Asian Indices:

- Australia's ASX 200 index fell by -69.5 points (-0.98%) and currently trades at 7,051.60

- Japan's Nikkei 225 index has risen by 65.55 points (0.23%) and currently trades at 28,299.84

- Hong Kong's Hang Seng index has fallen by -52.99 points (-0.24%) and currently trades at 21,961.60

- China's A50 Index has fallen by -83.41 points (-0.6%) and currently trades at 13,928.98

UK and Europe:

- UK's FTSE 100 futures are currently down -34 points (-0.45%), the cash market is currently estimated to open at 7,559.00

- Euro STOXX 50 futures are currently down -19 points (-0.5%), the cash market is currently estimated to open at 3,769.93

- Germany's DAX futures are currently down -71 points (-0.49%), the cash market is currently estimated to open at 14,374.99

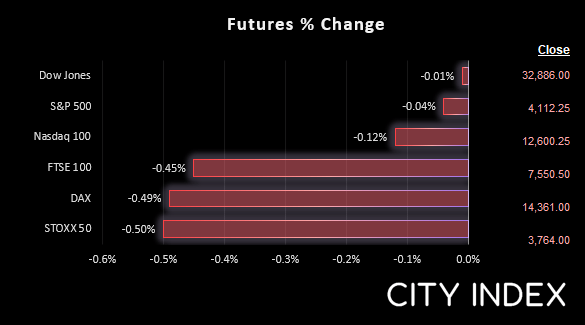

US Futures:

- DJI futures are currently down -4 points (-0.01%)

- S&P 500 futures are currently down -15.25 points (-0.12%)

- Nasdaq 100 futures are currently down -2 points (-0.05%)

US and European futures are a touch lower ahead of the open as investors brace themselves for another high stakes central bank meeting. Equities came under pressure on Tuesday when the RBA surprised the majority with a 50-bps hike and the reality began to sink in that the days of easy money are over. The DAX, STOX and FTSE futures are around -0.5% lower.

China’s exports rose 16.9% y/y in May – much higher than expected - as the effects of China’s reopening show up in the data. Imports rose 4.1% and their trade balance hit a 4-month high. CPI and producer prices are the main focus tomorrow for the world’s second largest economy.

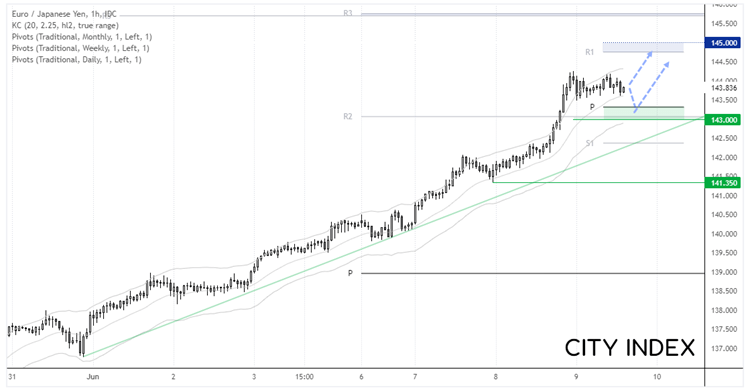

Euro in focus for today's ECB meeting

EUR/JPY is our preferred play for a hawkish surprise, as it would mark a wider policy divergence between the ECB and BOJ. Yes, it may look overbought form the view of a chartist, but macro trends don’t pay attention to overbought levels in events like this.

EUR/JPY is in a very strong uptrend on the hourly chart. The 20-bar eMA has continued to provide support and prices are now consolidating within a potential continuation pattern near yesterday’s highs.

A break higher from the small triangle assumes bullish continuation. 145 is its next logical target although 145.75 (the weekly/monthly R3 pivots) are also less than a day’s trading range away. Should we not glean anything unexpected, then EUR/JPY could finally retrace and head towards 143.0.

EUR/USD is looking comfortable above 1.0700 ahead of today’s meeting. But it risks a move beneath it should the ECB not deliver a hawkish message – such as hints we’re in for a 50-bps hike in July. Clearly the best case for euro bulls today is if they simply go ahead and raise rates. But that is an unlikely scenario given how careful the ECB have been to signal a July hike, and happily drag their heels in the world of high inflation.

Euro explained – a guide to the euro

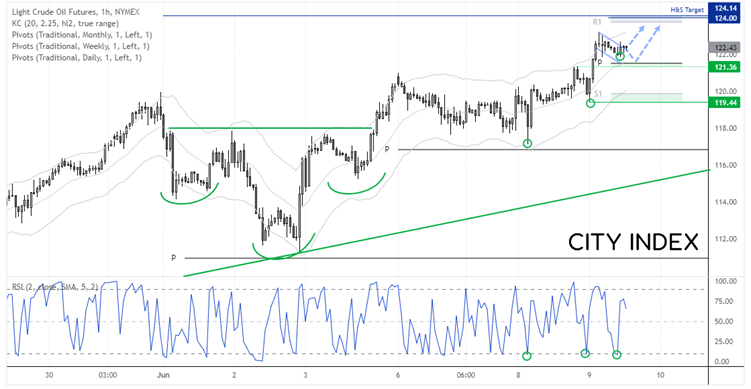

WTI (1-hour chart)

The inverted head and shoulders pattern remains in play on the WTI 1-hour chart, which projects a target around $124. A prominent swing low formed around $119.50 before bullish momentum increased, and prices have since retraced as part of a bull flag pattern.

Note that the RSI (2) has done a decent job nailing swing lows recently when it has dipped below 10 (oversold), and the overnight low found support just above the weekly pivot point. We’re now looking for prices to hold above 121.50 and rise to our $124 target, near the weekly R1 pivot and inverted H&S target.

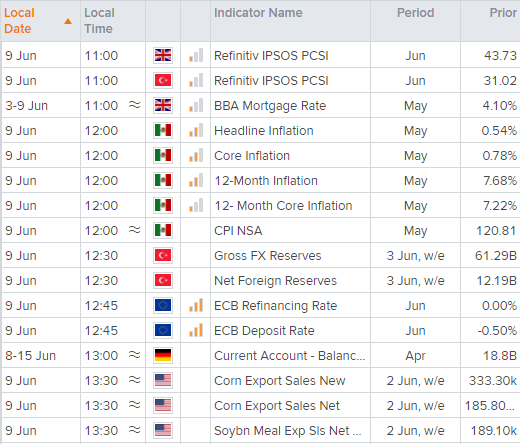

Economic events up next (Times in BST)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade