At the recent FOMC meeting, Chair Powell signalled that follow up 50bp rate hikes were likely at the June and July meetings. This means we are now just four weeks away from the Fed’s next 50 bp hike and two weeks away from the start of QT.

As viewed last week, US dollar strength has not only been about the expectations around the Fed’s aggressive rate-hiking cycle. The anti-cyclical U.S dollar has gained support as the slowdown in the Eurozone and China has become more concerning.

Woeful Chinese activity data released today has only fuelled China's slowdown concerns, following Chinese authorities’ dogmatic pursuit of a "Covid-zero" strategy on top of lingering headwinds from last year's regulatory reset.

After today’s soft activity data, a GDP print in the mid 3’s is possible for 2022, well below policymakers 5.5% target and less than half of last year's 8.1% growth rate.

To ease growth concerns, the National Bureau of Statistics released a statement today that "The impact of COVID 19 was temporary, and the economy was expected to stabilise and recover."

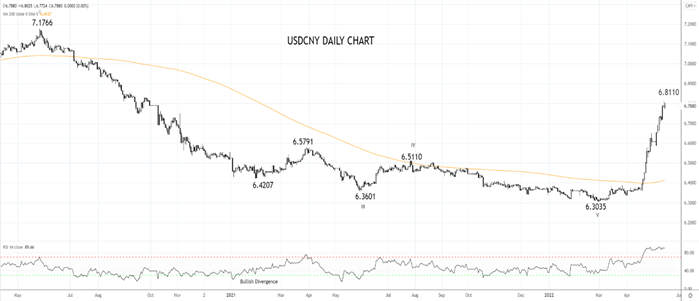

However, the price action in USDCNY told the real story. USDCNY rallied back above 6.8000, 7% higher than the 6.4000 level it was trading at just under one month ago.

Because Covid lockdowns erode the effectiveness of policy easing, the only effective lever for Chinese policymakers to pull currently is to let the CNY fall.

As such, we like buying USDCNY. However, as the rally is now overbought the preference is to buy dips back to 6.70, with a stop loss placed at 6.57. The target is a move to 6.95.

Source Tradingview. The figures stated are as of May 16th, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade