Asian Indices:

- Australia's ASX 200 index fell by -19.8 points (-0.27%) and currently trades at 7,219.00

- Japan's Nikkei 225 index has risen by 161.92 points (0.58%) and currently trades at 27,923.49

- Hong Kong's Hang Seng index has risen by 229.85 points (1.09%) and currently trades at 21,311.98

- China's A50 Index has risen by 163.46 points (1.21%) and currently trades at 13,677.64

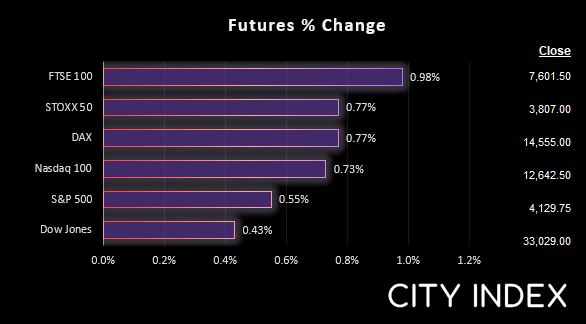

UK and Europe:

- UK's FTSE 100 futures are currently up 70.5 points (0.94%), the cash market is currently estimated to open at 7,603.45

- Euro STOXX 50 futures are currently up 28 points (0.74%), the cash market is closed today.

- Germany's DAX futures are currently up 102 points (0.71%), the cash market is closed today.

US Futures:

- DJI futures are currently up 140 points (0.43%)

- S&P 500 futures are currently up 89.25 points (0.71%)

- Nasdaq 100 futures are currently up 22.25 points (0.54%)

Oil prices gapped higher at today’s open after Saudi Arabia raised the price of their crude for July over the weekend. WTI reached a high of $121 before pulling back to $19.70. Gold continues to meander around $1850 as it strugglers to sustain a breakout in either direction. A weekly Doji formed and closed on its 50-week EMA, yet prices are holding above its 200-day MA. Friday’s selloff erased most of Thursday’s gains, which means Thursday’s breakout is unlikely to be part of a bull flag breakout, so we’ll step aside until the picture becomes clearer.

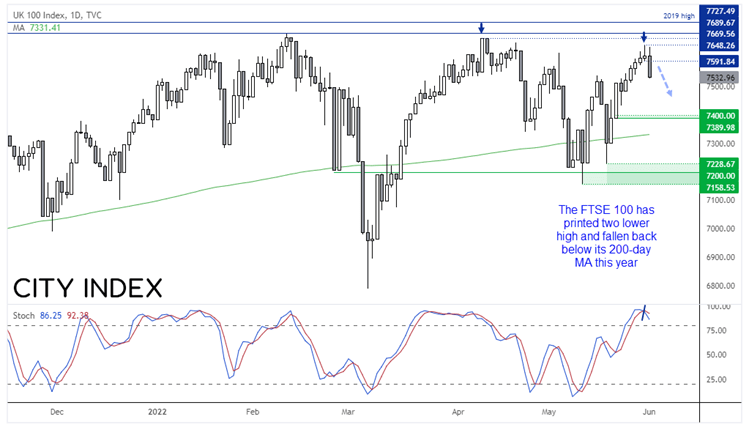

The FTSE 100 is back below 7600:

The FTSE has been closed since Wednesday the 1st of June, due to the Queen’s Platinum Jubilee celebrations. In Wednesday’s pre-market report we highlighted the potential for the FTSE to roll over, and it did not disappoint as it had its most bearish session in 8-days. It now appears that we have seen an important swing high at 7648.26, which would be its second lower high this year, and it coincides with a sell-signal on the stochastic oscillator.

Futures markets have opened higher which means the cash market is expected to gap higher at the open. We are therefore seeking bearish opportunities within Wednesday’s range particularly below Tuesday’s low of 7591.84. If this is a significant high, take note that the FTSE has twice reverted towards (and traded below) its 200-day average. So we could be looking for another 2-3% move lower.

FTSE 100 trading guide

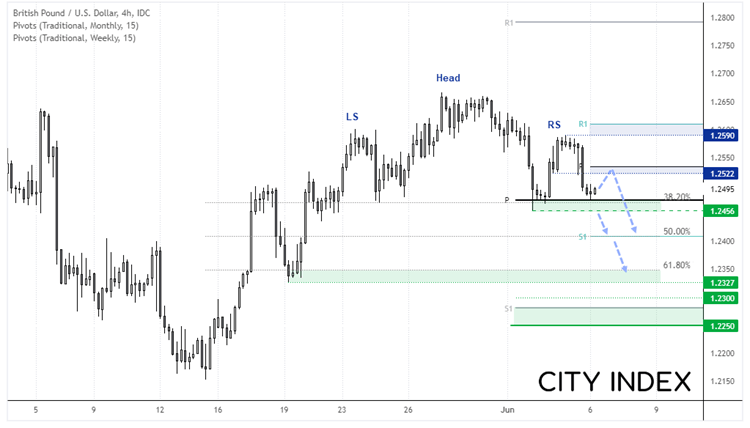

Potential head and shoulders top on GBP/USD

There’s a couple of potential scenarios on GBP/USD which may be worth exploring, and they both depend on how prices react around the current support zone. A potential head and shoulder top has formed on the 4-hour chart, which project a target around 1.2250 – just below the monthly S1 pivot. A break beneath 1.2456 confirms the bearish reversal pattern, and brings 1.2400 and 1.2350 support zones into focus.

However, with news economic data on the light side we may find volatility is also reduced. In which case we could see prices drift higher from support towards the monthly pivot point. We would then look for evidence of a swing high and seek bearish setups, ahead of an anticipated break lower.

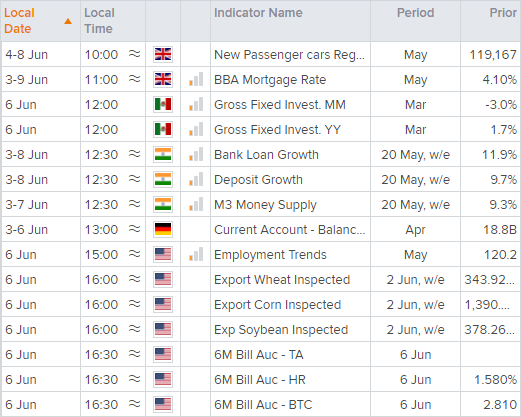

Up Next (Times in BST)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

- Open an account, or log in if you’re already a customer

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade