Key takeaways

- After Fed Chairman Powell’s testimony, this month’s NFP report will have a major impact on the whether the Fed hikes 25 or 50bps later this month.

- Leading indicators point to a potentially above-expectation NFP reading.

- However, dollar bulls may have gotten ahead of themselves in discounting a reacceleration to 50bps increases from the Fed, opening the door for dollar weakness on a soft NFP print.

NFP overview

Take a moment to put yourself in Fed Chairman Powell’s unenviable shoes: After raising interest rates at the fastest pace the country has seen in 40+ years, with the explicit goal of slowing down the red hot labor market, he learned that the US economy created another 500K+ jobs in January. After Powell’s testimony on Capitol Hill earlier this week, traders are now pricing in 80% odds of the central bank going back to a 50bps rate hike in two weeks’ time as inflation and the jobs market remain resilient.

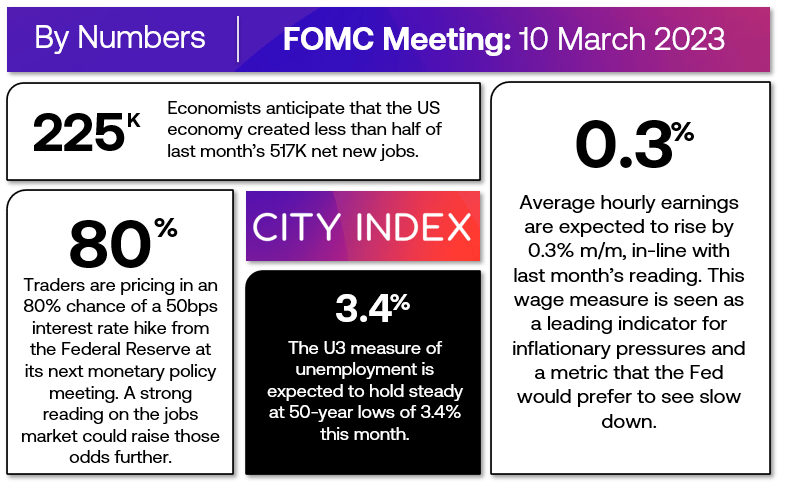

As the graphic below shows, traders and economists are expecting to learn that the US economy created around 225K net new jobs in February, and that the average hourly earnings for workers rose by 0.3% m/m, a development that would keep expectations for future price increases elevated:

Source: StoneX

Are these expectations justified? We dive into the key leading indicators for Friday’s critical jobs report below!

NFP forecast

As regular readers know, we focus on four historically reliable leading indicators to help handicap each month’s NFP report:

- The ISM Services PMI Employment component printed at 54.0, up from last month’s 50.0 print.

- The ISM Manufacturing PMI Employment component printed at 49.1, down from last month’s 50.6 reading and back in contractionary territory.

- The ADP Employment report came in at 242K net new jobs, above expectations and last month’s upwardly-revised 119K print.

- Finally, the 4-week moving average of initial unemployment claims were roughly steady at 197K vs. 198K last moth, near multi-decade lows.

Weighing the data and our internal models, the leading indicators point to a slightly above expectation reading in this month’s NFP report, with headline job growth potentially coming in somewhere in the 200K-300K range.

Regardless, the month-to-month fluctuations in this report are notoriously difficult to predict, so we wouldn’t put too much stock into any forecasts (including ours). As always, the other aspects of the release, prominently including the closely-watched average hourly earnings figure which rose 0.3% m/m last month, will likely be just as important as the headline figure itself.

Potential NFP market reaction

|

|

Earnings < 0.2% m/m |

Earnings = 0.3% m/m |

Earnings > 0.4% m/m |

|

< 175K jobs |

Strongly Bearish USD |

Bearish USD |

Neutral USD |

|

175K – 275K jobs |

Bearish USD |

Slightly Bearish USD |

Slightly Bullish USD |

|

275K+ jobs |

Slightly Bearish USD |

Neutral USD |

Bullish USD |

The US dollar index tagged new 2023 highs earlier this week on expectations of faster tightening by the Federal Reserve, but the four-in-five implied probability of a reacceleration to a 50bps rate hike tilts the odds slightly in favor of a dollar pullback unless we see a strong NFP report.

In terms of potential trade setups, readers may want to consider USD/CAD buy opportunities on a strong US jobs report. There is a clear monetary policy divergence between the Fed and BOC, and if that divergence appears likely to widen in the coming months, the North American pair could approach its May 2020 highs near 1.40 in short order.

Meanwhile, a weak (or even just as-expected) jobs report could present a buy opportunity in EUR/USD. The world’s most widely-traded currency pair is testing support from its late February lows and 200-day EMA, and if markets have reason to shift their expectations back toward a coinflip between 25 and 50bps from the Fed later this month, the EUR/USD could rally back toward the mid-week highs in the 107.00 area.

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter @MWellerFX