- Gold analysis: Metal consolidates below key $2K resistance

- Rebounding yields holding gold back

- Quiet week for data

Gold spent the whole of last week consolidating its sharp 7% rise recorded in October, ending a run of three consecutive weekly gains. The precious metal has struggled to move north of the key $2000 mark, though the metal hasn’t exactly sold off yet. So, the bulls would argue that its consolidation here may be a good thing, with price potentially gearing up for another upside break out soon. However, the bears would point to the drop in yields and the dollar both failing to lift the metal any further higher last week, which is potentially a sign of weakness. Today, yields have bounced back, and this is discouraging gold investors further.

Video: Nasdaq and Gold analysis

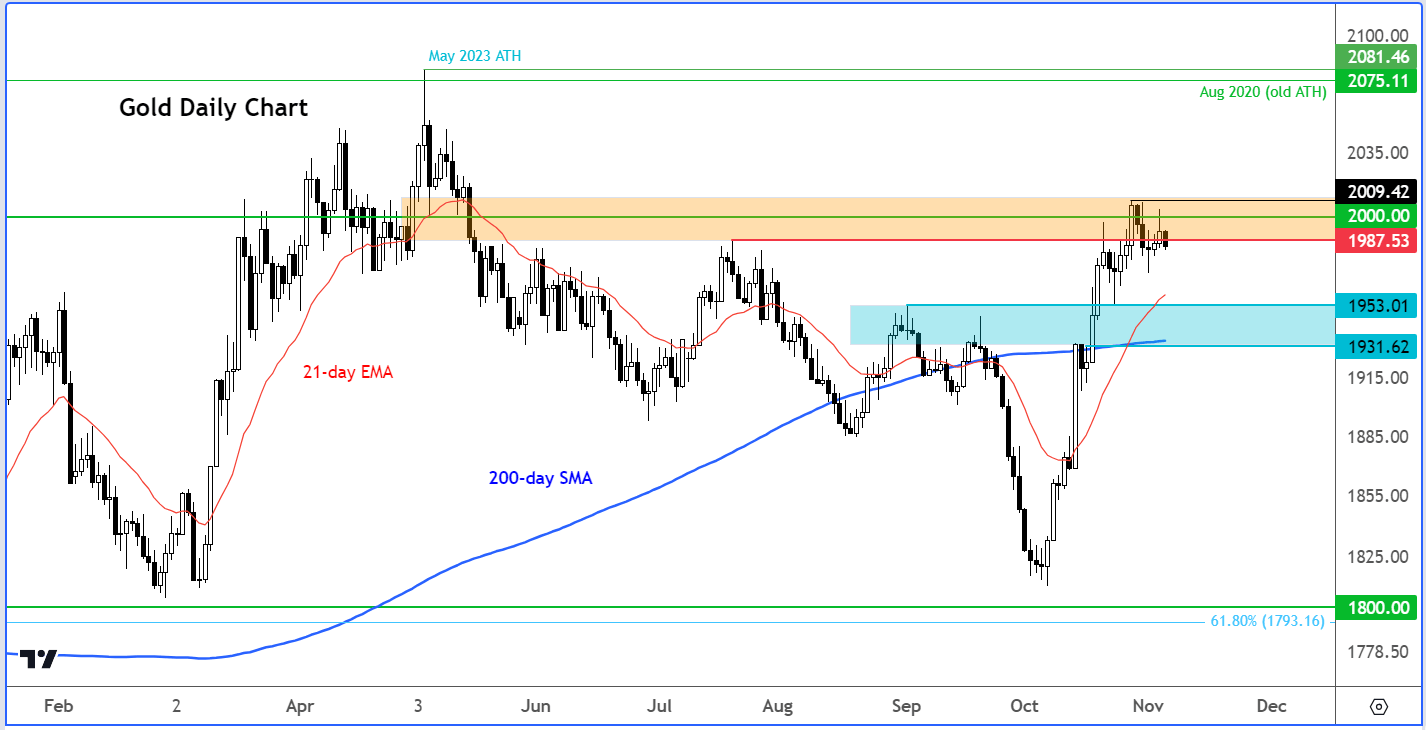

Before discussing the macro factors impacting gold prices, let’s have a quick look at the chart of gold.

Gold analysis: Metal consolidates below key $2K resistance

Source: TradingView.com

In light of gold’s struggle last week despite a positive macro environment, breakout traders who are bullish on gold will need to see the metal move decisively above the $2K level. Dip buyers will be happy to sit on the bid around prior resistance levels, with the area between $1930 to $1953 representing a key support zone. At around current levels, XAUUSD is in no man’s land having held below the key $2K resistance level. So, the very short-term path of least resistance may be to the downside again.

Rebounding bond yields holding gold back

November is typically not a strong month for gold, and with global interest rates seen remaining high for a long period of time, the opportunity cost of holding onto something that doesn’t pay any interest or dividends is high. This makes it difficult to be positive on gold’s outlook, at these levels.

However, you also have a growing list of concerns that continue to boost the appeal for haven assets like gold. Among them are raised geopolitical risks owing to the situation in the Middle East, while you also have concerns over the ballooning US debt – and its growing servicing costs.

So, it is a question of whether the safe haven appeal of gold will outweigh the negative influences mentioned. But with oil prices having given back their entire gains made since the flare up of the situation early last month, investors are perhaps focusing less on the Middle East situation.

Gold bugs are hoping that the “higher for longer” US interest rates narrative is now fully priced in. Judging by the dollar’s sell-off last week on the back of some weaker US data, it is starting to look that way. What we haven’t seen yet is consistent weakness in US data to completely change the focus from “higher for longer” to “when will the Fed start cutting rates.”

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade