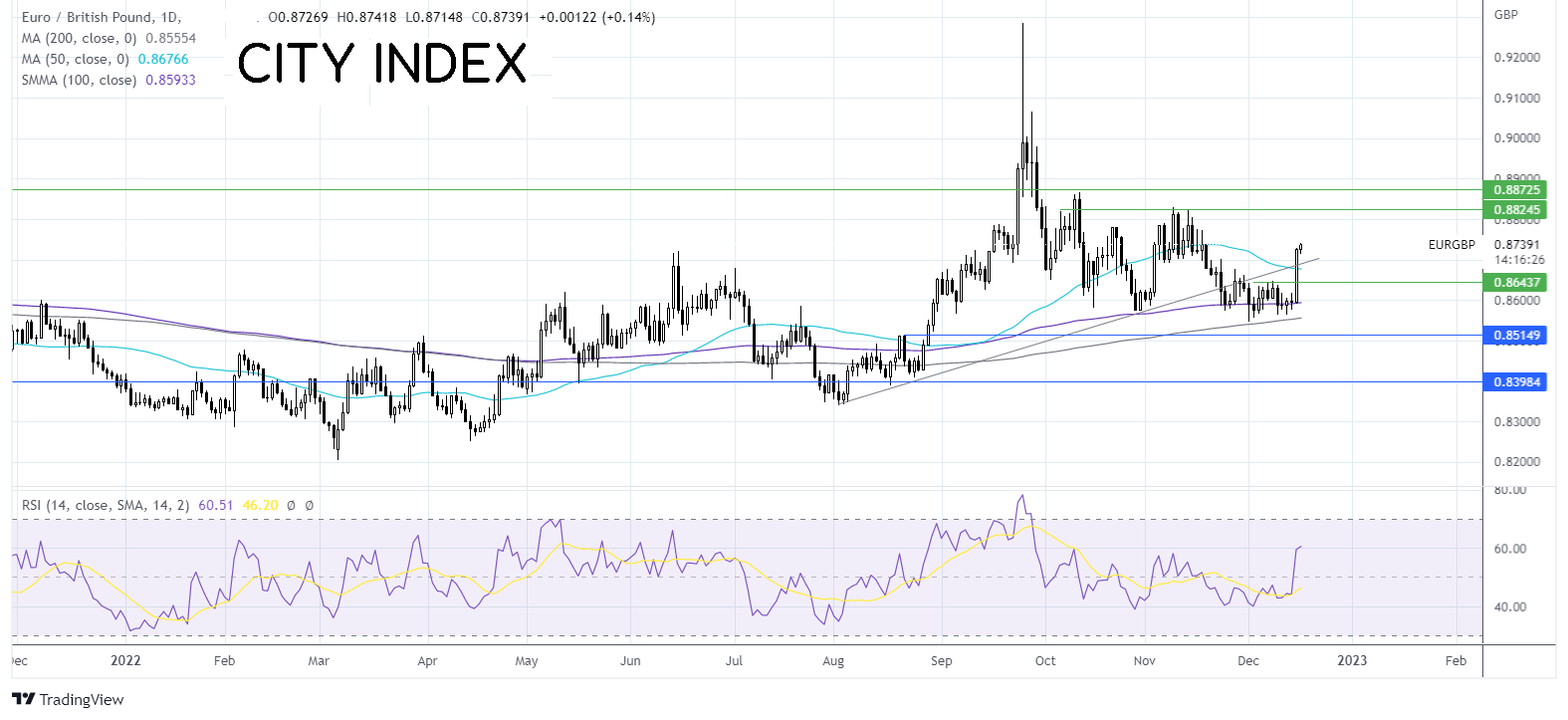

Where next for oil prices?

Oil trades in a falling wedge, which is considered a reversal pattern. Buyers could look for a break out above the falling trendline resistance at 77.80, the weekly high to expose the 50 sma, and December high around 83.00.

Should the sellers successfully defend the trendline resistance, the price could fall towards support at 73.60, the November low ahead of 70.00, the psychological level, and the falling trendline support.