- EUR/USD analysis: Risk-on rally weighs on US dollar

- Stronger services PMI data boosts single currency

- EUR/USD technical analysis shows rates testing a pivotal area

EUR/USD technical analysis video and insights on gold and silver

Risk on rally weighs on US dollar

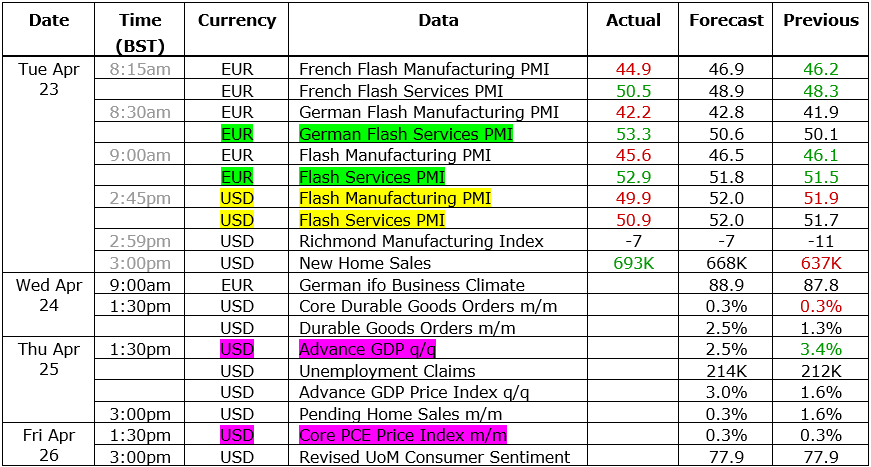

It has been a risk-on session so far, with equity indices rising sharply for the second consecutive day ahead of Tesla’s earnings tonight and other big tech companies reporting this week. Also on the rise today have been markets such as crude oil, the EUR/USD and even the GBP/USD. Sentiment was lifted by stronger PMI data from the services sector in Europe and UK, alleviating growth concerns even if the manufacturing sector PMI continued to remain depressed. The services and manufacturing PMI data from the US were far from great, however, although new home sales came in well above expectations. Still, the dollar fell amid the risk rally, which also helped to fuel a recovery in gold, silver and bond prices.

Investors will be looking forward to the release of US GDP and the Fed’s favourite inflation measure later in the week (see below). Strong growth and sticky inflation data have helped to rein in on rate-cut bets in recent weeks. But judging by the dollar’s weakness today, most of the hawkish repricing may be factored in by now. Thus, if we start to see weakness in US data again, then this will reduce recent concerns over the Fed’s ability to cut rates. The market has scaled back rate cut expectations considerably since the start of the year.

EUR/USD analysis: why is euro finding support today?

I think investors have welcomed the improvement in the services sector PMI, which is doing the heavy lifting, as manufacturing activity again contracted. There's evidence of inflation picking up in services sector, which to be fair is not the same levels as at the start of the year. Nevertheless, the further improvement in the services sector PMI point to improved economic conditions, yet this won't deter the ECB from cutting rates. The prospect of a stronger economy is therefore what the euro traders have focused on with the single currency bouncing back. The strength of the euro can also be observed in some popular euro crosses like the EUR/JPY, which today broke to a new multi-decade high above 165.50. All told, the risks on the EUR/USD still remain tilted to the downside as the Fed won't hasten in cutting rates this year. But if we see further improvement in eurozone data or weakness in US data then we could see the onset of a rally.

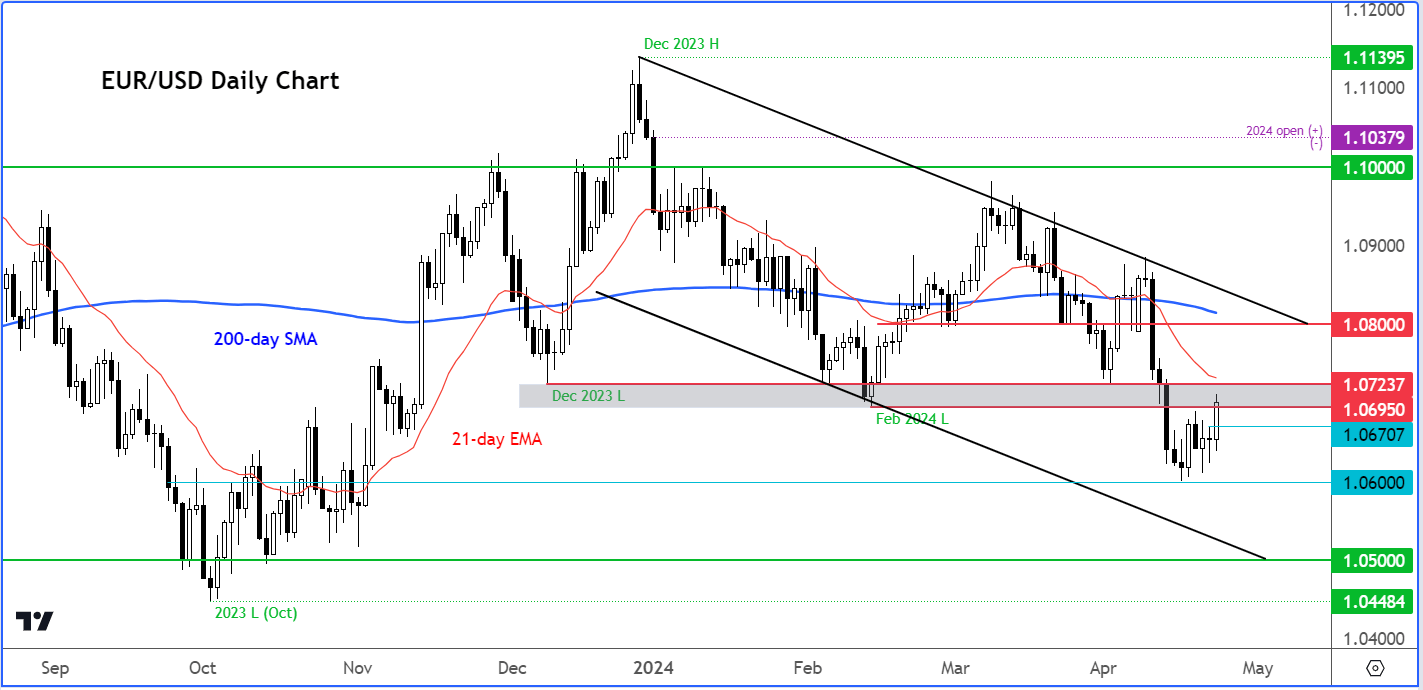

EUR/USD technical analysis

Source: TradingView.com

At the time of writing, the EUR/USD was testing a pivotal technical area around 1.07 handle, or more specifically in the 1.0695 to 1.0795 range. This area was support back in December and again in February, before giving way earlier this month. A potential recovery above this zone would therefore be a positive technical development for it will point to a possible false break scenario. Support comes in at 1.0670 initially ahead of 1.0600 thereafter.