Euro Talking Points:

- EUR/USD is starting the week with a bounce after running into a key spot of support last week after the European Central Bank rate decision.

- Support in EUR/USD has held at 1.0638, which was the March 2020 swing low that came back into play in late-May trade. This currently marks the six-month low in the pair and a breach below that exposes another key area around the 1.0500 psychological level.

- I’ll be discussing these themes in-depth in the weekly webinar on Tuesday at 1PM ET: Click here to register.

It’s Fed week in the US so much of the attention from markets is already geared towards the Wednesday rate decision. As of this writing there is a mere 1.0% chance of a rate hike with a 99% expectation for no change at all, so it would be far more surprising to see an actual move at that meeting. Going out to the end of the year, however, those odds widen out considerably, with a current 41.1% probability of seeing at least one more hike by the end of 2023.

Deductively, this means markets are looking for the Fed to set the stage for the rest of the year at Wednesday’s meeting, with little expectation for any actual change. And given that there’s only two more rate decisions this would mean looking for the Fed to highlight a possible hike in either November or December. If they do, that can certainly prod the US Dollar higher as the bullish trend has continued to show strength above the 105 level in DXY.

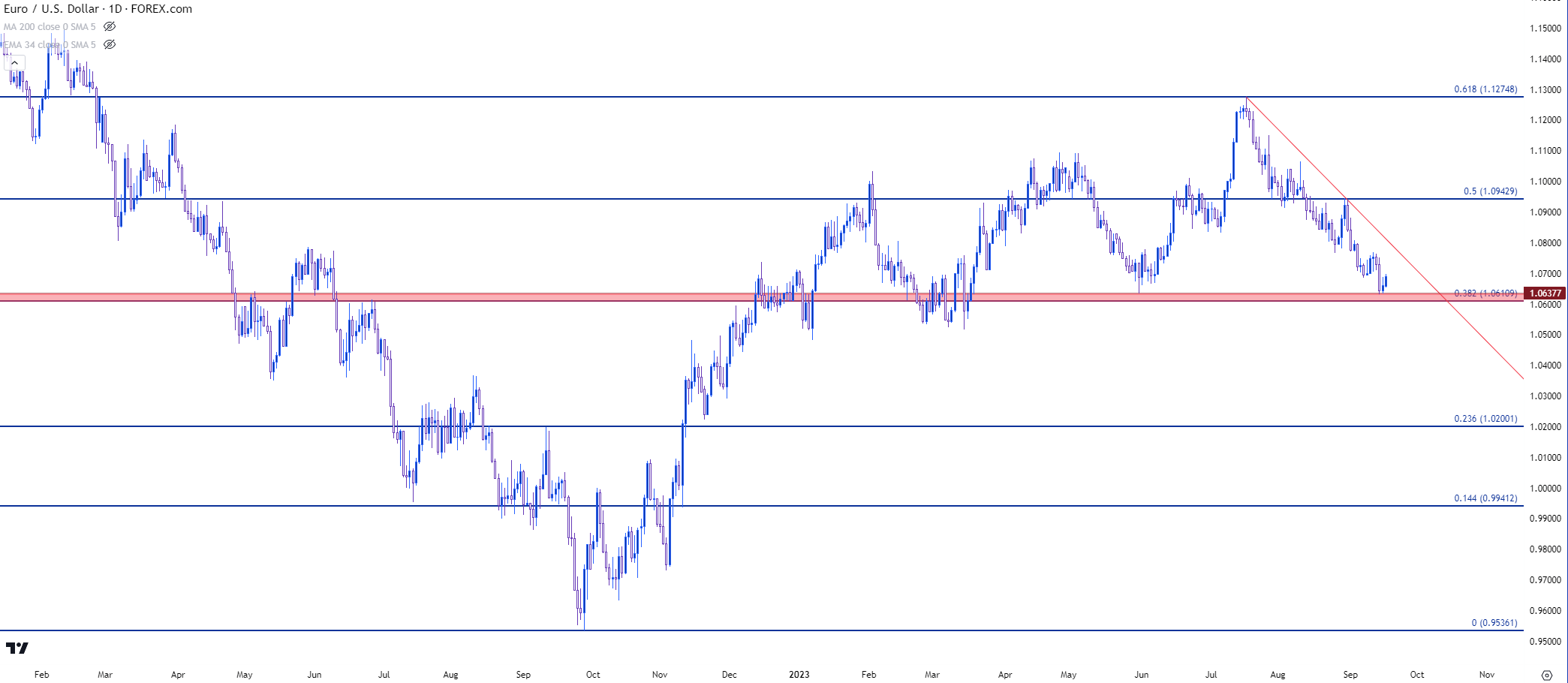

But also of importance is the European inflation print set to release on Tuesday morning along with the Friday release of German PMI numbers. Core inflation is expected to release at 5.3% tomorrow, and this would be softened from the prior month’s release at 5.5%. But perhaps more to the point is the building expectation that the European Central Bank may have just pushed through their last rate hike for this cycle. While the ECB did not explicitly state this, a worsening in economic data in Europe has raised questions about impact to growth. This is what helped to bring bears into the pair after setting a fresh high in July, right at the 61.8% Fibonacci retracement of the 2021-2022 major move. Since then, bears have been in control.

EUR/USD Weekly Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

EUR/USD Levels

Support has shown at a familiar spot: 1.0638 was the swing low in March of 2020 during the pandemonium from when the pandemic was being introduced to global markets, and that level came back into play a few months ago to set the low in EUR/USD. That inflection was on May 31st, and this led to another challenge of longer-term resistance above the 1.1000 handle.

But, as US data has remained strong and European data has started to take a turn for the worse, especially leading data points like PMI readings, there’s been a new theme getting priced-in as Euro bears have taken a strong role in the pair.

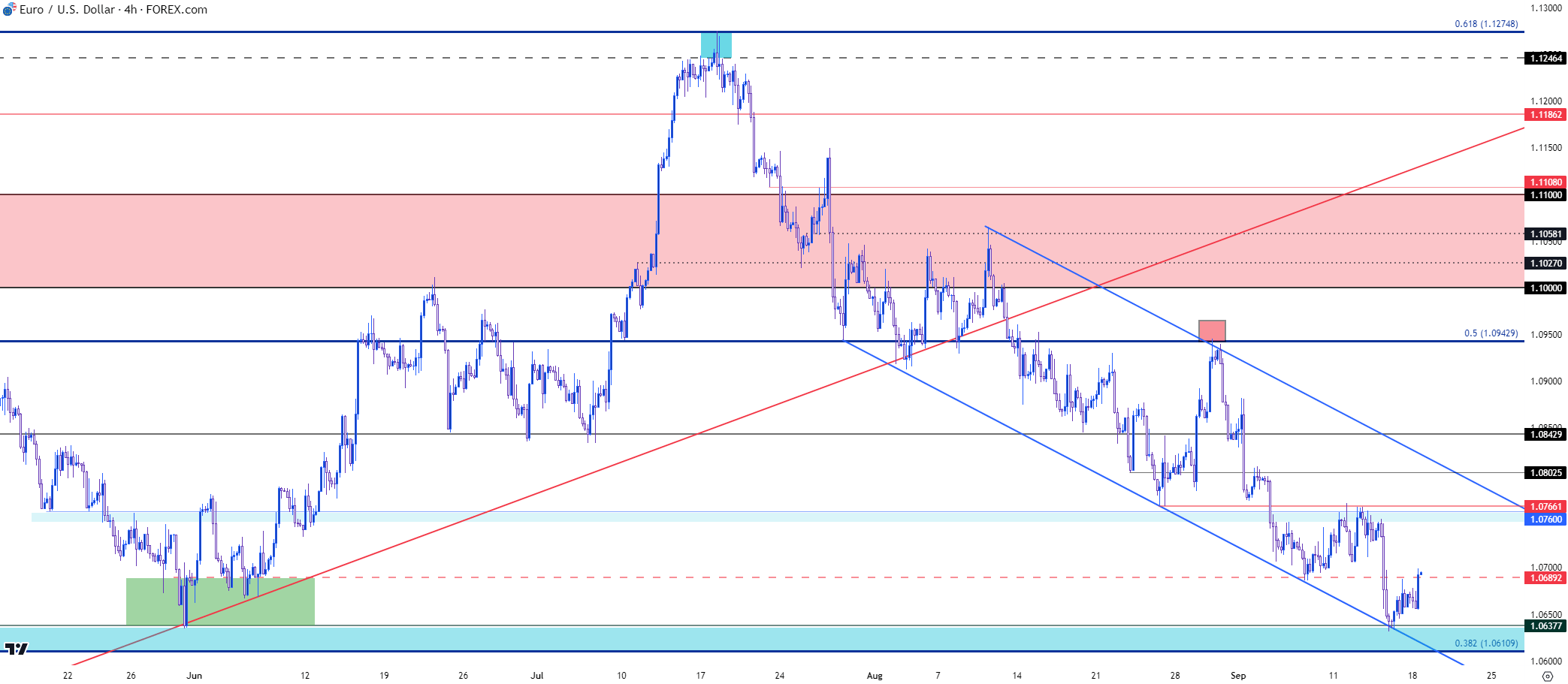

The level of 1.0638 was tested twice last week: It first came back into play on Thursday after the ECB rate decision, and it held the lows into the end of the week. So far, this week has started with a bounce, giving the appearance of a support hold at this key level. The question now is where bears may re-enter to try to continue the trend, and that inflation report set to be released tomorrow will probably have some sway over the matter.

From the four-hour chart below, we can see that support bounce building over the past few days, and this highlights a few key resistance levels sitting overhead. We’re already trading through 1.0689 which was a level that I’ve been talking about in webinars for a while. Above that is another key zone around 1.0760/1.0768, as this was a spot of prior support-turned-resistance. If bulls can force a break above that, there’s 1.0803 and then 1.0843 looming overhead.

If buyers can force a break above 1.0843, the bearish trend will start to look less attractive and there likely would’ve been some type of shift in the backdrop that led into such a change, perhaps a strong inflation read out of Europe or the Fed closing the door on hikes for the rest of the year even with US data remaining very strong.

These can both be seen as lower probability scenarios from where we’re at now, but with a busy economic calendar this week out of both the US and Europe, the range of possible scenarios widens considerably.

EUR/USD Four-Hour Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

--- written by James Stanley, Senior Strategist