- Dollar analysis: Dollar index resumes higher after breather

- Government bonds, gold and crude oil rise on Israel-Hamas conflict

- USD/CNH on watch with key data from both US and China to come

Welcome to another edition of Forex Friday, a weekly report in which we highlight selected currency themes.

Government bonds, gold and crude oil rise on Israel-Hamas conflict

The key theme on Friday has been this: geopolitics is driving everything right now. Safe haven gold was up $35 per ounce on the session, crude oil prices had risen nearly 4% and yields were lower amid haven flows into government bonds. Worries that Israel is preparing for a ground invasion of Gaza has sharply raised geopolitical risks in the region. If the situation escalates over the weekend, then watch out for more gaps to emerge at the Asian open next week.

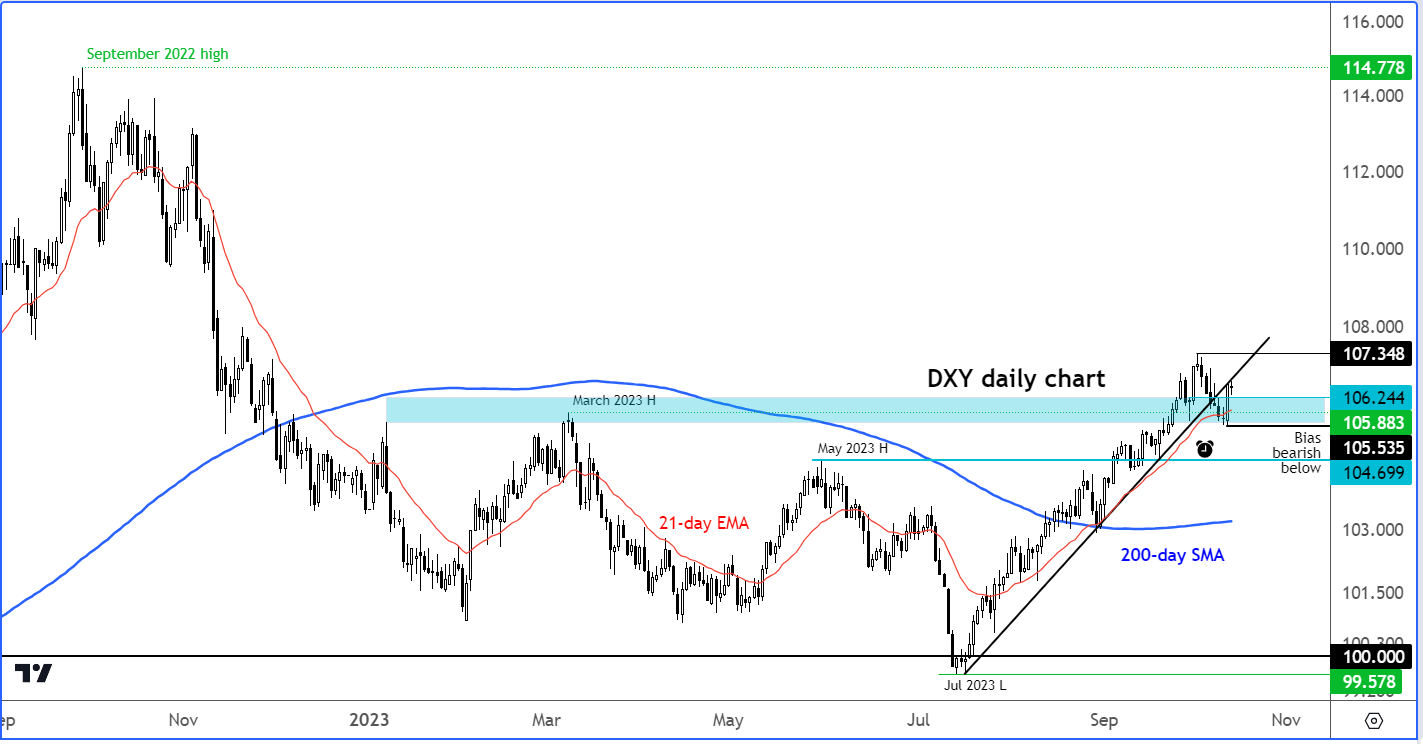

Dollar analysis: Dollar index resumes higher after breather

After pausing for a breather last week, the Dollar Index looks set to finish higher again, driven by have flows. Not even a sharply weaker UoM consumer sentiment survey (63.0 vs. 67.2 expected, and 68.1 last) was able to arrest the dollar’s rally. Perhaps it was the inflations expectations survey that helped to fuel the latest rally in the dollar. The 1-year inflation expectations rose to 3.8% vs. 3.2% previously, while the longer-term 5–10-year index was 3.0% vs. 2.8% prior. Elevated inflation expectations are not something the Fed wants to see, but it is a function of rising oil prices and the stickiness in CPI inflation. It looks like the dollar bears came out too early last week. More dollar strength should be expected for as long as risk appetite remains weak. In FX, commodity FX and the euro were all losing ground today, reflecting worries over the middle east situations.

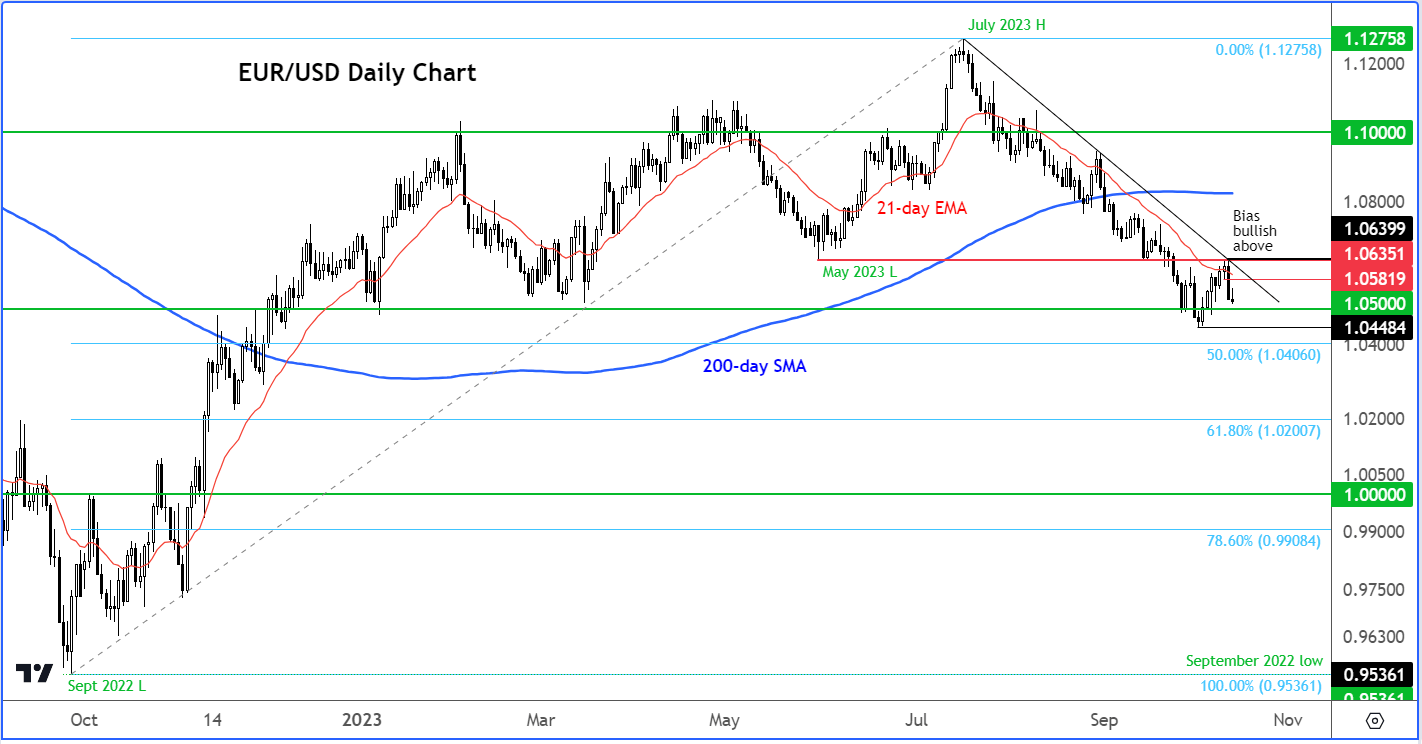

EUR/USD heading to sub-1.05?

The EUR/USD continues to lose ground following Thursday’s CPI-inspired sell-off. Support around 1.0550 area provided only temporary respite, and the pair looks like is heading down to 1.05 handle again, or even lower. While the slightly stronger US CPI data has given fresh life to the dollar’s bullish trend, inflation was not too hot to be a game-changer. But that’s not how the dollar bulls are seeing it, arguing that if anything, the latest inflation data (both CPI and UoM’s survey) support the higher for longer narrative.

Meanwhile, the economic output in the Eurozone remains very weak and the ECB has accordingly dropped its hawkish bias, albeit rates will be held at current levels for a long time yet.

This is the trouble for many foreign currencies, not just the euro. The decline in economic activity have been more severe in regions like the Eurozone and UK, than the US. This is why the dollar has remained fairly resilient, with investors reluctant to buy the euro or the pound, or the Aussie for that matter.

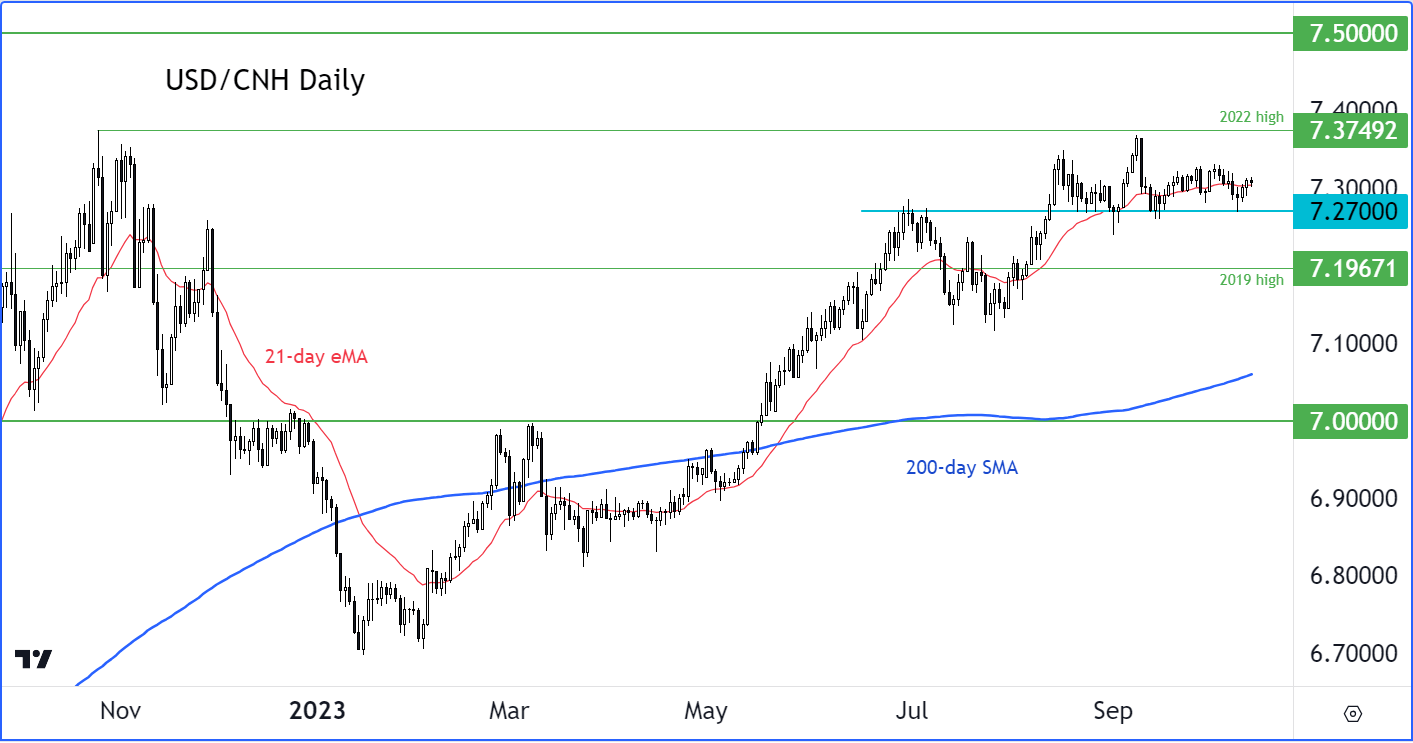

USD/CNH on watch with key data from both US and China to come

The USD/CNH has been consolidating near the previous year’s high of 7.3450. But over the next week or so, there will be lots of key data releases from both the US and China to move this pair decisively. The key support level to watch is at 7.2700. A break below this level is needed to ignite some real selling pressure. Otherwise, more gains could be on the way for the USD/CNH, like the rest of the USD/XXX pairs.

Here are some key data releases to watch next week, concerning the USD/CNH:

US retail sales

Tuesday, October 17

Us retail sales have held up relatively well in recent months, despite borrowing costs continuing to rise and price pressures remaining elevated. Concerns over interest rates remaining high for longer in the US was intense in September, but not so much in October so far with equity markets staging a bit of a recovery. Can retail sales and industrial production data (that will be released on the same day) ignite those concerns again? However, it is likely that spending is likely to fall on non-essential items, potentially causing the economy to come to a standstill in the months ahead.

Chinese GDP

Wednesday, October 18

As well as GDP, we will have industrial production and retail sales data to look forward to from the world’s second largest economy on Wednesday. Concerns over China’s struggling economy has been a key theme for much of the year, which has held back the local stock markets and the yuan, as well as some commodity prices like copper. But will we start to see some signs of stabilisation in data to arrest the underperformance of Chinese assets?

Next week will also feature a few other important economic pointers from around the world, including for example UK CPI on Wednesday.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade