US futures

Dow futures +0.20% at 34648

S&P futures +0.36% at 4479

Nasdaq futures +0.78% at 15398

In Europe

FTSE +0.07% at 7483

Dax +0.35% at 1795

- China’s data buoys the mood & Janet Yellen sees a soft landing

- Tesla jumps 5% on a broker upgrade.

- Yen jumps after the BoJ’s Ueda hints at the end of negative rates

- Oil pauses for breath after another weekly rise

Chinese data wasn’t as bad as feared; Yellen sees a soft landing

US stocks are pointing to a higher start on Monday after steep losses across the previous week. The market mood is being helped by a slight improvement in risk appetite amid signs of stabilization in the Chinese economy.

Over the weekend, data showed that Chinese consumer inflation tipped back into positive territory while the PPI cooled at a slower pace, suggesting that the economy could be steadying after slower growth over the past few months.

Still, the market mood remains cautious ahead of the key US inflation data on Wednesday, which is expected to show a rise to 3.6% YoY. Meanwhile, core inflation is expected to have cooled to 4.3% YoY, down from 4.7% in July.

The data comes ahead of next week's Federal Reserve interest rate decision, where investors are pricing in a 93% probability that the US central bank will leave rates unchanged. However, the November meeting is less clear-cut with the market pricing in a 50% probability of another hike.

The probability of a November rate hike rose last week after stronger-than-expected data showed that the US economy is more resilient than initially expected. The ISM services PMI unexpectedly increased, and US initial jobless claims also fell to the lowest level since February.

Over the weekend, US Treasury Secretary Janet Yellen said that she's increasingly confident that the US will contain inflation without causing significant damage to the economy.

Corporate news

Tesla is rising premarket after Morgan Stanley upgrades stock, setting the price target of $400 per share, a new street high. Analysts cited the Dojo supercomputer, set to enhance and train its complete self-driving system, as the reason for the improved outlook for the stock.

Alibaba ADRs will be in focus after the company’s share price slumped in the Asian session after an announcement that the outgoing chief executive, Daniel Zhang, will also step down from the cloud business unit. The spin-off will still go ahead as planned.

Oracle is due to release earnings after the close and is expected to post EPS of $1.15 on revenue of $12.47 billion. The stock has traded 50% higher so far this year.

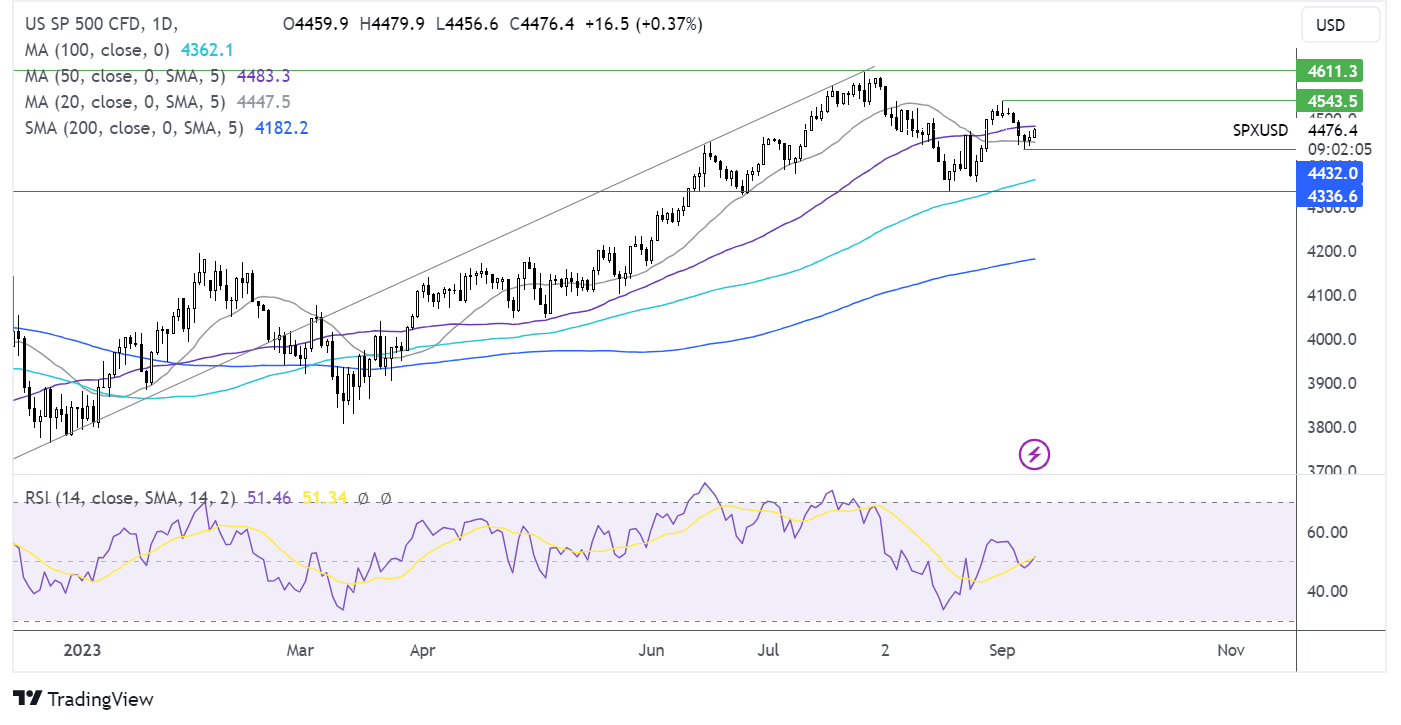

S&P500 forecast – technical analysis.

After finding support last week a 4430, the S&P500 has pushed higher, rising above its 20 sma and is testing the 50 sma resistance. The RSI is neutral. Buyers will need to overcome the 50 sma at 4483 to extend the rebound towards 4500 round number and 4540 the September high. Failure to retake the 50 sma could see sellers retest 4430, the September low. A break below here creates a lower low.

FX markets – USD falls, GBP rises

The USD is falling after solid gains across the previous week. The US dollar booked an eighth straight weekly rise, marking the strongest weekly rally since 2014. Today, the USD is coming under pressure as the yen soars following comments from BoJ governor Ueda, who hinted at the end of negative interest rates, narrowing the Fed - BoJ divergence.

EURUSD is rising, capitalising on the weaker US dollar after losing around 1% in the previous week. The ECB rate decision on Thursday is the key focus for the euro. However, the decision is far from clear-cut. Highlighting concerns over the economic outlook, the EU Commission has said that the economy will grow slower than previously expected, downgrading GDP to 0.8% in 2023 from 1.1% previously expected.

GBP/USD is heading higher, taking advantage of the weaker U.S. dollar and recovering from a three-month low reached last week. The pound fell almost 1% last week amid a combination of stronger U.S. economic data and concerns over the health of the UK economy. The BoE we'll meet next week to discuss monetary policy. The market is pricing in a 70% probability of a 25-basis point rate hike. But investors have slashed the likelihood of another rate hike after that.

EUR/USD +0.2% at 1.0723

GBP/USD +0.37% at 1.2512

Oil pauses for breath after another weekly rise

Oil prices are easing from a 10-month high reached in the previous week after top producers Saudi Arabia and Russia extended their voluntary supply cuts, tightening 1.3 million barrels per day to the end of the year.

Both the International Energy Agency and OPEC are due to release their monthly oil reports this week. Investors will be looking for comments on the demand outlook, particularly in light of recent data from China, the world’s largest oil importer, which has raised concerns over its faltering economic recovery.

WTI crude trades -0.6% at $86.55

Brent trades -0.3% at $90.16

Looking ahead

N/A