DAX falls with eyes on the Middle East

- The Israel -Hamas conflict stays in focus

- German wholesale prices fall 4.1% YoY

- DAX rises from support at 15130

The DAX is starting the week on the back foot following a 1.5% fall on Friday as investors watch developments in the Middle East cautiously and as Brent crude holds firmly above $90 a barrel.

Attention will remain on the Israel-Hamas conflict amid concerns that it could spill across the borders. Iran in particular, has warned of regional escalation if the attacks continue.

While the mood has improved today compared to Friday, investors will keep an eye on oil prices, which jumped over 5% on Friday. High oil prices fuel inflation concerns how may support policymakers' tone of keeping interest rates higher for longer, which is bad news for equities.

On the data front German wholesale prices fell by 4.1% year on year in September, dropping to the lowest level since the pandemic, signaling a weakening demand environment. The data comes after German industrial output declined for a fourth straight month in August, falling 0.2%. The data raises concerns over the outlook for the eurozone's largest economy.

Looking ahead, the eurozone trade balance is expected to show a widening from €6.5 billion to €12.5 billion in August.

ECB president Christine Lagarde is also due to speak later, and any comments regarding the economic outlook or the future path for interest rates will be watched closely.

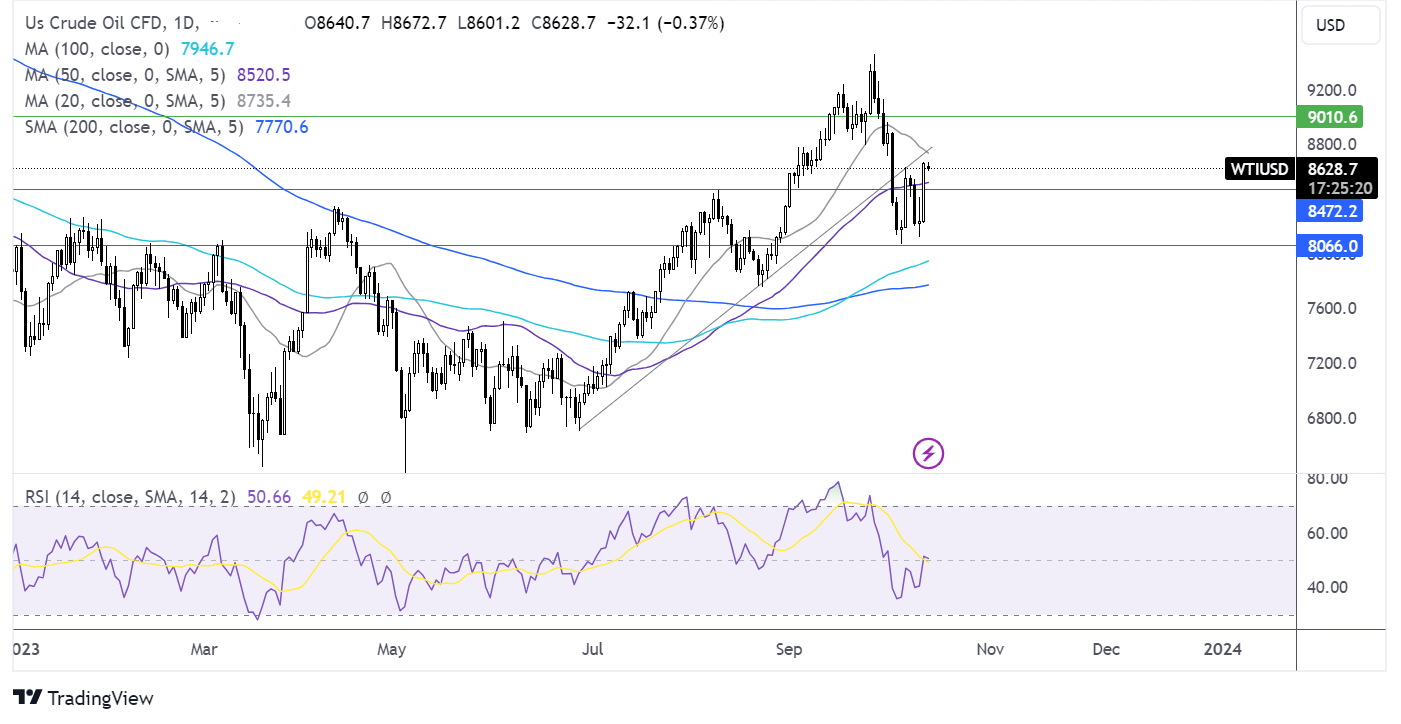

DAX forecast – technical analysis

The DAX continues to trade below its 50, 100 and 200 sma and falling trendline. The price ran into resistance at 15575 last week and fell lower, finding support on Friday at 15130.

Sellers could be encouraged by the 50 sma crossing below the 200 sma in a death cross bearish signal. Sellers will need to take out 15130 to extend the bearish trend toward 14945, with a break below here creating a lower low and opening the door to 14800, the March 27 low.

Should buyers successfully defend 15130, there are several obstacles to overcome. A rise above the 20 sma at 15350 and last week’s high of 15575, exposes the 200 sma and the confluence with the falling trendline at 15675. Above here. 15860 comes into play.

Oil holds onto Friday’s gains

- Oil rose 5% on Friday & holds most of those gains

- Middle Eastern developments are in focus

- Oil needs to rise above 86.70 to create a higher high

Oil is edging modestly lower but holds on to the majority of Friday's gains as traders continue to watch developments in the Middle East to see if the conflicts draw in oil rich nations. This would be a development that could potentially boost oil prices higher.

Investors are weighing up and trying to understand the impact of the conflict as troops amass on the Gaza borders. While Israel itself is not a big oil producer, there is potential for other oil-rich countries, such as Iran to become more involved.

Iran has warned that it will intervene if Gaza operations continue and warned through the UN against a ground offensive in Gaza, saying that the situation could spiral out of control with far-reaching consequences.

Amid concerns of the conflict escalating, US Secretary of State Antony Blinken returns to Israel today to talk about the way forward. However, the oil price is likely to remain supported until there is a de-escalation in the conflic and tensions in the Middle East.

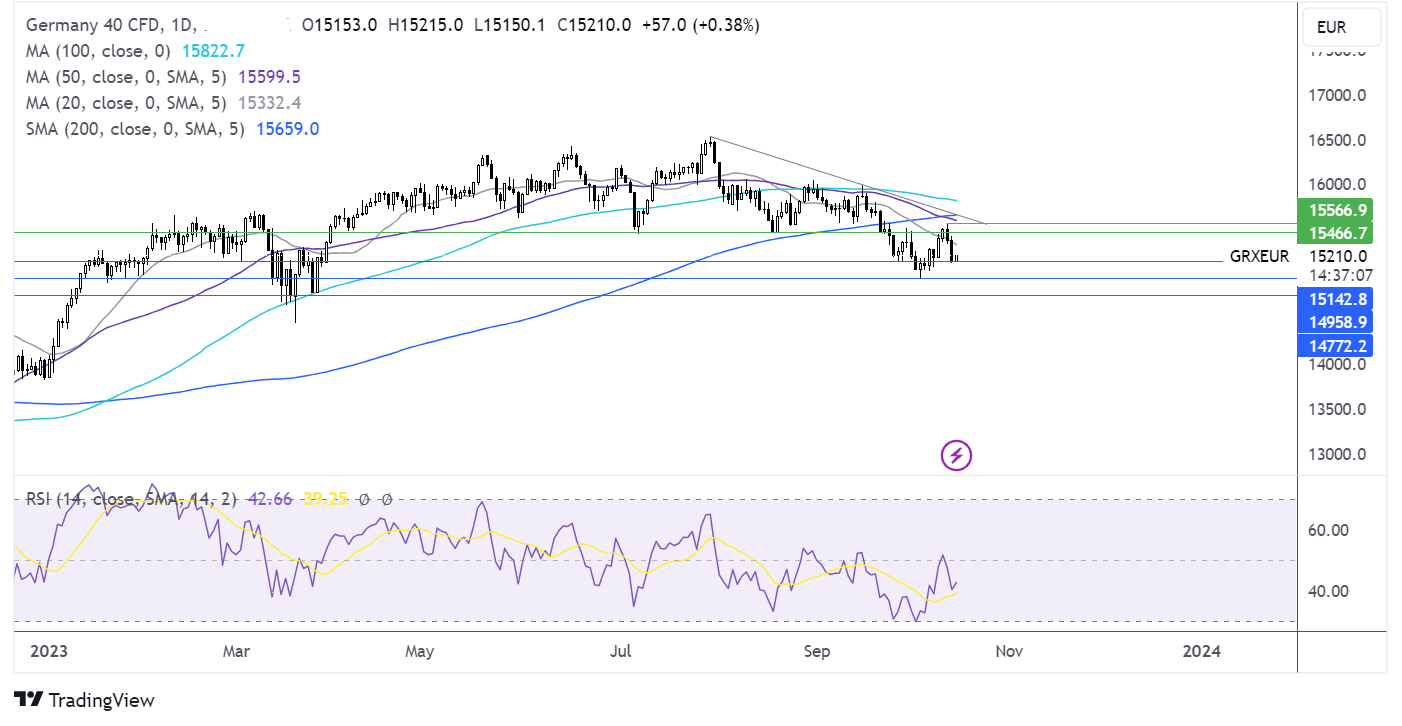

Oil forecast – technical analysis

Crude oil surged above the 50 sma to test resistance at 86.70 on Friday. A rise above this level is needed to test the 50 sma and rising trendline resistance at 87.30. Above here, 90.00 the psychological level comes into play.

On the flip side, failure to rise above 86.70 could see sellers test the 50 sna at 85.20 ahead of the August high of 84.60. A fall below here opens the door to 81.20 last week’s low and 80.70 the October low.