- Nasdaq 100 outlook deteriorates as stronger services data boosts ‘higher for longer’ narrative

- Gold drops as yields and dollar rise

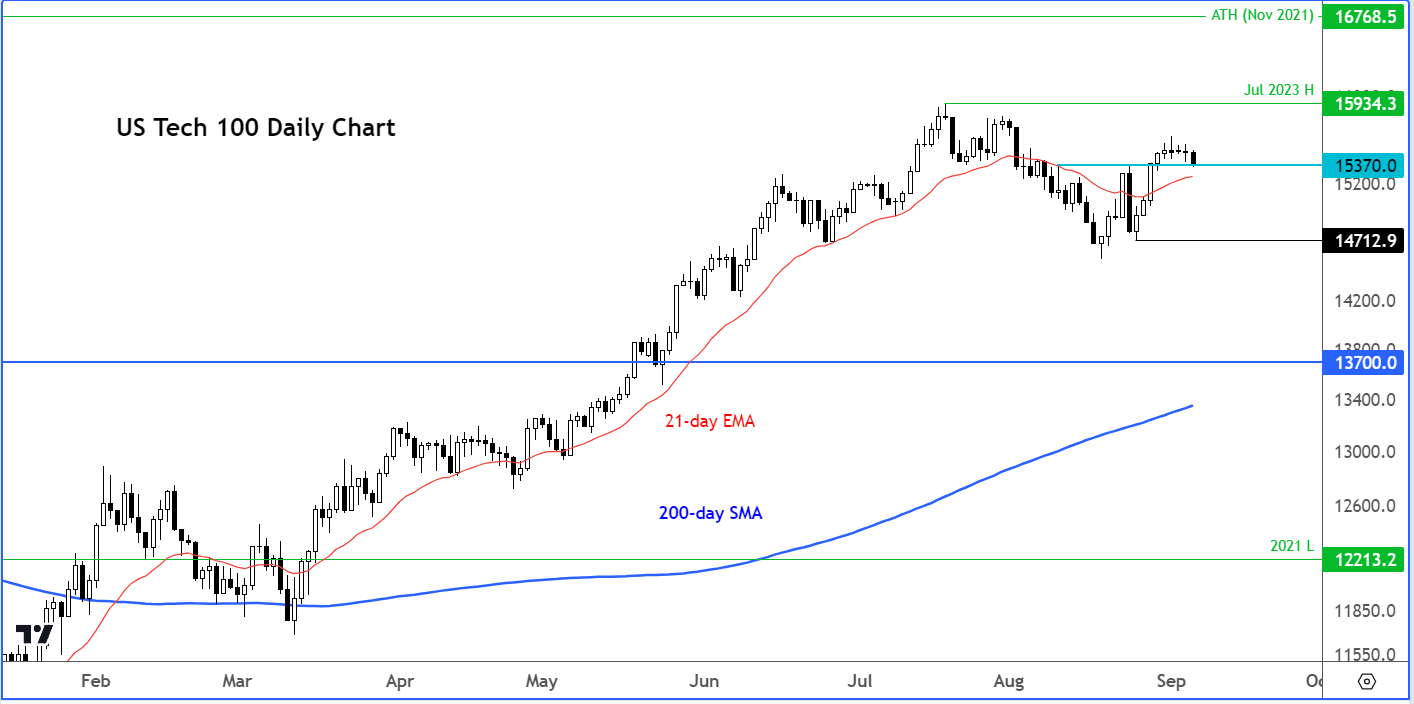

- Nasdaq 100 tests key level around 15370

The Nasdaq 100 fell as bond yields pressed higher in the aftermath of a strong ISM PMI report, which also sent the dollar sharply higher across the board. With government bonds offering high yields, many investors are finding it difficult to justify holding growth stocks with stretched valuations. And with crude oil also surging this week, this could give rise to concerns over another round of inflation and keep bond yields underpinned. That in turn could hurt growth stocks and weigh on the Nasdaq further.

Rising yields also undermine gold

For the same reason, gold also fell to testing its 200-day average around $1918, as rising yields further increased the opportunity cost of holding an asset that doesn’t pay any interest or dividends. In FX space, the EUR/USD fell near 1.07 handle to relinquish its entire 2023 gains. The GBP/USD was hit by a double whammy of strong US data and dovish comments from BoE Governor Bailey.

ISM PMI surprises to boost November Fed hike bets

The ISM services PMI was surprisingly strong at 54.5, when a decline of 52.5 from 52.7 was expected. It was the gauge’s best reading in six months. Consequently, traders boosted speculation that the Federal Reserve will keep interest rates higher for longer and the implied probability of another hike in November rose to 60% from 50%.

China and Eurozone growth worries intensify

Global stocks have come under a bit of pressure because of softness in Chinese and Eurozone data of late. In China, the services PMI slumped to its slowest pace of growth in eight months, according to the private Caixin survey. In Europe, we saw German factory orders came in at -11.7% for July, more than losing the +7.6% gain in the previous month. The outlook for Germany industrial output doesn’t look great, given that last week the manufacturing PMI fell to 39.1 in August, marking the second-lowest reading since May 2020 and highlighting the extent of the weakness in the sector. In a clear sign of a struggling consumer, Eurozone retail sales have either fallen or stagnated in each of the past 6 months. After falling 0.3% in June, sales fell by an additional 0.2% in July, once again disappointing expectations.

Nasdaq 100 outlook: Technical analysis

From a technical point of view, the Nasdaq is not looking too bearish just yet, but it is one that needs to be watched closely here. A decisive move below support at 15370, which was being tested at the time of writing, could trigger follow-up technical selling as the bulls rush for the exits. So, just keep an eye on this index, even if you don’t trade it as it could get interesting. The bulls meanwhile will now want to see a move above the July high to regain full control again.

Source: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade