Asian Indices:

- Australia's ASX 200 index fell by -53.4 points (-0.73%) and currently trades at 7,301.20

- Japan's Nikkei 225 index has fallen by -434.2 points (-1.32%) and currently trades at 32,276.89

- Hong Kong's Hang Seng index has fallen by -11.27 points (-0.06%) and currently trades at 19,506.11

- China's A50 Index has risen by 12.05 points (0.09%) and currently trades at 13,127.10

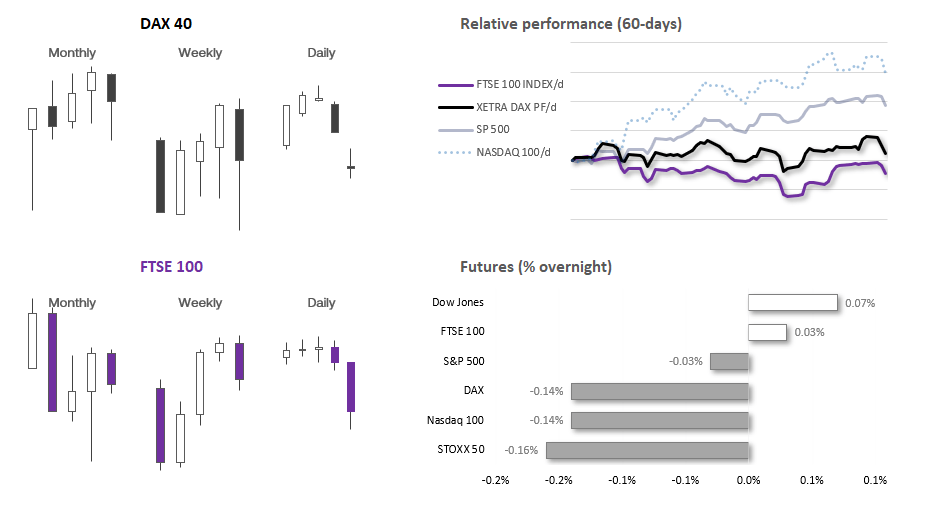

UK and Europe:

- UK's FTSE 100 futures are currently up 3.5 points (0.05%), the cash market is currently estimated to open at 7,565.13

- Euro STOXX 50 futures are currently down -7 points (-0.16%), the cash market is currently estimated to open at 4,329.50

- Germany's DAX futures are currently down -23 points (-0.14%), the cash market is currently estimated to open at 15,997.02

US Futures:

- DJI futures are currently up 27 points (0.08%)

- S&P 500 futures are currently down -0.75 points (-0.02%)

- Nasdaq 100 futures are currently down -20.75 points (-0.13%)

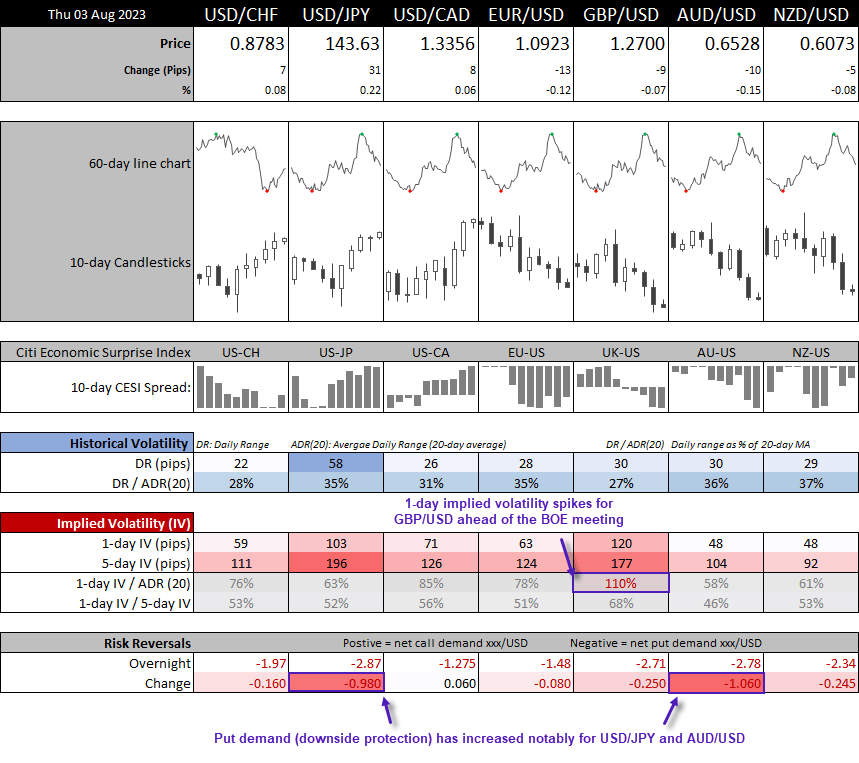

Volatility levels very much died down during Thursday’s Asian session, as traders across the region seemingly paused for breath to assess the damage done over the previous 24 hours. It is still early days regarding the US credit downgrade – and perhaps it won’t amount to anything significant. But what makes me question whether there is more downside to come for risk sentiment is that this downgrade came out of the blue, and after strong moves across some markets. Wall Street was approaching its record highs and oil had rallied over 20% in the day leading up to this announcement. So even if the worst is behind us, it’s probable that many investors are questioning their appetite for risk after bullish moves, and at a time of year usually associated with choppy trading conditions. It therefore likely remains to be a ‘traders market’ over one that favours investors over the short term, and pockets of volatility should be expected.

As for today, the main event is the BOE (Bank of England) interest rate decision at 12:00 BST. Odds now favour a 25bp hike to take their base rate to 5.25%, thanks to speculation that inflation rates have finally topped which saw bets of another 50bp hike today scaled back. Given inflation has topped elsewhere, I’m not convinced the BOE really have the need to be so aggressive today, and risks denting sentiment further if they did go for the 50. Still, 8 of the 9 MPC members are expected to vote for a hike, which will be the first time we have seen more then 7 vote to do so this year. And that itself could be deemed as hawkish.

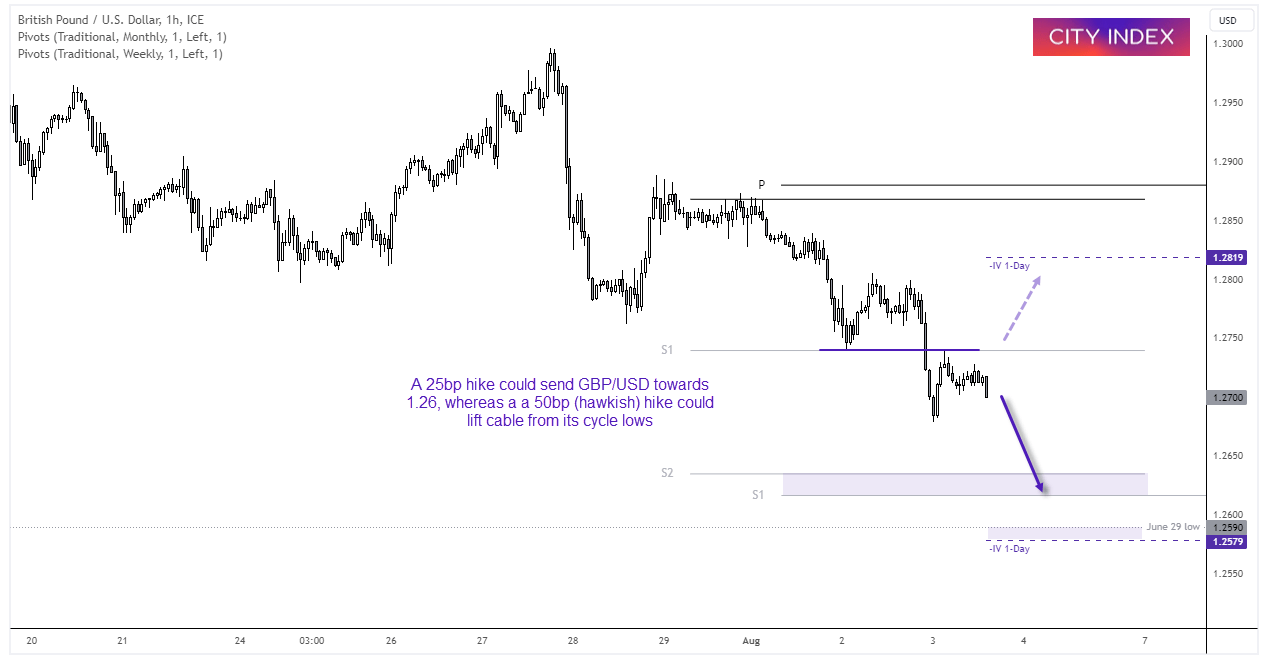

Rates are now expected to peak at 5.75%, up from 5.5% in June. Around a third of economists still back a 50bp hike today – and that could result in GBP/USD lifting itself up from its cycle lows if they do.

- 1-day implied volatility for GBP/USD is above its 20-day average ahead of today’s BOE meeting, which suggests a 66% chance of a 120 pip move in either direction (with the BOE’s rate decision likely to direct that direction)

- EUR/GBP eventually saw the move higher we were looking for, but it stopped just short of the 0.8630 area we sought and pulled back to the open to form a Doji. Stil, it is holding above the weekly and monthly pivot, and if the BOE’s 25bp hike is not as hawkish as it could have been just a few weeks ago, it could pave a path higher for EUR/GBP again today

- The DAX fell to (and below) our 16k target, and action on futures markets suggests it is trying to form a base around these key levels. We see the potential for a minor bounce form current levels (or a larger bounce if markets look past yesterday’s commotion)

GBP/USD 1-hour chart:

GBP/USD remains within a downtrend on the 1-hour chart, and momentum is turning lower ahead of the UK open in an apparent attempt to retest its recent cycle low. Note that Wednesday’s high respected Tuesday’s low and the weekly S1 pivot as resistance, making it a pivotal level – a break above which assumes the BOE ran with a hawkish 50bp hike. But if they go for the 25bp hike (with 7 votes in favour, not 8) and tip their hat to peak UK inflation, we could be looking at a run towards 1.26.

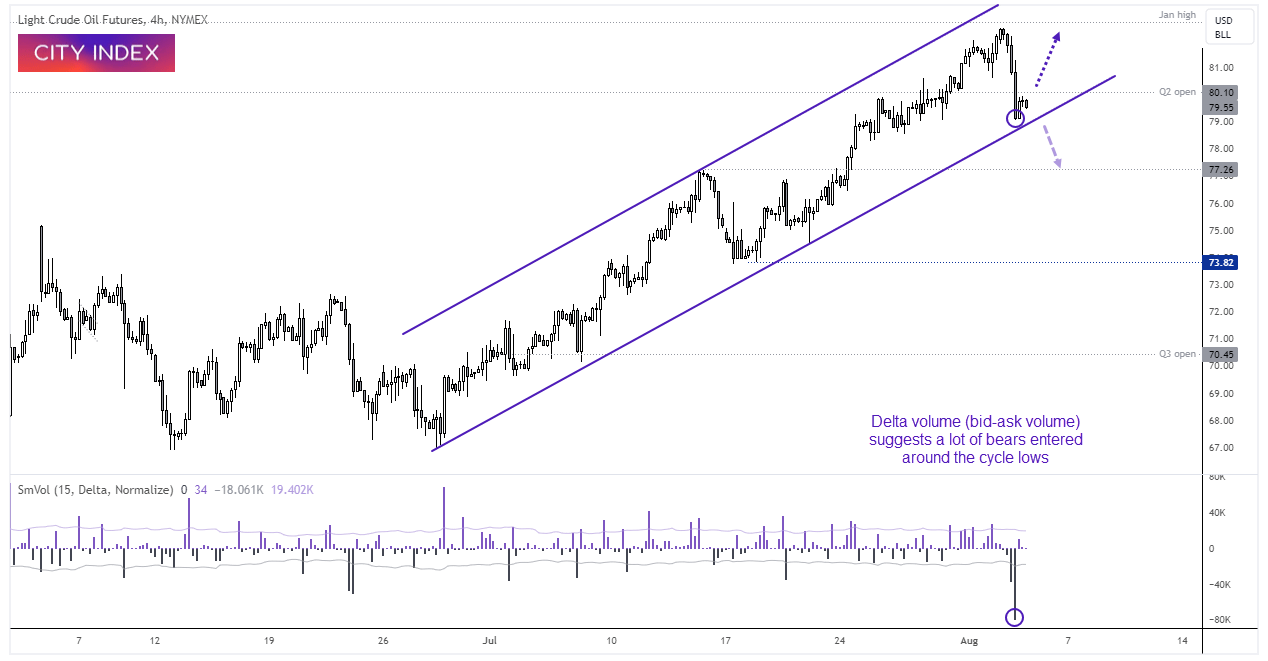

WTI crude oil 4-hour chart

Oil prices felt the strain of lower appetite for risk, sending WTI crude down to the lower bounds of its bullish channel. Whilst the move lower was aggressive (and could point to a bearish break of trend support), we saw a deep pullback earlier in the trend which saw momentum revert higher.

Furthermore, delta volume (which is contracted traded at the bid minus contracts traded at the ask) is extremely negative at the cycle low, which tells us there was heavy selling into the cycle low. If prices now move higher, it could prompt many of these bears to cover and send prices higher still. A break above 80.10 assumes bearish capitulation and a resumption of its bullish channel. A break of the lower channel assumes bearish continuation.

Whichever way it goes, traders would be wise to keep an eye on indices and VIX to monitor appetite for risk, as oil prices are tracking it closely at present.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade