USD/JPY takeaways

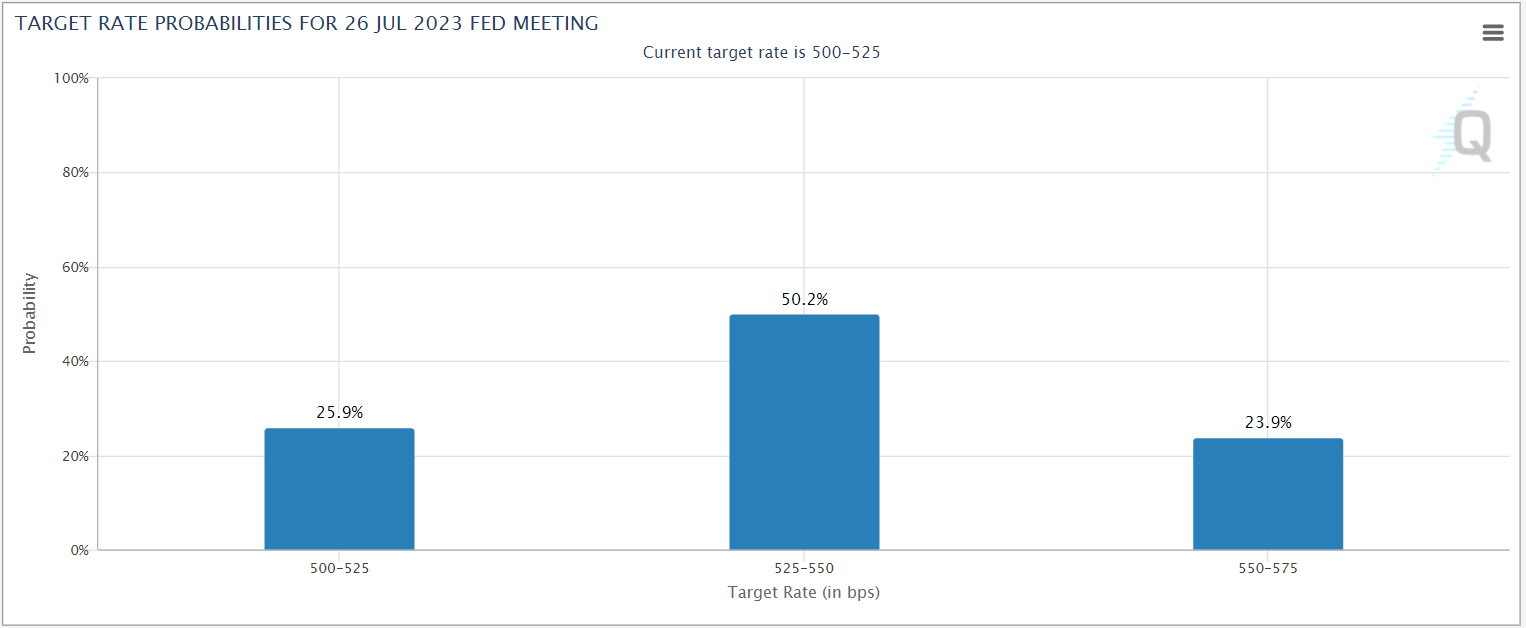

- After this morning’s strong US data, traders are now pricing in a nearly 75% chance of another 25bps rate hike from the Fed by July.

- Tomorrow’s US Core PCE report, the Fed’s preferred inflation measure, is the key fundamental data release to watch.

- USD/JPY remains in a bullish short-term trend, with room to extend its rally toward 142.00 before encountering meaningful resistance.

USD/JPY fundamental analysis

Debt ceiling, schmebt ceiling.

Despite a potentially worrying lack of progress toward a US debt ceiling deal ahead of next week’s deadline (and the accompanying news that ratings agency Fitch has put the US credit rating on negative watch for a potential downgrade), the US dollar is the strongest major currency on the day.

Part of the boost comes from economic data: This morning, Q1 GDP for the US was revised to 1.3% q/q, beating expectations for a 1.1% print, and initial unemployment claims came in at just 229K, solidly below the 249K reading anticipated by economists.

With both backward-looking and coincident data showing a stronger-than-expected US economy, traders have started to seriously consider the prospect of another interest rate hike from the Federal Reserve. Once seen as a longshot, traders are now pricing in a nearly 3-in-4 chance that we could get another 25bps increase in one of the next two Fed meetings, per the CME’s FedWatch tool:

Source: CME FedWatch

Tomorrow’s Core PCE report, the Fed’s preferred measure of inflation, will be the economic data highlight for the week, with economists looking for a 0.3% m/m print that would leave the year-over-year rate steady at 4.6%. A higher-than-expected reading here would increase the market’s expectations for another Fed hike, marking a particularly sharp divergence with the BOJ’s ongoing easy monetary policy.

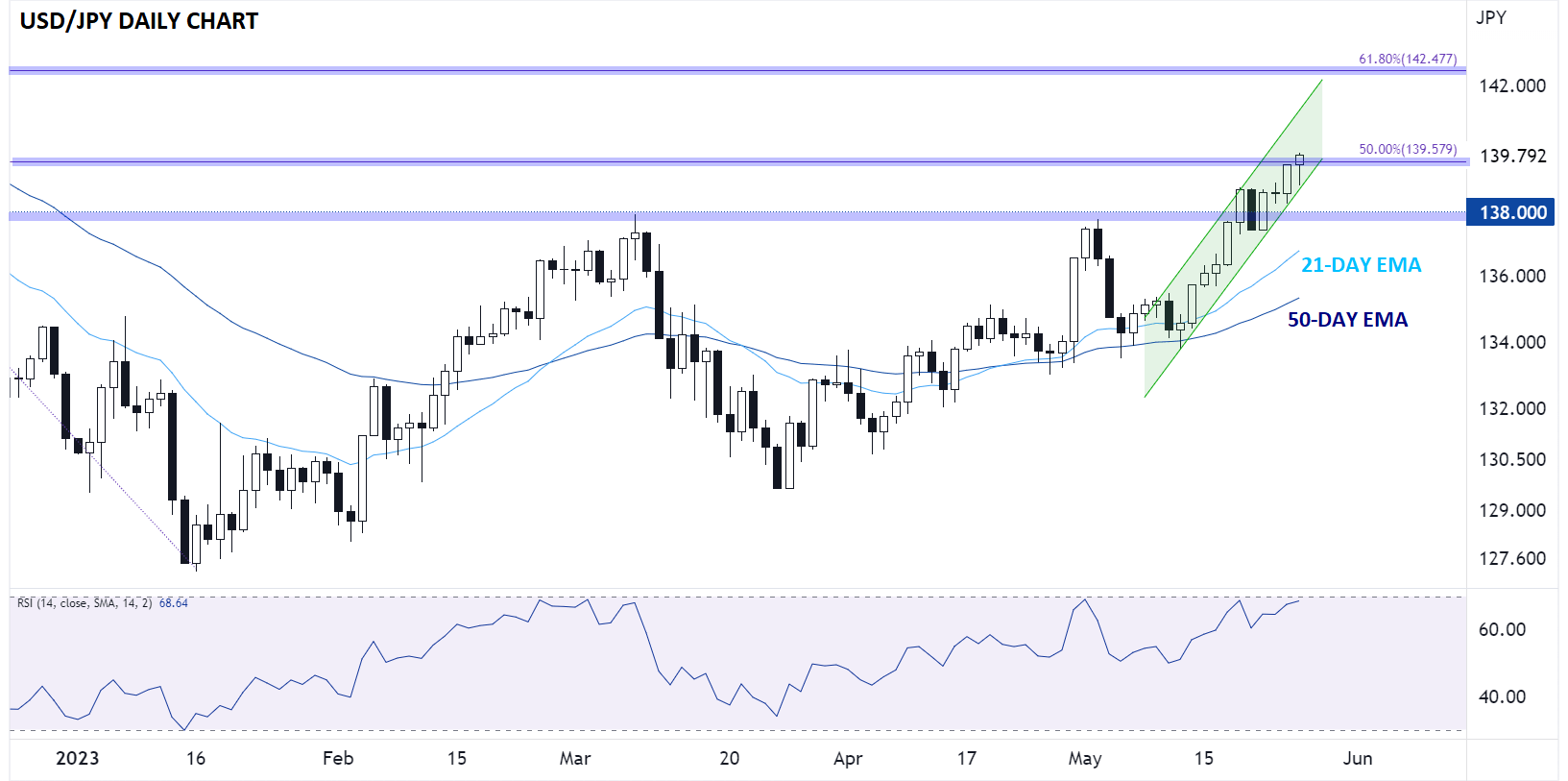

Japanese yen technical analysis – USD/JPY daily chart

Source: Tradingview, StoneX

Looking at the daily USD/JPY chart, rates continue to rise within a well-defined 2-week bullish channel. The pair has now eclipsed its year-to-date high near 138.00, and as of writing, rates are peeking out above the 50% Fibonacci retracement of the October-January drop near 139.60.

A clean break above that level (perhaps helped along by a hot Core PCE reading tomorrow) would leave little in the way of nearby resistance until closer to 142.00, where the 61.8% Fibonacci retracement and a minor high from November converge. Only a break back below the bullish channel and previous-resistance-turned-support at 138.00 would erase the near-term bullish bias.

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter: @MWellerFX