Asian Indices:

- Australia's ASX 200 index rose by 57.3 points (0.82%) and currently trades at 7,006.10

- Japan's Nikkei 225 index has risen by 194.89 points (0.6%) and currently trades at 32,777.88

- Hong Kong's Hang Seng index has fallen by -16.84 points (-0.1%) and currently trades at 17,409.37

- China's A50 Index has fallen by -11.21 points (-0.09%) and currently trades at 11,970.42

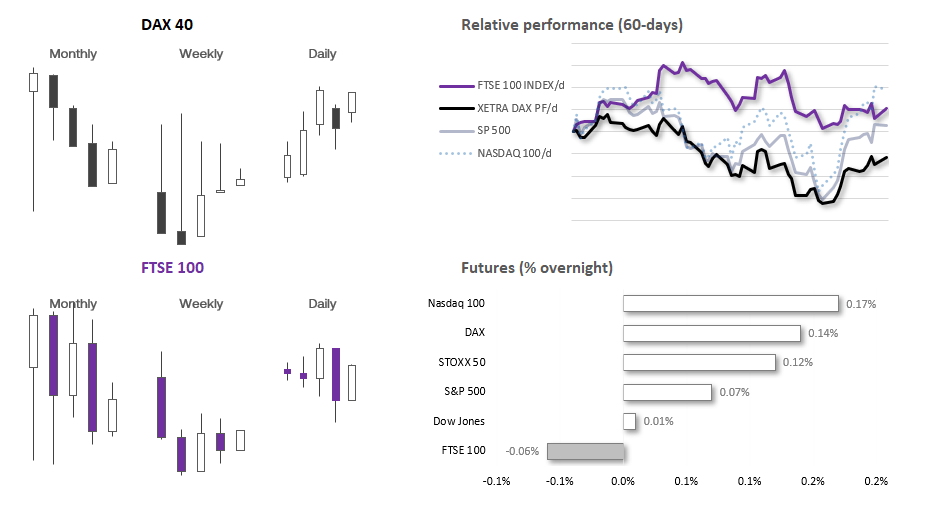

UK and European indices:

- UK's FTSE 100 futures are currently down -4 points (-0.05%), the cash market is currently estimated to open at 7,421.83

- Euro STOXX 50 futures are currently up 6 points (0.14%), the cash market is currently estimated to open at 4,238.19

- Germany's DAX futures are currently up 22 points (0.14%), the cash market is currently estimated to open at 15,367.00

US index futures:

- DJI futures are currently up 4 points (0.01%)

- S&P 500 futures are currently up 3.25 points (0.07%)

- Nasdaq 100 futures are currently up 27 points (0.17%)

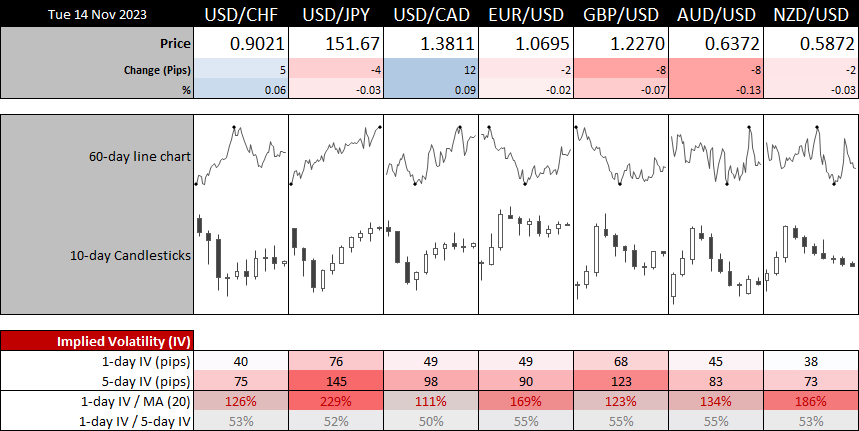

Once again, the 1-day implied volatility levels for EUR/USD and USD/JPY have blown out ahead of a busy calendar. Central bank members from the Fed, ECB, BOE and SNB will hit the wires, European GDP is also on tap ahead of the key US inflation report.

US inflation is likely to be a binary event; it either comes in hotter than expected to justify hawkish comments from the Fed and weigh on risk whilst supporting the US dollar, or it comes in soft and we see the reverse. Unless of course data comes in roughly on target and we’re none the wiser as to whether market pricing or Fed comments are closer to the truth.

Volatility has been typically low ahead of such an event, but we doubt it will remain that way by the close.

Events in focus (GMT):

- 07:00 – UK earnings, employment data

- 07:45 – SNB chairman Jordan speaks

- 08:00 – Spanish CPI, ECB Lane speaks,

- 08:45 – ECB’s Enria speaks

- 09:00 – IEA monthly report

- 10:00 – Eurozone GDP, employment, ZEW economic sentiment, German ZEW economic sentiment

- 10:30 – Fed Jefferson speaks

- 13:30 – US inflation

- 13:45 – BOE member Pill speaks

- 15:00 – Fed vice chair Barr speaks

- 17:45 – Fed Goolsbee speaks

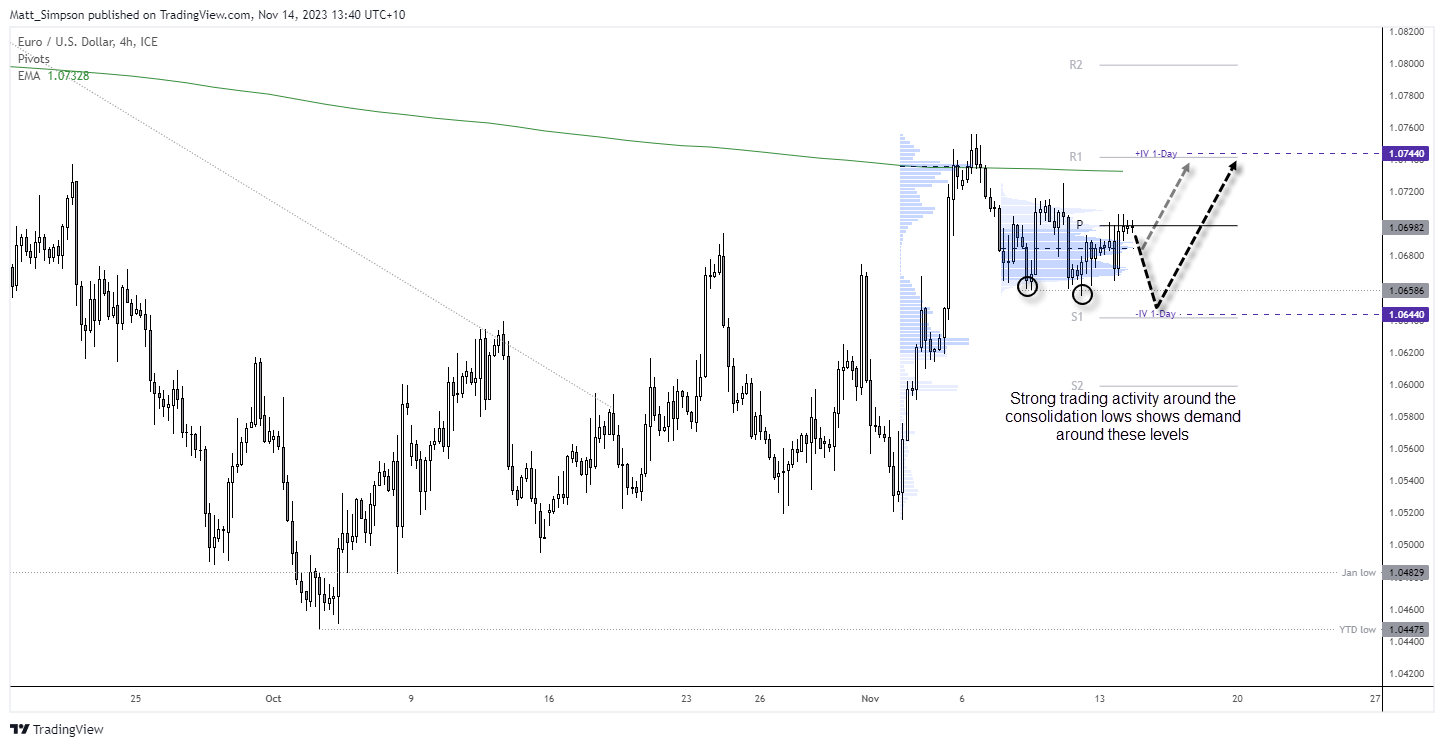

EUR/USD technical analysis (4-hour chart):

EUR/USD has been within a consolidation over the past six days, after its strong rally above the 1.07 handle was foiled by the 200-day EMA. I noted in the weekly COT report that futures traders have continued to trim their short exposure in recent weeks which has allowed EUR/USD to rise, despite weak economic data coming out of Europe. And that means there may be more upside potential over the near-term, especially if US inflation data comes in softer than expected.

The 4-hour chart shows that the current consolidation has filled the liquidity gap between 1.6680 – 1.0690 that was left during its strong rally to 1.07. Interestingly, heavy trading activity has taken place around the consolidation lows, with a series of lower wicks also suggesting there’s demand around 1.0670.

The bias is for prices to eventually move higher. But I would not be surprised to see EUR/USD try and at least test the lows before momentum realigns with its intended direction (higher). Therefore, unless we see a particularly strong set of CPI data from the US, I would prefer to seek bullish setups around support levels in anticipation of a break back above 1.0700.

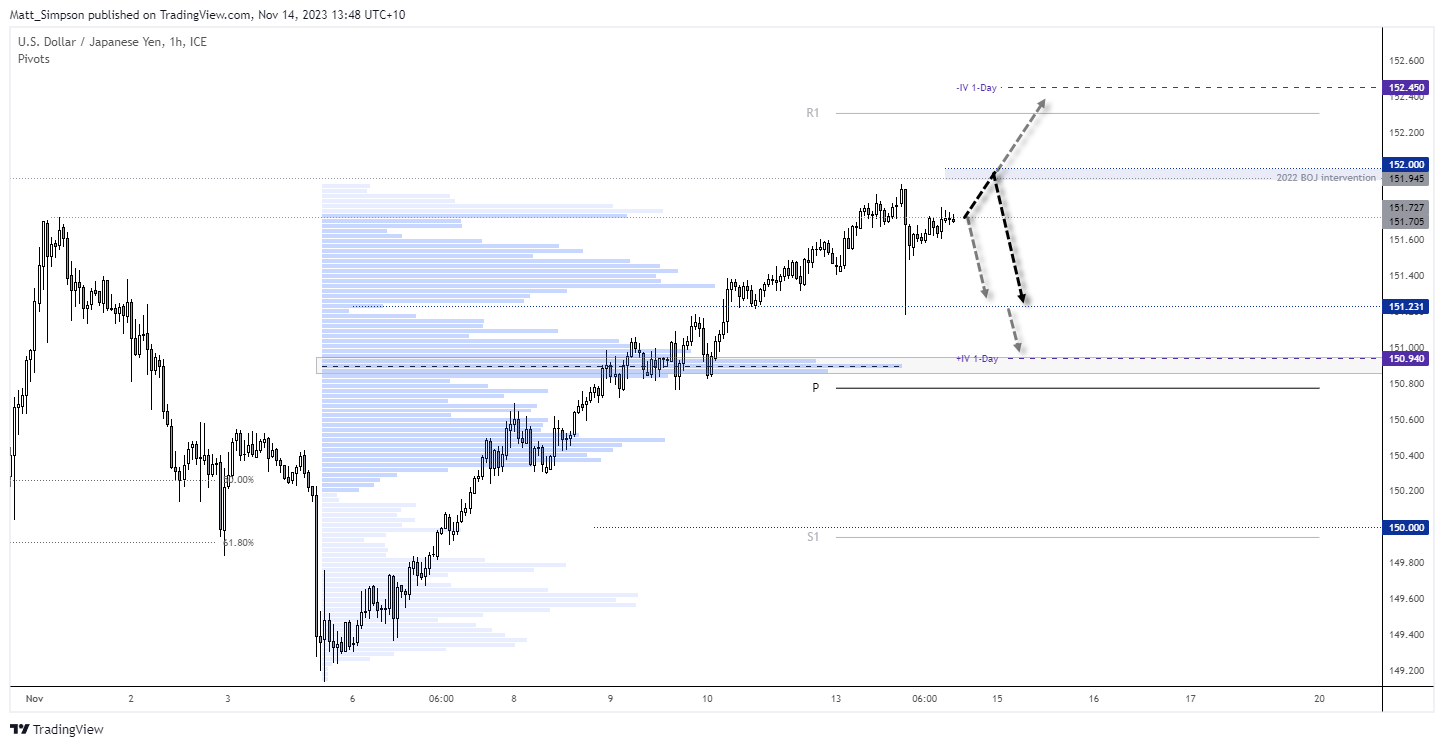

USD /JPY technical analysis (1-hour chart):

USD/JPY may have reached a 13-month high on Monday, yet its 70-pip drop suggests options traders do not want to see this higher for now. And if it does rise leading into US CPI, I wouldn’t be surprised if we saw USD/JPY selloff again around the 2022 BOJ intervention / 152 handle.

Take note that the 1-day implied volatility level is around 220% of its 20-day EMA ahead of today’s inflation report, so volatility is clearly expected.

A refreshingly soft CPI print could send USD/JPY sharply lower, although I’d expected a decent support around the 151 handle due to the high-volume node form the prior rally and the monthly pivot point just below.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade