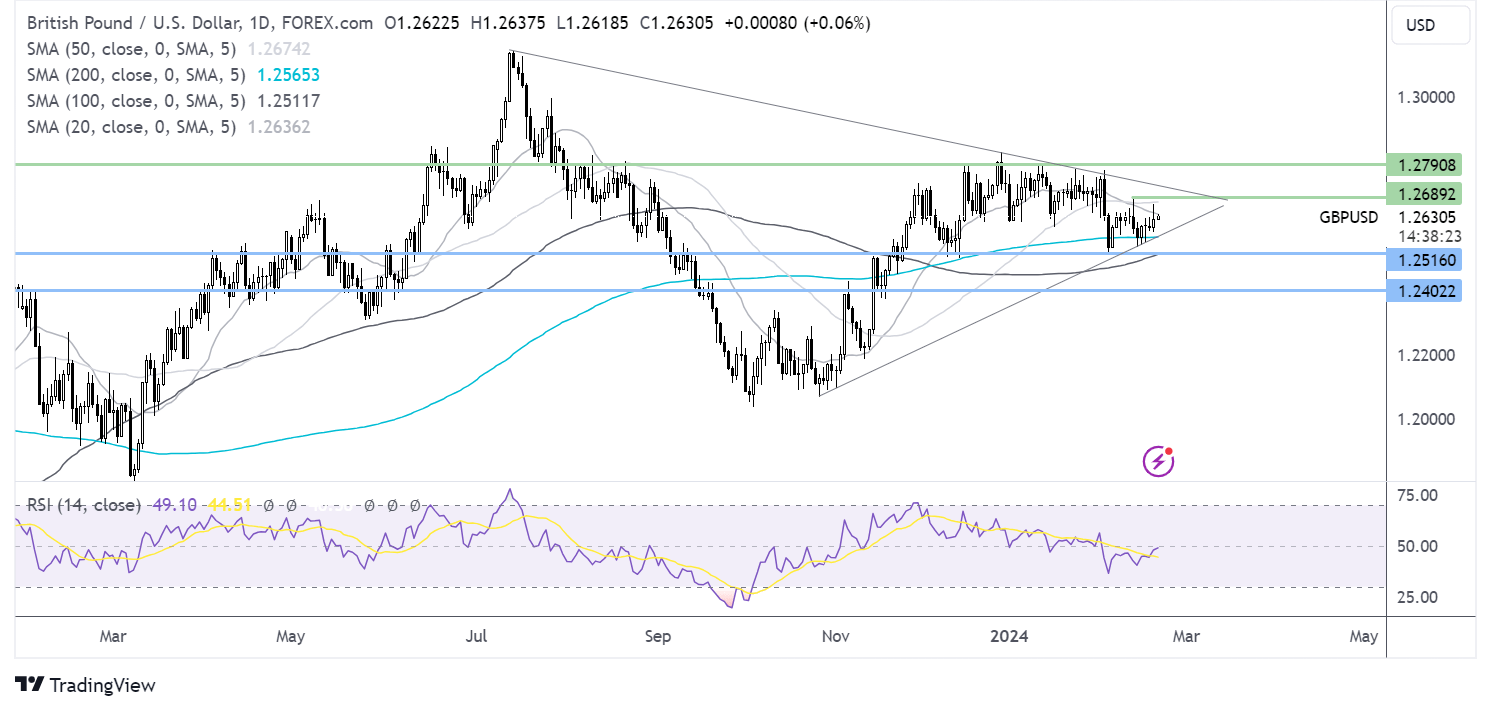

GBP/USD holds above 1.26 ahead of the FOMC minutes

- UK PSNB surplus of £16.7bn vs £18.7 bn forecast

- Hawkish FOMC minutes could lift USD

- GBP/USD trades in a symmetrical triangle

GBP/USD is inching higher on U.S. dollar weakness, and after data showed that Britain recorded a smaller than expected budget surplus of £16.7 billion in January, expectations had been for his surplus of £18.7 billion.

Since the beginning of the financial year in April 2023, public borrowing has totaled £96.6 billion, which is £3.1 million less than in the same period of the 2022/23 financial year.

The data is ahead of Jeremy Hunt's budget on March 6th, where he will be looking for scope to cut taxes in order to boost the Conservative party’s chances of re-election later in the year.

Meanwhile, the pound is also drawing support from hawkish comments from Bank of England governor Andrew Bailey, who was optimistic about the outlook for the UK economy, saying that he believes it could perform better than expected after going into recession in late 2023.

Meanwhile, the US dollar is trading on the back foot, tracking treasury yields lower ahead of the minutes of the January Federal Reserve meeting, which investors will be watching closely for clues over the timing of the first Federal Reserve's interest rate cut.

Since the FOMC meeting, Fed Jerome Powell and Fed policymakers have been pushing back on rate cut expectations, particularly given last week's hotter-than-expected inflation data.

Currently, the market is expecting the Fed to start cutting rates in June. Hawkish minutes could see this pushed back further, which could lift the US dollar.

GBP/USD forecast - technical analysis

GBP/USD trades within a symmetrical triangle. The price has lifted from the 200 SMA and is heading towards last week’s high of 1.2690. A rise above here could see buyers test the falling trendline resistance at 1.2730 ahead of 1.28.

Meanwhile, support can be seen at 1.2565, the confluence of the 200 SMA, and the rising trendline support. A break below here could see 1.2520; the 2024 low tested ahead of 1.24.

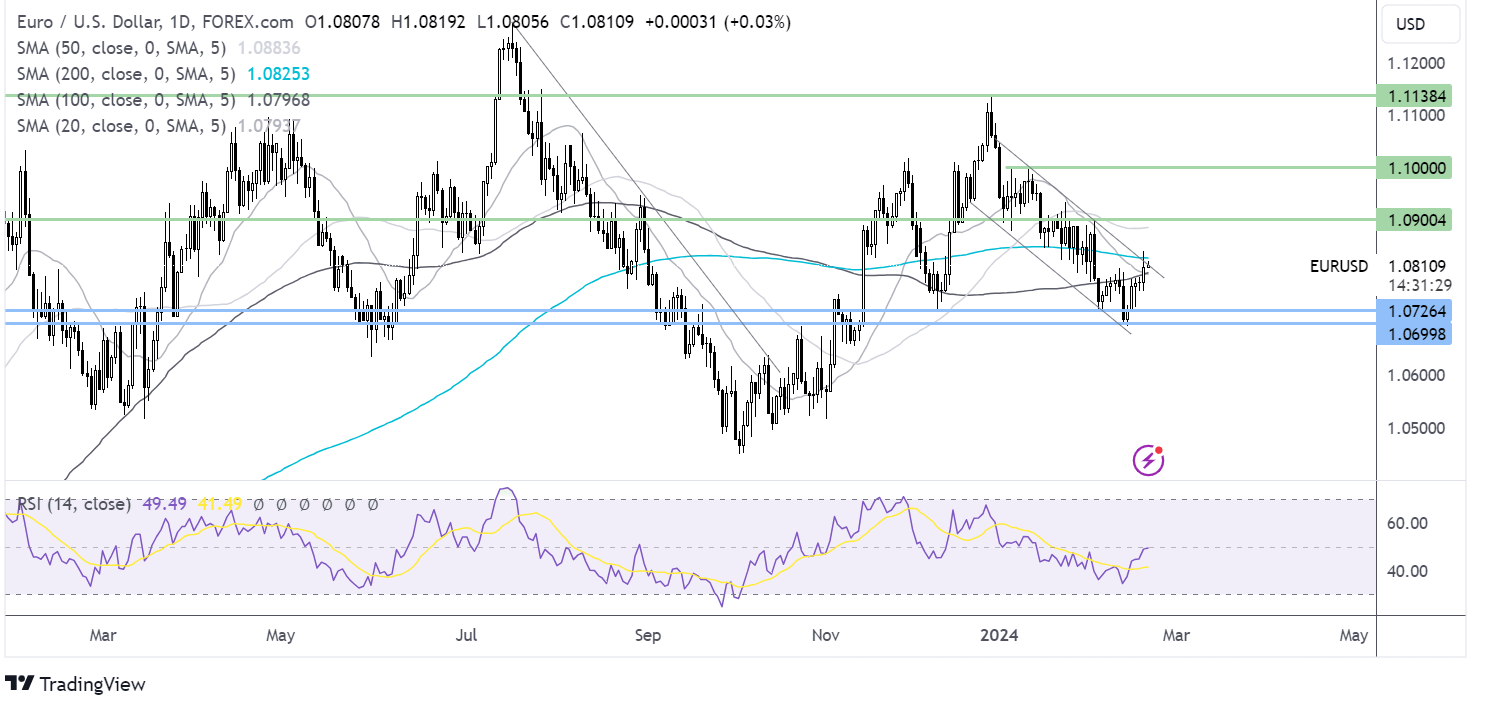

EUR/USD holds above 1.08 as it waits for Fed minutes, eurozone consumer confidence

- Eurozone consumer confidence to rise to -15.6 vs -16.1

- Fed minutes could push back on rate cuts

- EUR/USD tests the upper band of falling channel

EUR/USD is holding steady after five days of gains on U.S. dollar weakness and amid a mixed market mood ahead of the FOMC minutes. Eurozone consumer confidence data is also in focus.

The pair trades above 1.08 at a two-week high, with markets still expecting over four interest rate cuts by the Federal Reserve despite the US central bank pointing to three. The hot inflation data and resilient U.S. economy have been priced in for now. The dollar will need strong hard to extend gains further.

The eurozone economic calendar has been relatively quiet this week. Attention is now on consumer confidence, which is expected to improve slightly after falling in January; which wasn’t that surprising given the gloomy economic outlook and the record-high interest rates in the region. Expectations are for consumer confidence to rise to -15.6, up from -16.1, although it remains well below the long-term average.

While consumer confidence data doesn't impact the ECB's rate decision, it often goes hand in hand with stronger consumer spending, which could help base the eurozone economy and the EUR.

EUR/USD forecast – technical analysis

EUR/USD is extending its recovery from the 2024 low of 1.0690 and testing the upper band of the falling channel and the 200 SMA at 1.0820.

A rise above here and 1.0840, the weekly high, could bring 1.09 into focus.

On the flip side, support is seen at 1.0720, ahead of the 2024 low of 1.0690, with a break below this level creating a lower low.