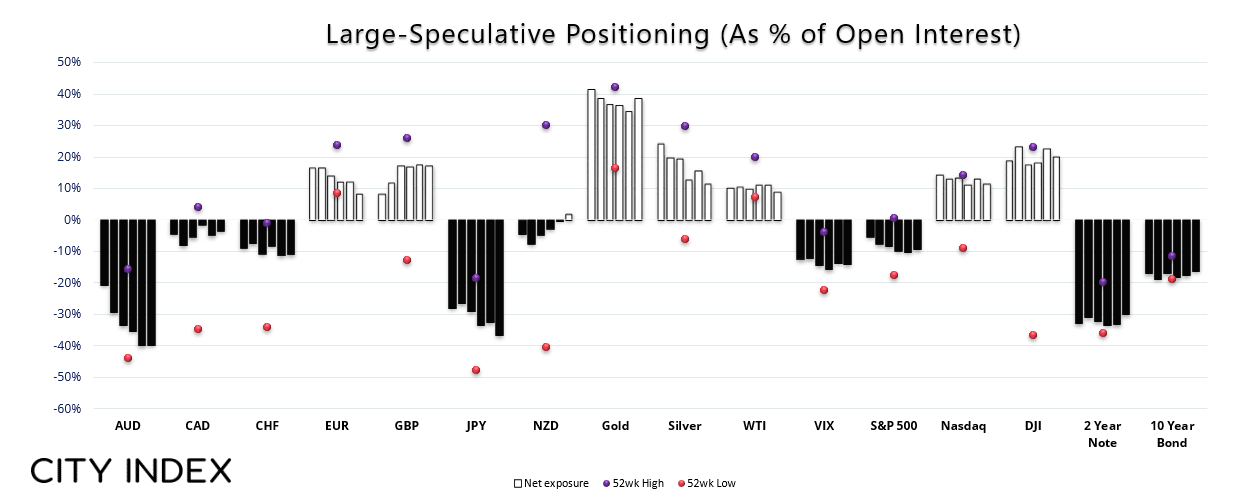

Market positioning from the COT report - as of Tuesday Feb 13, 2023:

- Traders flipped to net-long USD exposure against G10 currencies on the CME exchange last week, according to data compiled by IMM (International Money Markets)

- Net-short exposure to JPY futures rose to a 3-month high

- Large speculators were their most bullish on GBP/USD futures in nearly six months

- NZD/USD remained in net-long exposure for a second week

- Net-long exposure to NZD/USD futures fell to its least bullish level since October 2022

- Large speculators and managed funds increased shorts bets against gold and trimmed longs

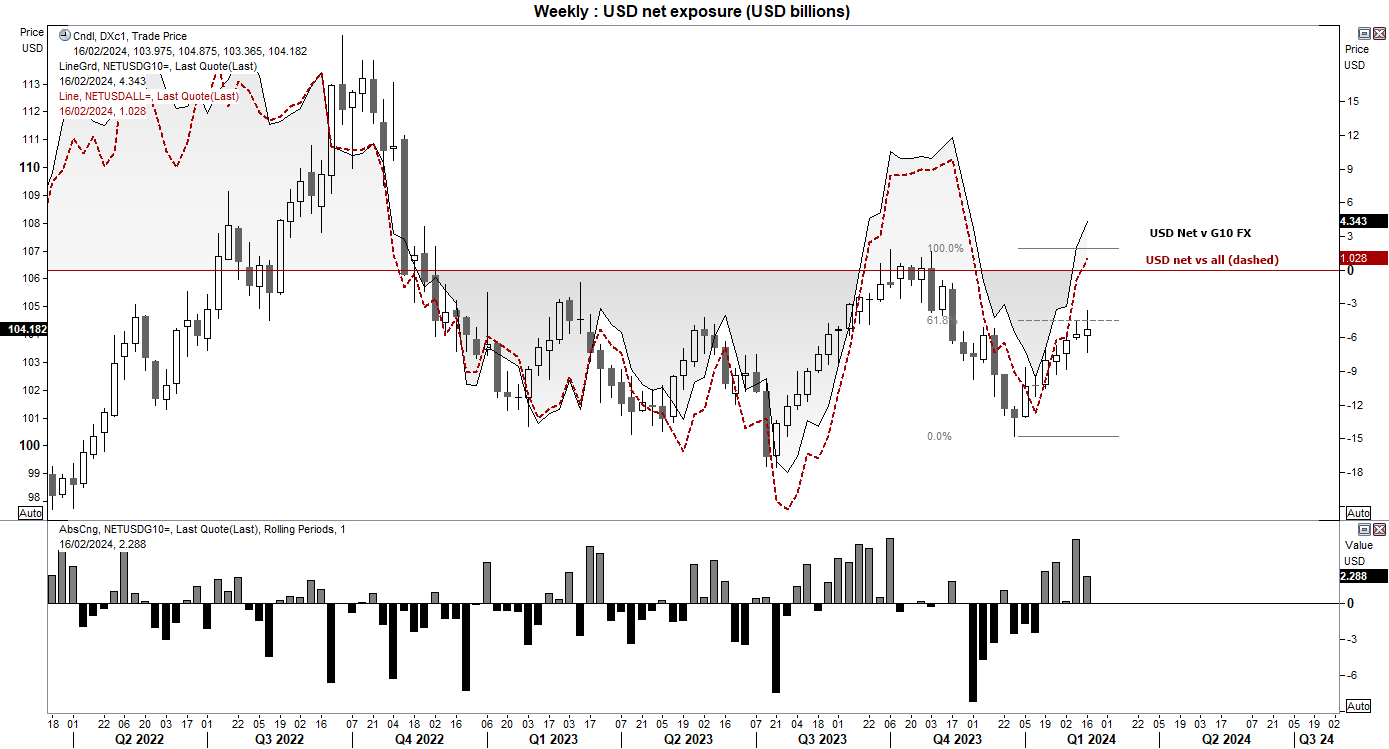

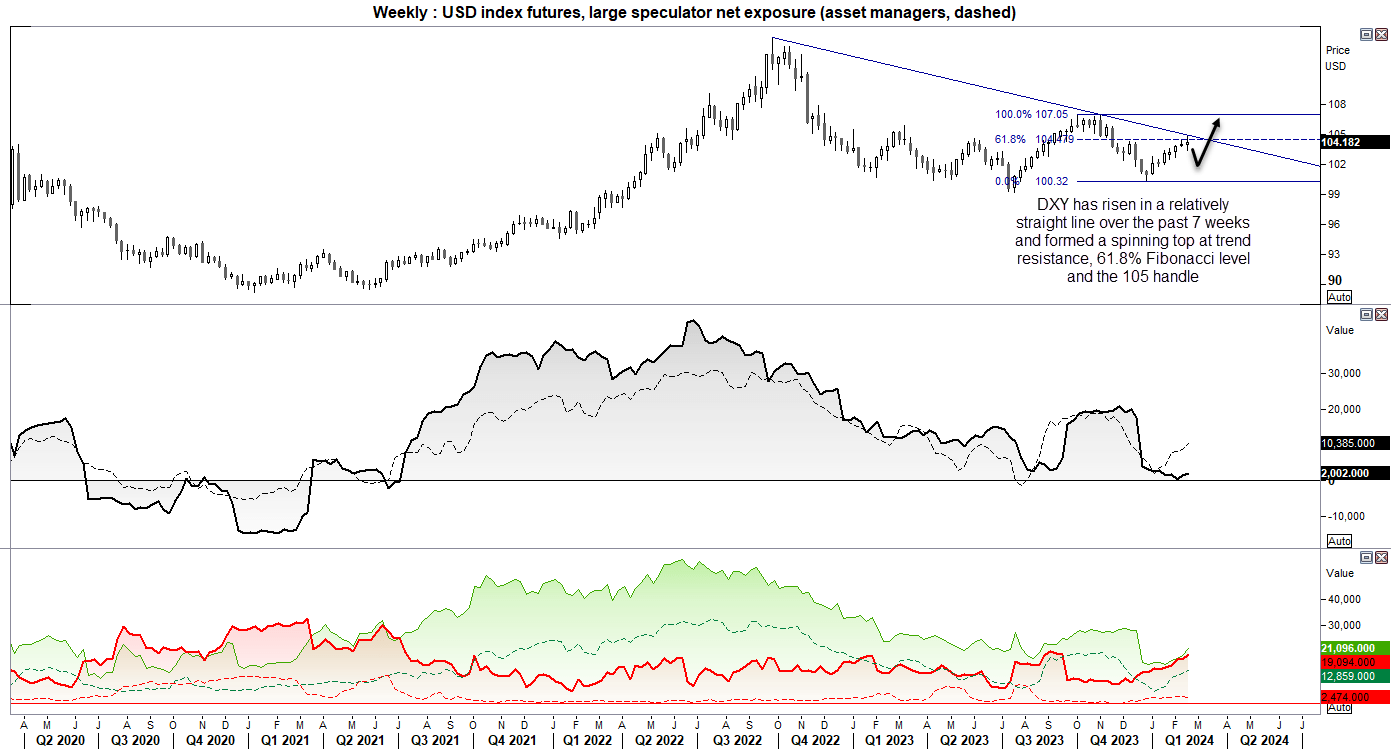

US dollar positioning (IMM data) – COT report:

Last week I warned that traders were on the cusp of flipping to net-long exposure, and that is what we have seen in the latest round of COT report data. Futures traders were bullish again all currencies on the CME exchange (and G10 currencies) fore the first time in three months according to data compiled by the International Money Markets (IMM). The question now is whether we’ll see some follow through to the upside.

US dollar index technical analysis:

Futures traders remains net-long the US dollar index last week. Large speculators are barely net long whilst asset managers increased their net-long exposure to suggest they’re more confidence of US dollar upside. However, the US dollar index has stalled near trend resistance and the 105 handle. Furthermore, the US dollar index has also risen in a mostly straight line over the past seven weeks and spinning top doji formed on the weekly chart around 105 resistance. Therefore, I suspect a pullback on the US dollar could be due this week which could allow key pairs to retrace higher against the US dollar, before its next leg higher.

And as we have a bit of an ‘in between’ week for US data, and that could see its rally lose steam.

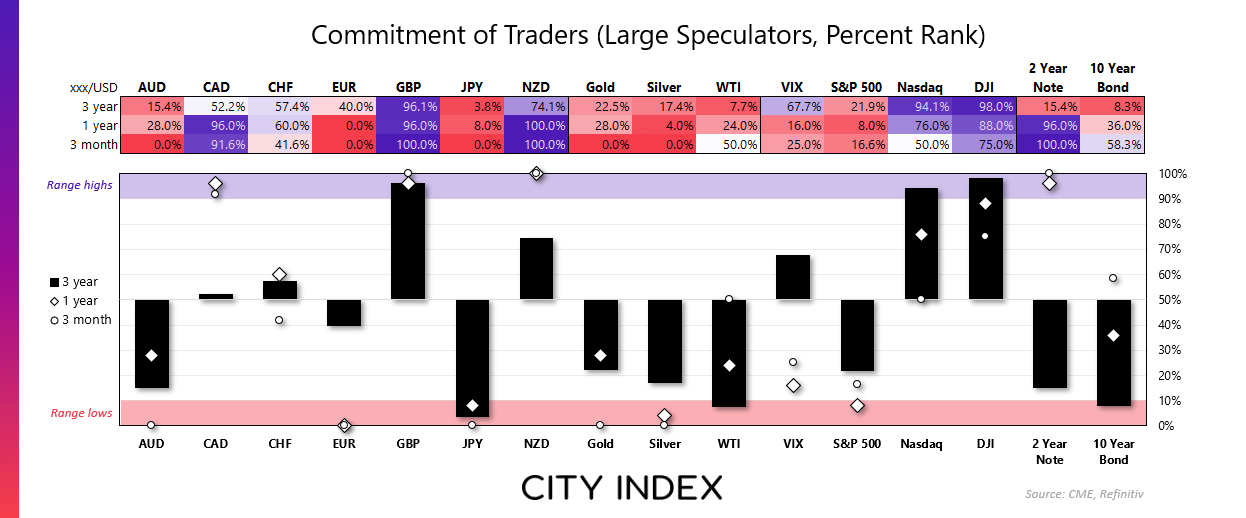

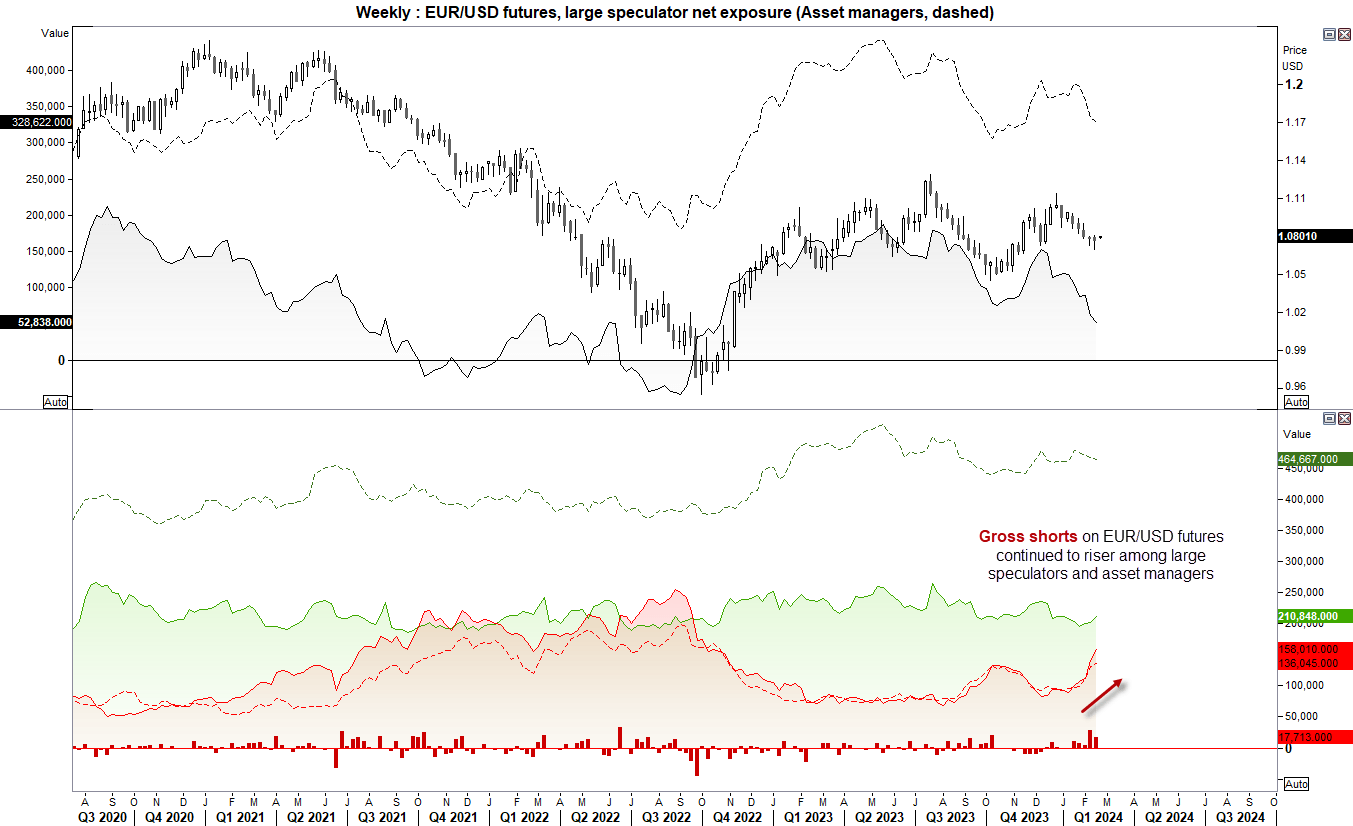

EUR/USD (Euro dollar futures) positioning – COT report:

Large speculators and managed funds continued to increase their gross-short exposure to EUR/USD futures, which dragged net-long exposure for large specs to their least bullish position since October 2022. However, long exposure also ticked higher. And with two bullish hammers on the weekly chart after a 7-week decline alongside the US dollar index showing signs of a potential pullback, perhaps EUR/USD can perform a technically-driven bounce.

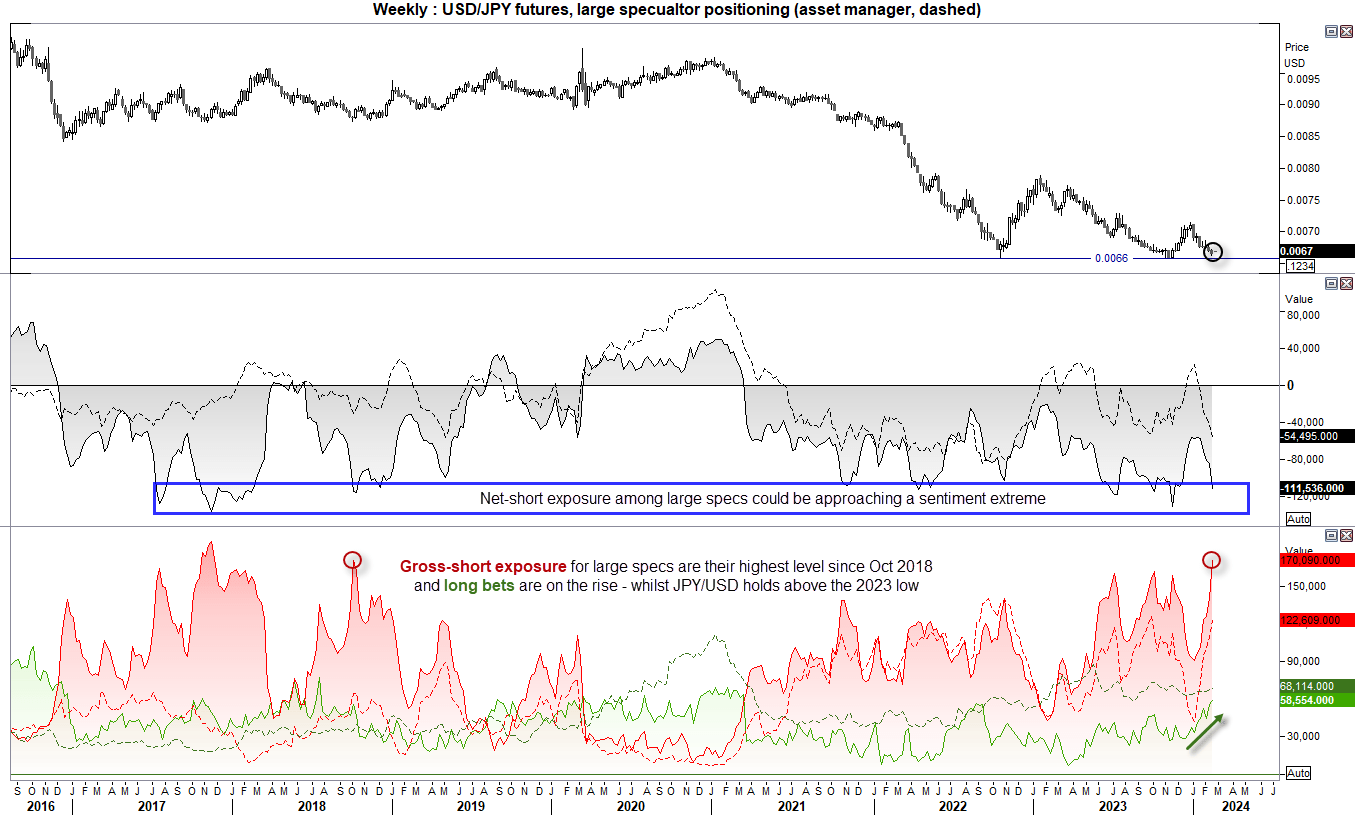

JPY/USD (Japanese yen futures) positioning – COT report:

I have previously outlined a bias for USD/JPY to head for its 2023 highs, just below 152. It might get there, but I am now questioning its ability to break above it. Concerns that the BOJ could intervene in 2023 saw markets do the BOJ’s work for them and pull USD/JPY back from its highs. But market positioning is also nearing a potential sentiment extreme.

Net-short exposure among large speculators is approaching levels that has resulted in a higher JPY/USD. Gross-short exposure is also at its highest level since 2018, and long exposure amongst this group of traders is also trending higher. And that leaves the risk of a technical bounce for yen futures form the cycle lows, which would be bearish for USD/JPY.

As the year develops, the likelihood of USD/JPY break and holding above 152 remains down to expectations of a hawkish Fed versus an ultra-easy BOJ, and the BOJ’s appetite to either warn of intervention, or perform one. Therefore, the best bet of a sustainable move above 152 is for US data to remain firm but not strengthen (to keep hawks at bay but retain higher for longer rates) and no signals from the BOJ to tighten. This could allow a weaker but less volatile yen, because the BOJ do not want to see it depreciate too quickly.

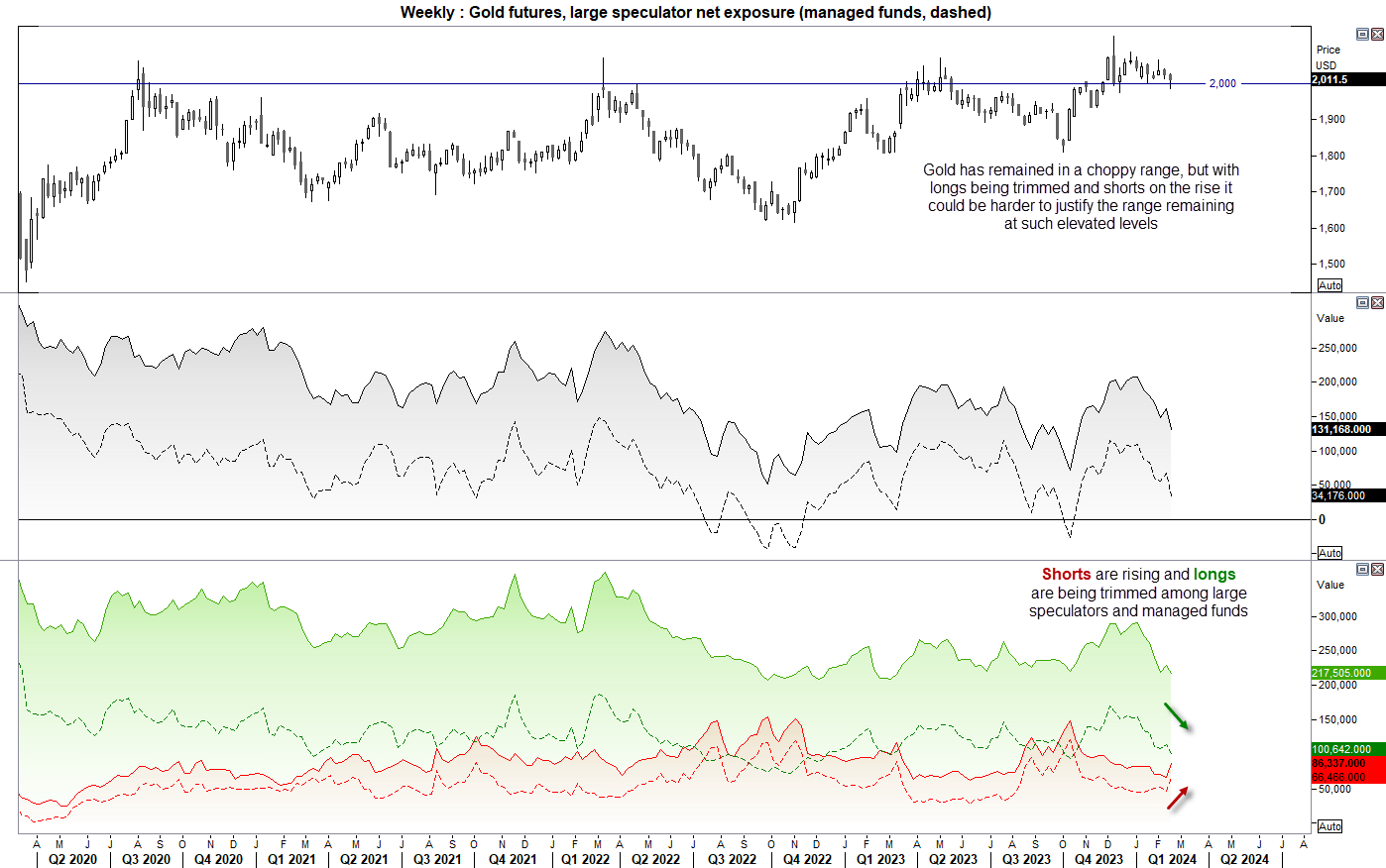

Gold futures (GC) positioning – COT report:

Earlier this month I highlighted my bias for gold to remain in a choppy but elevated range. That is now harder to justify with the Fed pushing back on multiple rate cuts and inflation data remaining elevated. Furthermore, longs are being trimmed and shorts are on the rise among large speculators and managed funds, so perhaps we will see gold futures break beneath $2000 after all.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade