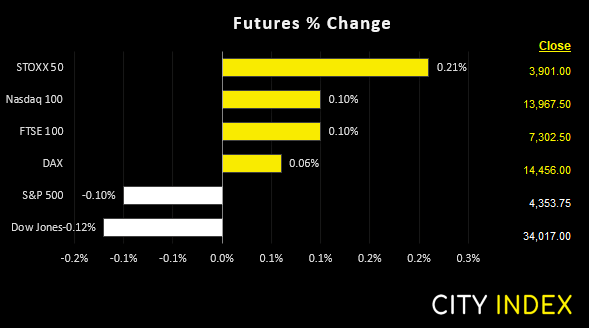

Wednesday US cash market close:

- The Dow Jones Industrial rose 518.76 points (1.55%) to close at 34,063.10

- The S&P 500 index rose 95.41 points (2.51%) to close at 34,058.75

- The Nasdaq 100 index fell 0 points (0%) to close at 13,956.79

Asian futures:

- Australia's ASX 200 futures are up 83 points (1.16%), the cash market is currently estimated to open at 7,337.10

- Japan's Nikkei 225 futures are up 760 points (2.97%), the cash market is currently estimated to open at 26,522.01

- Hong Kong's Hang Seng futures are up 1094 points (5.44%), the cash market is currently estimated to open at 22,344.97

- China's A50 Index futures are up 362 points (2.68%), the cash market is currently estimated to open at 14,161.79

China’s ambassador said that China will “never attack Ukraine” and they will continue to provide support and aid. This is in contrast to earlier intelligence reports that Russia had asked for China’s military assistance for the conflict and claims that China was aware of Russia’s intention to invade leading up to the Beijing Olympics. But, whatever China’s actual stance on the situation, it is a step forward for China to take less of a neutral view and could be seen as a defiance against Russia.

Strong employment data for Australia

The RBA have been defiantly dovish despite the urge for fellow central banks to not only hike rates, but lay out a path for further hikes. And with the Fed now openly saying they could hike seven hikes in total this year (with more to follow), then today’s strong employment data surely makes the RBA’s dovish stance harder to pull off with a straight face. Or not… as wage growth remains sanguine and is a key data point the RBA want to see rising sustainably before they take action. And that could help explain why the Aussie only rose 0.37% overnight, despite the strong employment report.

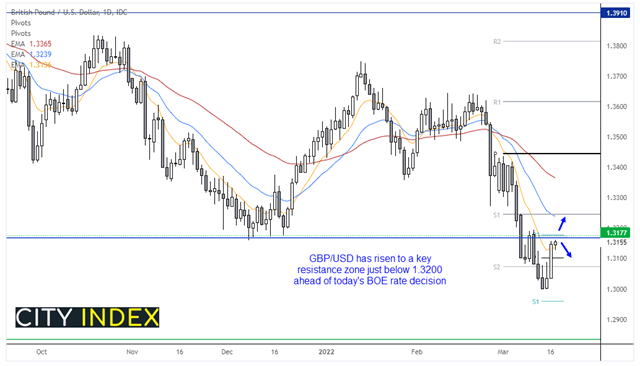

BOE expected to hike today

It will be the third consecutive hike today if they do, and that is what markets are expecting. The Ukraine crisis is putting upside pressure on (already hot) inflation, and that has seen expectations for more aggressive hikes from BOE over the coming months. We saw nine vote for a hike in February’s meeting, so to see another nine vote for a hike today along with hawkish comments likely paves the way for another hike in April to take them to 1% base rate.

GBP/USD rallied to a 5-day high following yesterday’s FOMC press conference, although prices are now trading in a tight range around a key resistance zone. The December lows coincide with a long-term Fibonacci ratio (38.2% between the 2020 low and 2021 high) and the weekly R1 pivot point. Should the BOE disappoint with their level of hawkishness then current levels could temp bears to fade the move, whereas a break above resistance brings 1.3250 into focus near the 20-day eMA and monthly S1 pivot point.

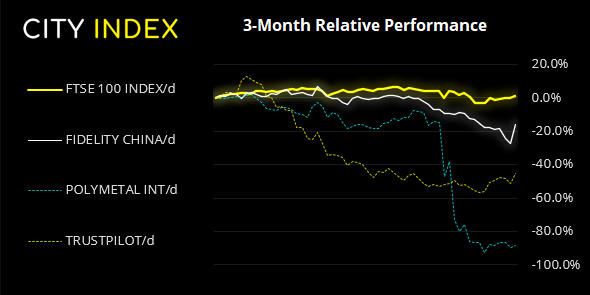

FTSE 100 probes 7300

I think we can deem yesterday’s breakout a success, given it opened at the low of the session and probed the 7300 resistance zone. Whist the daily trend appears bullish over the near-term, trend resistance from the Feb high and 50-day eMA and weekly R1 around 7350 make the reward to risk undesirable at current levels, on the daily chart.

FTSE 350: 4103.62 (1.62%) 16 March 2022

- 312 (89.14%) stocks advanced and 32 (9.14%) declined

- 4 stocks rose to a new 52-week high, 0 fell to new lows

- 30% of stocks closed above their 200-day average

- 28.57% of stocks closed above their 50-day average

- 18% of stocks closed above their 20-day average

Outperformers:

- + 16.02% - Fidelity China Special Situations PLC (FCSS.L)

- + 13.91% - Polymetal International PLC (POLYP.L)

- + 13.45% - Trustpilot Group PLC (TRST.L)

Underperformers:

- -13.26% - Avast PLC (AVST.L)

- -9.35% - Centamin PLC (CEY.L)

- -4.00% - Chemring Group PLC (CHG.L)

Oil shows sign of stability

WTI has fallen over 28% from its $130.50 high, but there comes a point with any market where selling has to subside. And we’ve seen early signs of that now that its plunge has found support around its 50-day eMA, held above Tuesday’s low before rising a cute 1.7% today. Whether it is decent buying level remains to be seen, and we’d expect $100 to cap as resistance anyway. So our view on oil remains the same; if you must participate, stay nimble. And remember it is highly sensitive to headline and geopolitical risk.

Gold has performed a tad batter and has risen 2.3% form yesterday’s low. Yet in context of its decline from last week’s high means it could simply be part of a dead-cat bounce whilst prices remain below $1950. And with the Fed now on an aggressive hiking, good news for Ukraine could be bad news for gold bugs.

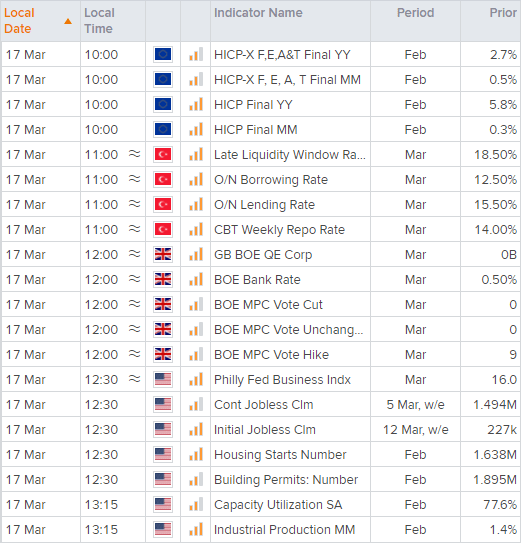

Up Next (Times in GMT)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade