- Gold and silver analysis: drop in yields and softer dollar underpin recent recovery

- Focus turns to US inflation data, expected to moderate a little

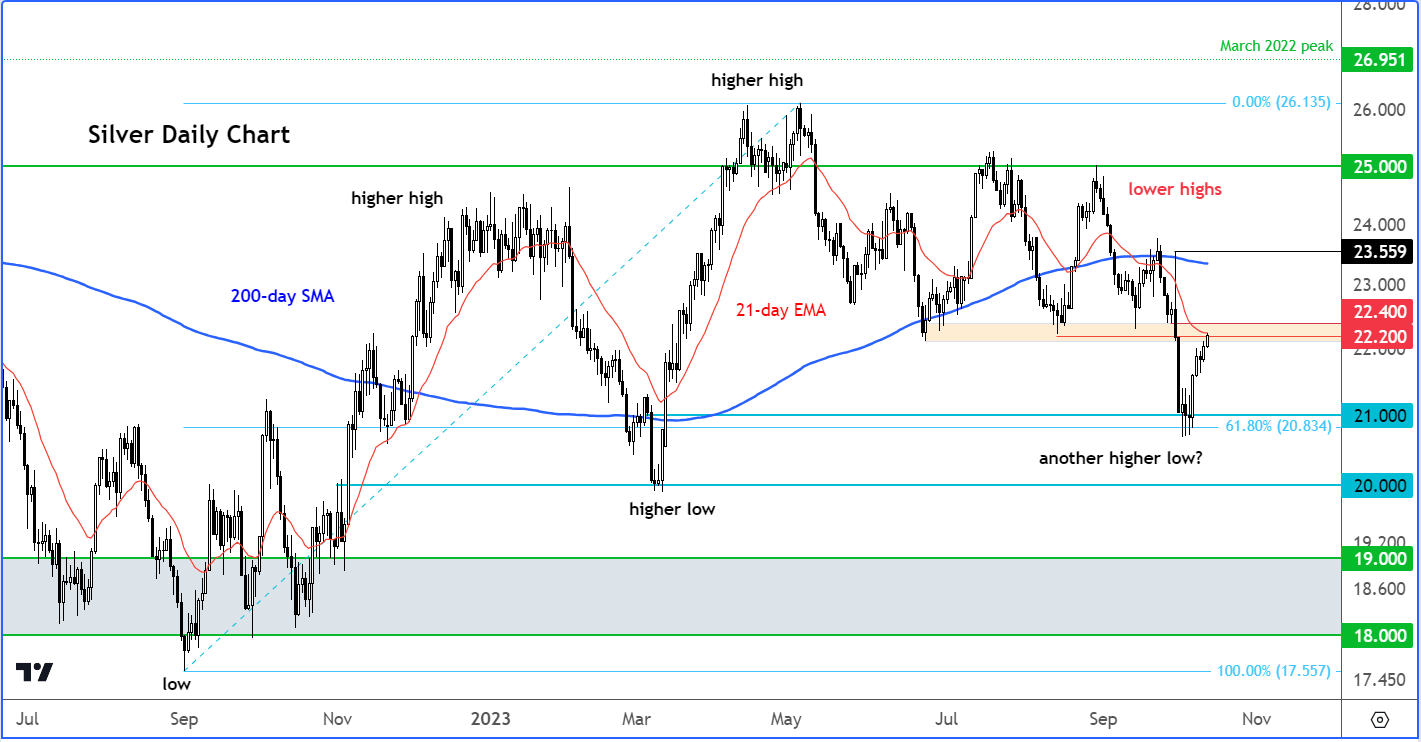

- Silver technical analysis: Broken support at $22.22-$22.40 must be reclaimed by bulls before outlook turns positive

Thanks to the recent drop in bond yields and the dollar, both gold and silver are continuing to make back lost ground. The metals have been further supported by raised geopolitical risks, highlighted by gold’s breakaway gap at this week’s Asian open. The focus will remain on the dollar and yields with the release of key US inflation data today.

So why have yields fallen back?

Until recently, the Fed was the standout central bank among the most hawkish camps, with many central banks elsewhere dropping their uber-hawkish rhetoric earlier. But we have now noticed a bit of a dovish tilt in the FOMC’s rhetoric in more recent days, suggesting that the hiking cycle is now complete. The hawkish repricing of the Fed’s interest rates following the central bank’s last meeting in September, where it signalled just two rate cuts are on the way next year instead of four it had pointed to previously, is also probably now complete. This is probably why the dollar failed to respond positively to the stronger-than-expected PPI data and the hawkish FOMC minutes on Wednesday.

Gold and silver analysis: Focus turns to US CPI for investors

Attention will be on US inflation data, due for release at 13:30 BST today. Headline CPI inflation is expected to cool to 3.6% y/y in September, down from 3.7% in August. Meanwhile, core inflation is expected to ease to 4.1% YoY from 4.3% previously.

Today’s release of CPI may provide a bigger test for the dollar bears, but if those PPI figures are anything to go by, then investors may not pay too much weighed behind CPI figures, if they turn out to be slightly stronger-than-expected CPI figures.

This is because investors seem to be backing the view that, while there will be bumps on the road, the disinflation process is well under way and that the Fed won’t have to tighten its belt any further. The “higher for longer” narrative won’t change materially regardless of today’s data release. Hawkish Fed officials such as Christopher Waller have recently been suggesting that the Fed can now take a wait-and-see approach after raising rates so aggressively in recent months, even if they hold that inflation is “unacceptably high,” according to the FOMC’s last meeting minute. The Fed must also be getting at least a little worried about the recent spike in bond yields, so they will be extra careful in their language now that rates are this high. They won’t want to unintentionally send yields any higher than they are right now, that’s for sure.

If inflation data proved to be weaker than expected, then this could cement expectations that the Fed has indeed ended its rate hiking cycle. Consequently, we should see a weaker US dollar and potentially stronger gold and silver prices.

Anyway, let’s see what type of a reaction today’s inflation numbers will bring rather than pre-empting it too much.

Silver analysis: technical levels to watch

Source: TradingView.com

Following the big drop in September, there was some initial downside follow-through in the selling pressure in the first few days of October. Silver reached a fresh multi-month low by Tuesday of last week at $20.68. But since then, the metal has recovered nicely, along with equity markets and the EUR/USD.

At the time of writing, silver was testing a major pivotal area around $22.20 to $22.40. This area had offered consistent support throughout the summer months. When silver broke below here on the last trading day of September, this led to a further $1.50 or so drop in early October. But now that silver has made back the $1.50 (or ~ 7%) loss in a relatively short period of time, this is an early indication that the breakdown was perhaps not a genuine game-changer in so far as the silver’s long term trend is concerned.

So, what I would be watching for now is further evidence that it is the bears, in fact, who are getting trapped.

A potential daily close above that $22.20-$22.40 range, ideally today, would be one such signal. If seen, this could be another indication for silver bulls that the metal may be looking to make a higher high above $23.55, the last high made prior to the latest breakdown. If that level is achieved then we will have a higher high in place, which should further encourage momentum traders to join the long side.

However, let’s not get too ahead of ourselves, especially ahead of a key US data release, and given how the markets have behaved throughout much of the year. I certainly wouldn’t be too surprised if the sellers were to re-emerge as the dollar could easily find renewed support, given how weak European data has been. A bearish looking price pattern such as an inverted hammer or bearish engulfing candle on the daily time frame around current levels would raise serious doubts again over silver’s short term bullish story.

Video: EUR/USD levels to watch ahead of CPI

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade