What to expect from the OPEC+ meeting?

The OPEC+ group will meet on Thursday to decide production levels for May. The group meets as oil prices remain well over $100, and volatility shows few signs of easing.

The broad expectation is that OPEC+ will stick with the pr-agreed production quota increase of 400,000 barrels per day. Even if the group did decide to increase the output quota, they are unlikely to reach the new upwardly revised output levels. So far, the group has failed even to match the current 400,000 bpd increase, let alone anything higher.

Oil prices rose to a high of $139 in early March before easing to current levels around 106.00. 3% daily swings have almost become the norm as the markets digest sanctions, oil supply fears, and demand concerns as Shanghai goes into lockdown.

Russian exports drop

The latest data shows that Russia’s oil exports dropped 26% to 3.63 million barrels a day last week. While just the US and UK have placed embargos on Russian oil, many buyers in Europe and the West have tried to avoid Russian shipments amid concerns of embargos and or sanctions.

Little interest from OPEC+

OPEC+ has shown little interest in coming to the market’s rescue, despite pleas from the G7, IEA, the UK, and the US. While the US and its allies consider releasing more strategic oil reserves to help ease prices, this is only a short-term fix. A more substantial and longer-term release of oil is needed to bring prices lower.

The UAE’s ambassador to Washington created some hope earlier in the month when he said that the UAE favours production increases. However, this was quickly followed by the UAE highlighting Russia’s pivotal role in the OPEC+ group, suggesting that OPEC+ will continue to look for Russia’s support at decision-making time.

OPEC+ is likely to stick to the belief that there is sufficient oil in the market and that the recent surge in prices is not a supply issue but a geopolitical issue that is not OPEC’s to resolve.

The two big players in OPEC, Saudi Arabia, and the UAE, that have the capacity to boost production significantly, are unlikely to do so without the group's support because that would violate the OPEC agreement, and it pretty much goes without saying that Russia would be against such a move.

Without more oil coming to the market, oil prices are likely to remain elevated. OPEC+ is unlikely to be the catalyst to send oil prices lower. Progress in peace talks or a cease-fire would help oil prices fall, as would further lockdowns in China, which would hit the demand side of the equation.

Where next for oil prices?

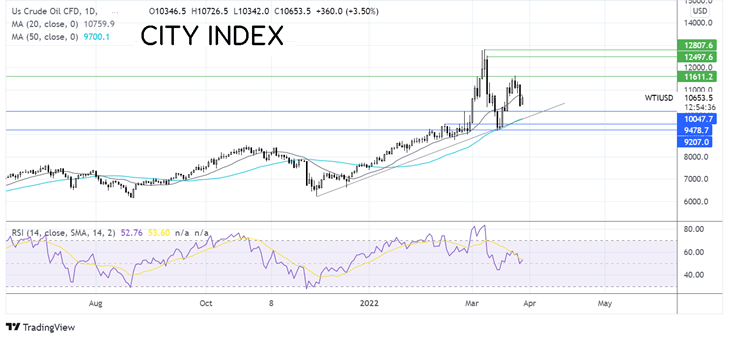

Oil prices rebounded higher off the 50 sma at 92.30 before running into resistance at 116.30 last week. The price has since fallen lower, below the 110 psychological level but remains above 100.

The RSI is just over 50 but below the 14-day moving average. Buyers would need to move above the resistance of the 20 sma at 107.50 in order to open the door to 110 the psychological level and 116.30, above here the price would create a higher high and could see the bulls gain moment.

Sellers could run into support at 100.00 but the real test would be the 50 sma at 97.70. Oil has traded above its 50 sma since the beginning of the year.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.