If we look at the percent rank (PR) table, we can quickly see how sentiment sits within a near, medium and longer-term timeframe. Although it does not necessarily mean a particular market is net long or short in aggregate. Having looked across the key markets we track, we following observations stand out.

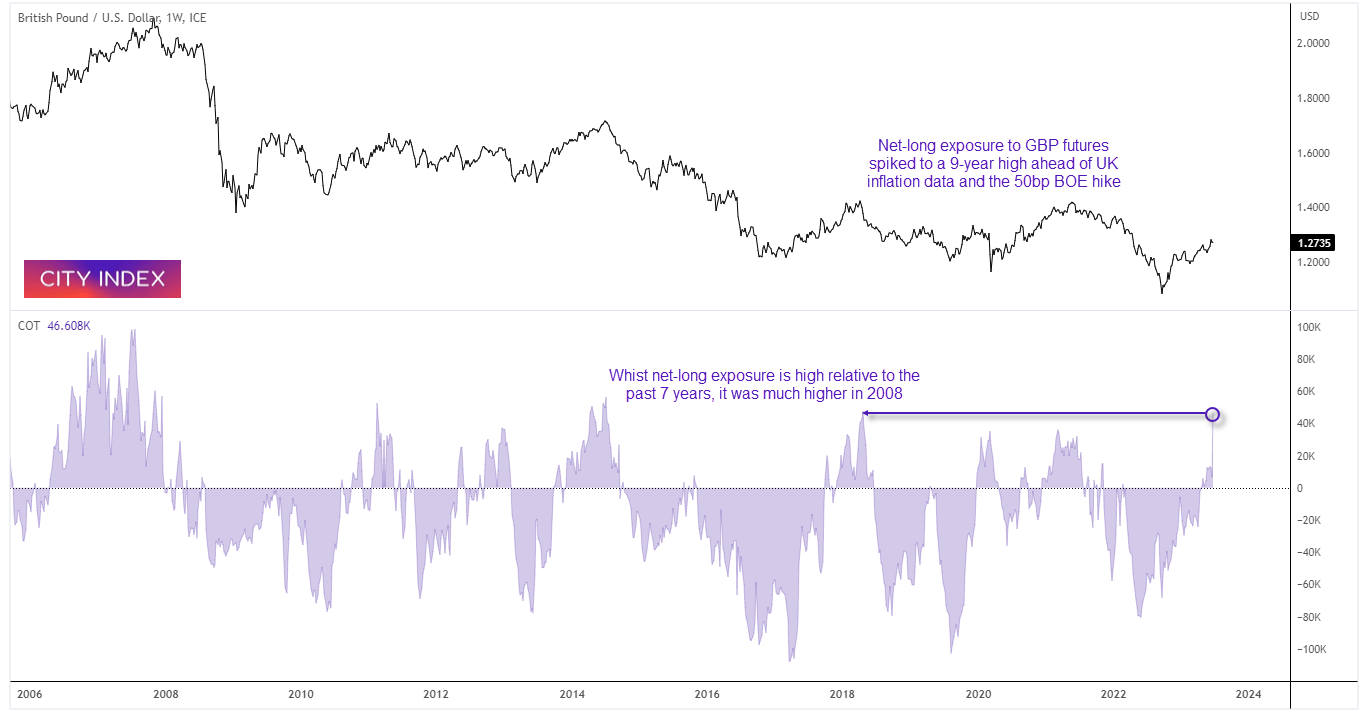

GBP/USD futures saw an acceleration of bullish bets ahead of UK CPI and BOEs infamous 50bp hike, 3-month, 1-year and 3-year all at their range highs of 100%. Large speculators remain bearish on JPY/USD futures with the 3-month, 1-year and 3-year percent rank at or just above 0%. Traders are less bearish on the Canadian dollar, with the 3-month PR near its range highs, the 1-year above 50% and the 3-year retracing off of its range lows.

Traders remain very bearish on US bonds, with positioning on the 2-rear note at its range lows for all three timeframes, although the 3-month for the 10-year is within the lower quarter of its respective range.

Commitment of traders (forex) – as of Tuesday 20 June 2023:

- Net-long exposure to GBP/USD surged to its highest level since April 2018

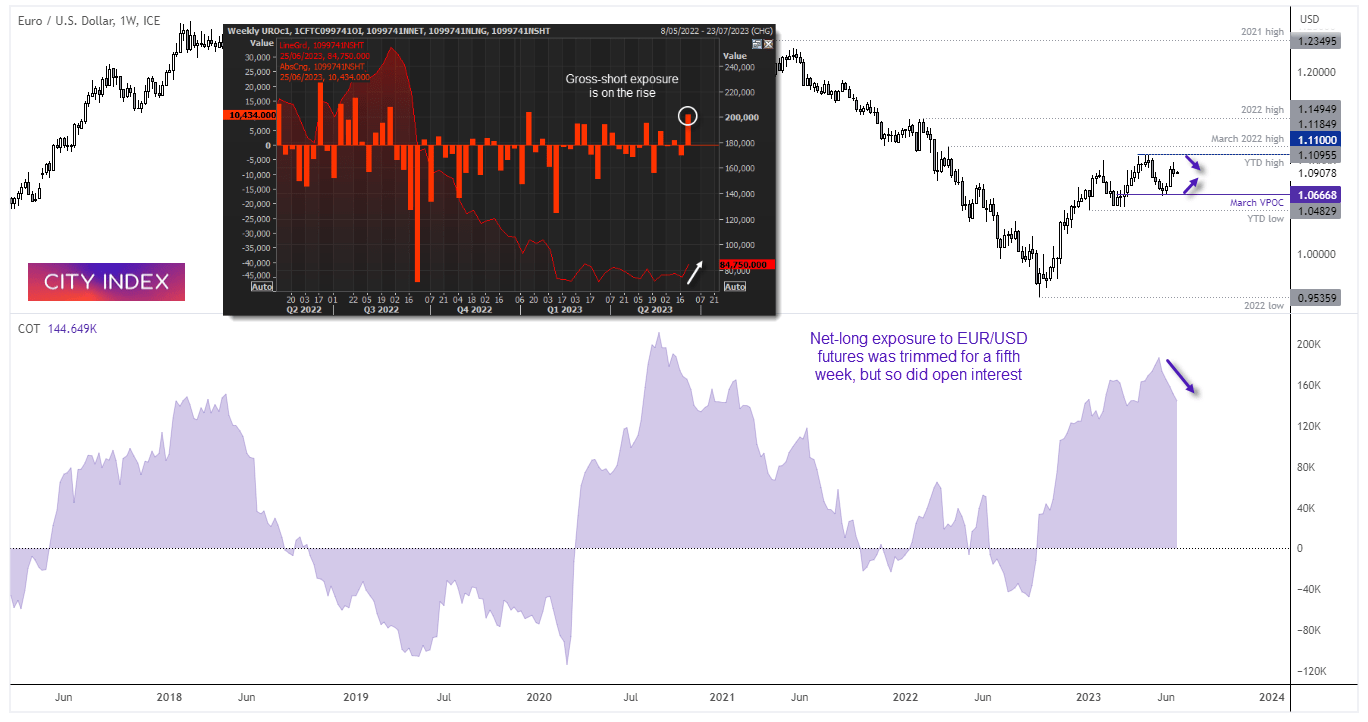

- Net-long exposure to EUR/USD futures fell for a fifth week

- Traders increased their bet-long exposure to DXY futures (USD index) to a 20-week high

- Large speculators increased gross-long exposure to CAD futures by 81.4% (+12.6k contracts)

- Traders increased their net-short exposure to JPY futures to a 58-week high

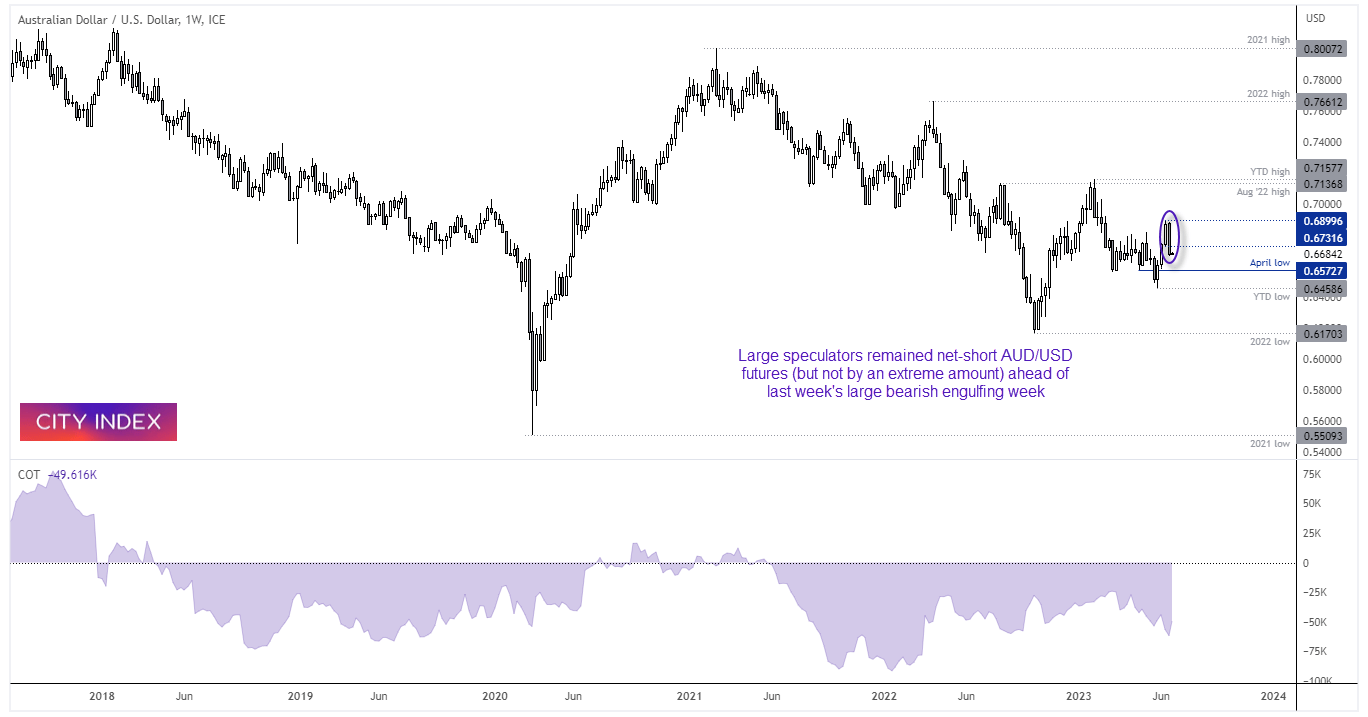

- Open interest for AUD/USD futures fell for a second week, and at their fastest weekly pace in six months

Euro dollar futures (EUR/USD) – Commitment of traders (COT):

Net-long exposure for EUR/USD futures was trimmed for a fifth consecutive week, having reached a sentiment extreme of bullish exposure despite falling prices. Interestingly, prices have actually risen over the past three weeks despite net-long exposure falling. It was a reduction of long exposure which dragged on net-long positioning, but we also note that 10.4k short contracts were added last week – which was its largest weekly gain in 23 weeks, even if short interest remains at relatively low levels. Due to the time of year (summer in the US), signs of deflation across Europe and markets not quite believing the Fed could hike two more times this year, we may find that EUR/USD trades within a range over the coming weeks.

British pound futures (GBP/USD) – Commitment of traders (COT):

Bullish bets on the pound accelerated over the past two weeks, but even more so last week ahead of UK CPI data and the BOE’s 50bp hike. Net and gross-long exposure for large speculators surged to their most bullish level since April 2018, yet open interest for all GBP/USD futures trades on the front month plunged at its fastest pace since June 2018. As GBP/USD actually closed the week lower, it would seem that large speculators bought the rumour and sold the fact, whilst investors in general are wary that the increased pace of BOE tightening is going to trigger a hard landing for the economy. We’ll have to wait for next week’s report, but I would suspect that gross-shorts took quite a hit.

Australian dollar futures (AUD/USD) – Commitment of traders (COT):

In last week’s report we wanted that open interest had declined by a noteworthy amount despite a 3-week rally on AUD/USD, which warned that both bulls and bears were having doubts about AUD/USD’s direction. Hawkish central banks, weak PMIs and inverted yield curves saw spurred risk-off trade and made AUD the weakest FX major last week, which suggests 0.6900 could be a key seeing high. An initial move to the April low seems feasible, a break of which brings the YTD low in to focus. A key inflation report is released for Australia on Wednesday which could drive AUD sentiment.

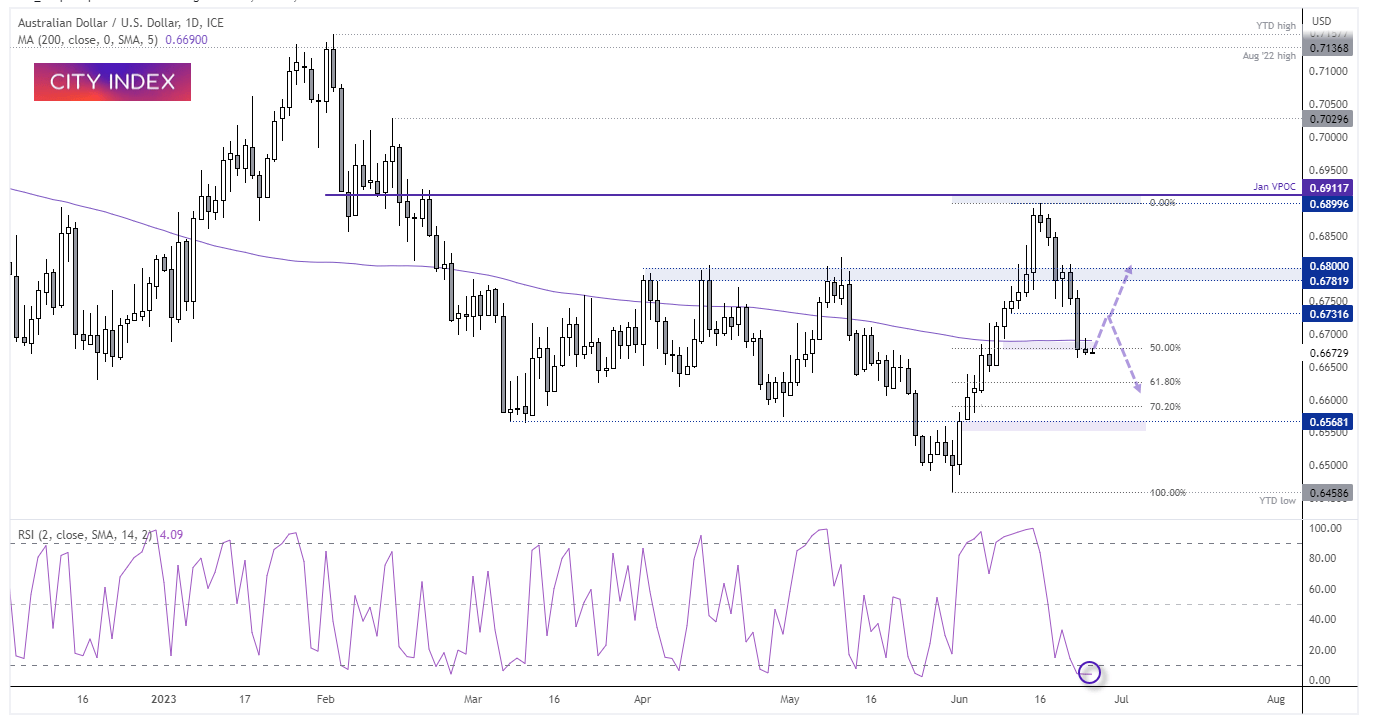

AUD/USD daily chart:

Risk-off trade stemming from inverted yield curves and hawkish central banks has seen AUD/USD fall just under -3.5% from its June high, after its rally faltered just beneath January’ VPOC (volume point of control, or the most traded price by volume in January). Support has been found around the 50% retracement level, although the 200-day MA capped as resistance yesterday during low-liquidity trade. Whilst this is a big level to break, we can expect some volatility around it before its next directional move occurs. And as we suspect indices and other ‘risk assets’ such as AUD/JPY are oversold over the near-term, we see the potential for a technical bounce. RSI (2) is also oversold to suggest a near-term oversold condition.

- A break above yesterday’s high / 200-day AM assumes an initial move to 0.6730 as part of a technically-riven retracement against the preceding move

- If appetite for risk improves (with indices and AUD/JPY trading higher) then the 0.6800 resistance zone comes into focus for bulls

- We may need to see a strong Australian inflation report tomorrow for it to break above this key level, given it marks the resistance area which formed when the RBA paused their tightening cycle in April

- Bears could look for swing high around 0.6700 or 0.6800 in anticipation for a move lower towards 0.6600 / 0.6570 lows

- If risk-off ensues, the downside more likely prevails

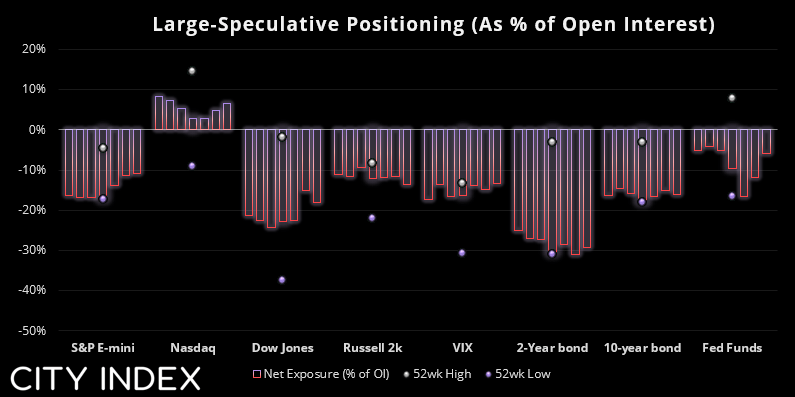

Commitment of traders (indices, bonds) – as of Tuesday 20 June 2023:

- Traders reduced exposure to S&P 500 and Nasdaq futures with open interest falling ~23% for both futures markets

- Large speculators trimmed net-short exposure to 30-day Fed Fund Futures for a second week (less-hawkish expectations)

- Whilst net-short exposure for the 2 and 10-year bond futures declined, it is from a record bearish level gross exposure for both was increased (which points to bullish yields)

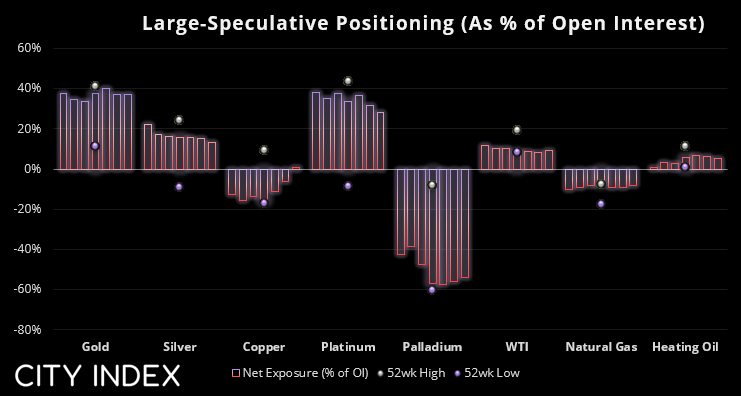

Commitment of traders (commodities) – as of Tuesday 20 June 2023:

- Traders flipped to net-long exposure to copper futures, with gross shorts falling for a third week

- Large speculators flipped to net-long copper futures

- Traders decreased their net-long exposure to platinum futures by -11.4%

- Open interest was trimmed for WTI crude, natural gas and heating oil futures

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade