US futures

Dow futures 0.51% at 38080

S&P futures 0.63% at 5048

Nasdaq futures 0.80% at 17450

In Europe

FTSE 0.52% at 8160

Dax 0.48% at 17955

- Fed leaves rates unchanged & calms fears of a hike

- Jobless claims are stronger than expected at 208k

- Apple reports after the close

- Oil steadies after OECD upwardly revised global growth

Jobless claims hold steady, Apple reports after the close

US stocks are set to open higher after modest losses yesterday as investors continued to digest the Federal Reserve interest rate decision and the latest jobs data.

As expected, the Fed left interest rates on hold at 5.25 to 5.5% but also gave a mixed message. Federal Reserve chair Jerome Powell said a rate hike is unlikely despite inflationary pressures, calming some market fears and sending the USD lower yesterday.

However, he also warned that rates could remain high for longer in the fight against inflation. The expectation is now for just one rate cut this year, although the timing of such a cut remains uncertain, particularly in light of the solid economic growth.

The market is pricing 35 basis points worth of cuts this year, up from 29 basis points before the meeting. The market sees a 55% probability of the first rate cut of at least 25 basis points being delivered in September.

Attention now turns to tomorrow’s non-farm payroll report. Ahead of the report, today’s jobless claims were stronger than expected at 208k, in line with last week’s but below the 212k forecast.

Earnings season remains in focus, and of the 310 companies in the SNP that have reported, 77.4% have surpassed earnings forecasts ahead of the historical average of 67%.

Corporate news

Apple will report after the close. Investors brace themselves for the tech giant reporting Q2 earnings amid a slowdown in iPhone sales in China. EPS is expected to be $1.50 on revenue of $90.3 billion, marking a 4.75% year-on-year revenue decline. The share price trades 5% lower this year and flat over 12 months, whilst peers such as Microsoft and Alphabet are up 25% and 37%, respectively.

Qualcomm is gaining in premarket after the smartphone chip supplier posted quarterly sales and profits ahead of forecasts.

DoorDash is set to open 11% lower after the food delivery firm projected second-quarter core profits below Wall Street's expectations.

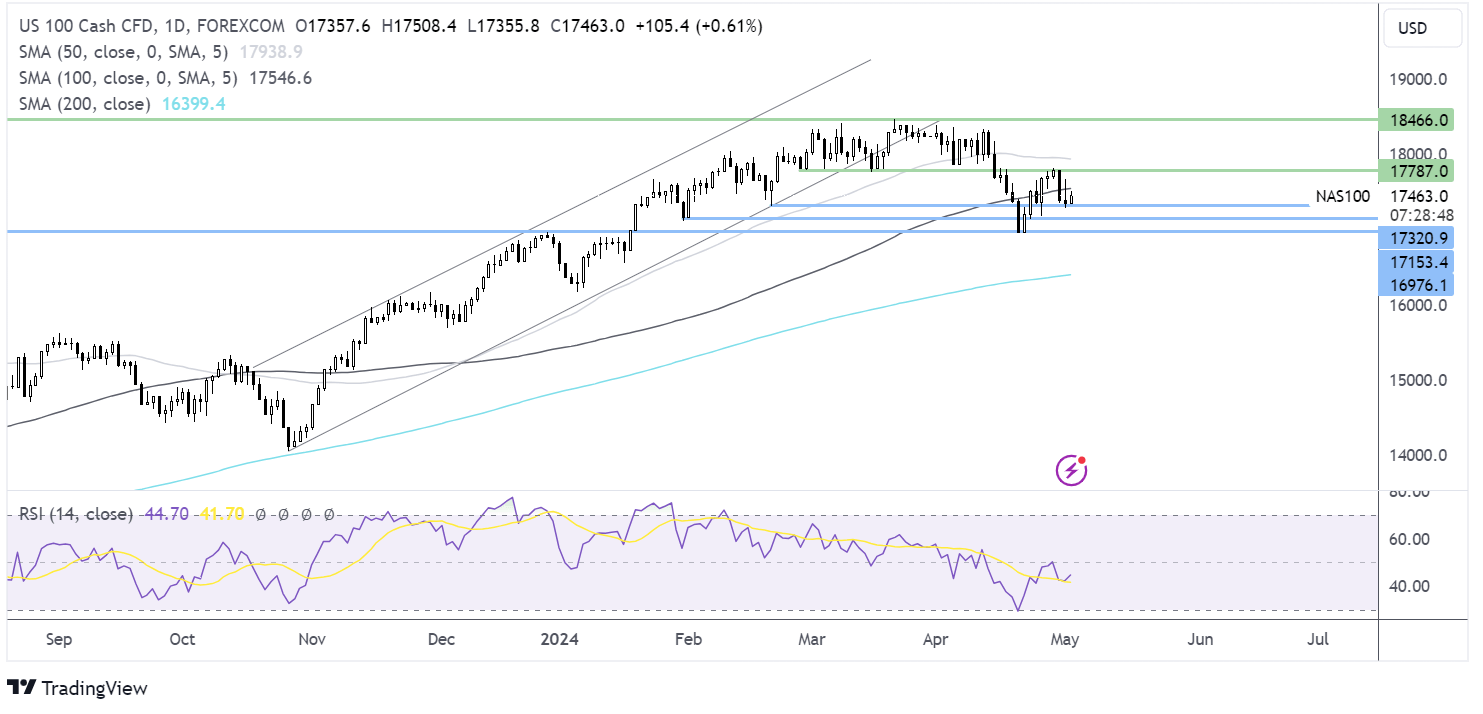

Nasdaq 100 forecast – technical analysis.

After facing rejection at 17800, the price rebounded lower, breaking below the 100 to support at 17320 at the mid-February low. Buyers would need to retake the 100 SMA at 17500 to extend gains towards 17800, last week’s high, and 18000. Should sellers regain momentum, a break below 17320 could open the door to a test of 17160, the February low, and 17000 round number. A break below here extends the bearish trend, exposing the 200 SMA.

FX markets – USD holds steady, GBP/USD falls

The USD is holding onto yesterday’s losses after the Federal Reserve interest rate decision and despite stronger-than-expected US jobless claims.

EUR/USD is falling after the eurozone manufacturing PMI confirmed a contraction again in April. The manufacturing PMI was 45.7, marking a four-month low and supporting the view that patience is needed for a recovery in the manufacturing sector. The services sector is supporting the economic recovery.

GBP/USD is edging lower. The OECD downwardly revised the UK growth outlook for 2024 to 0.4%, down from 0.7%, and also forecasted just 1% growth in 2025, marking the weakest growth within the G7. Inflation is expected to be 2.7% this year, falling 2.3% next year. Weak growth is anticipated due to persistently sticky service sector inflation and a shortage of skilled staff.

Oil steadies after OECD upwardly revised global growth

Oil prices are holding steady after a three-day falling trend and recovering from a seven-week low.

Prices fell over 3% yesterday on worries over demand after the Federal Reserve left interest rates on hold but warned over stubborn inflation and high rates for longer, which could slow economic growth.

Crude inventories also rose by 7.3 million barrels in the week ending April 26, well above the 1.1 million barrel draw that analysts had expected.

Still, oil prices are receiving support today after the OECD's upward revision to global growth with the US and China’s growth lifted. The global economy is expected to grow 3.1% this year and 3.2% in 2025.

Breaking this down, the US is expected to grow 2.6% this year and 1.8% in 2025, while China, the world's second-largest economy, is expected to expand by 4.9% in 2024 and 4.5% next year, up from 4.7 and 4.2%, respectively. The upbeat numbers halted the selloff in oil, at least for now.