View related analysis:

Bitcoin forecast: BTC could retest $70k before its next leg lower

Bitcoin falters at $70k yet again, volatility could be set to remain

Bitcoin bulls eye record highs - but we could see some ‘chop at the top’

In recent articles I highlighted the tendency for Bitcoin to enter a multi-week period of choppy trade when it gunned for $70k. And it is safe to say we have seen that pattern repeat, after a hyperbolic rally to a new high. Admittedly, Bitcoin has made more of an effort to stay above $70k this time around, but that doesn’t mean it I set to simply rally to $100k from here in a straight line.

Ultimately, Bitcoin has a long history of sucking in bulls and then spitting them out before entering corrections of up to 80-90%. I very much doubt such a correction is now on the cards given the institutional activity apparent on the Bitcoin futures market, but bulls should still be wary of a correction from here – even if it looks like it wants to set a new high.

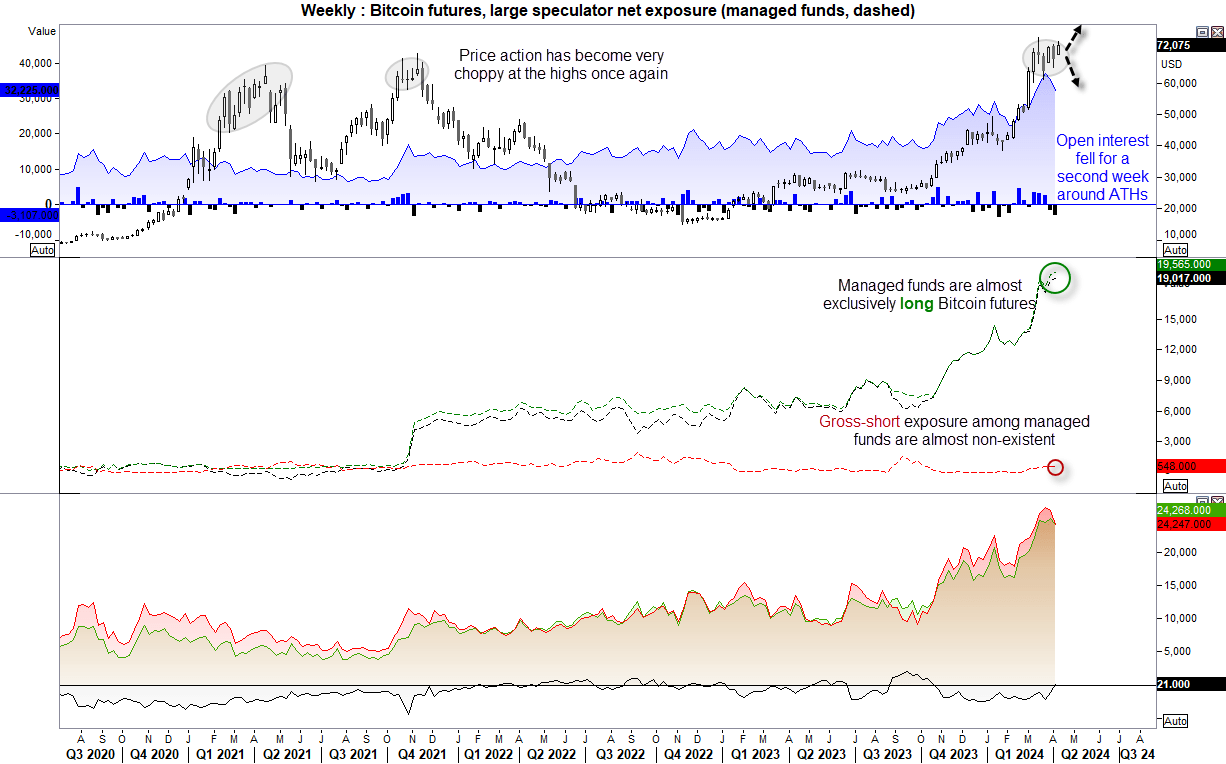

Bitcoin CME futures market positioning (from the weekly COT report, CME):

I have been studying COT data for currencies for well over a decade, and I’ll have to admit that I am still deciding whether market positioning data for Bitcoin adds any value. Net-log exposure among managed funds is almost exclusively made up of log bets, with short contracts being outnumbered by longs at a rate of 35.7:1. Yes, that sounds like a sentiment extreme. But we don’t really have a lot of data to compare this too, which makes it difficult to say with confidence that there are too many bulls relative to bears.

Yet we have a different problem with large speculators who seem to be well hedged throughout. This set of traders flipped to net-long exposure last week for the first time since last October. Yet a glance at gross longs and shorts show that they tend to move in tandem, which again makes it less reliable for a sentiment indicator.

However, open interest has fallen for a second consecutive week which suggests some nervousness at these highs. And if volumes continue to deplete, the bullish rally becomes harder for the remaining bulls to support.

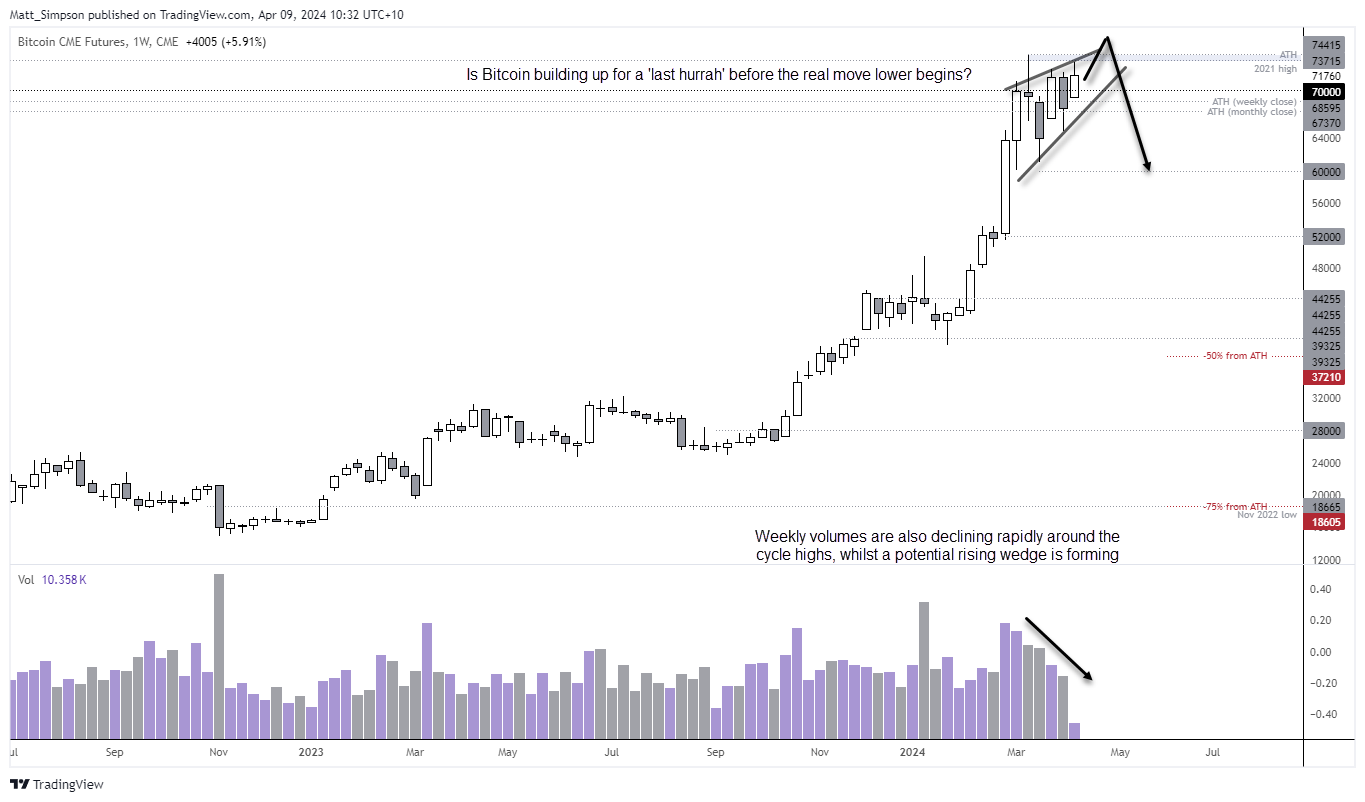

Bitcoin futures technical analysis (weekly chart):

The bullish trend on the weekly chart remains intact, yet the characteristics of price action have clearly changed since it reached $70k in late February. The weekly ranges are mostly overlapping whilst they grind higher, which to my eyes is reminiscent of the earlier stages of a topping pattern.

I have highlighted a potential rising wedge, but such patterns require lots of flexibility. I would not be surprised to see another surge higher to a record high before prices slam back down, so the wedge lines are there to show my thinking – but not to be strict lines for prices to respect as the traditionally messy pattern plays out.

Regardless, the downside target would be around the base of the pattern, just above $60k.

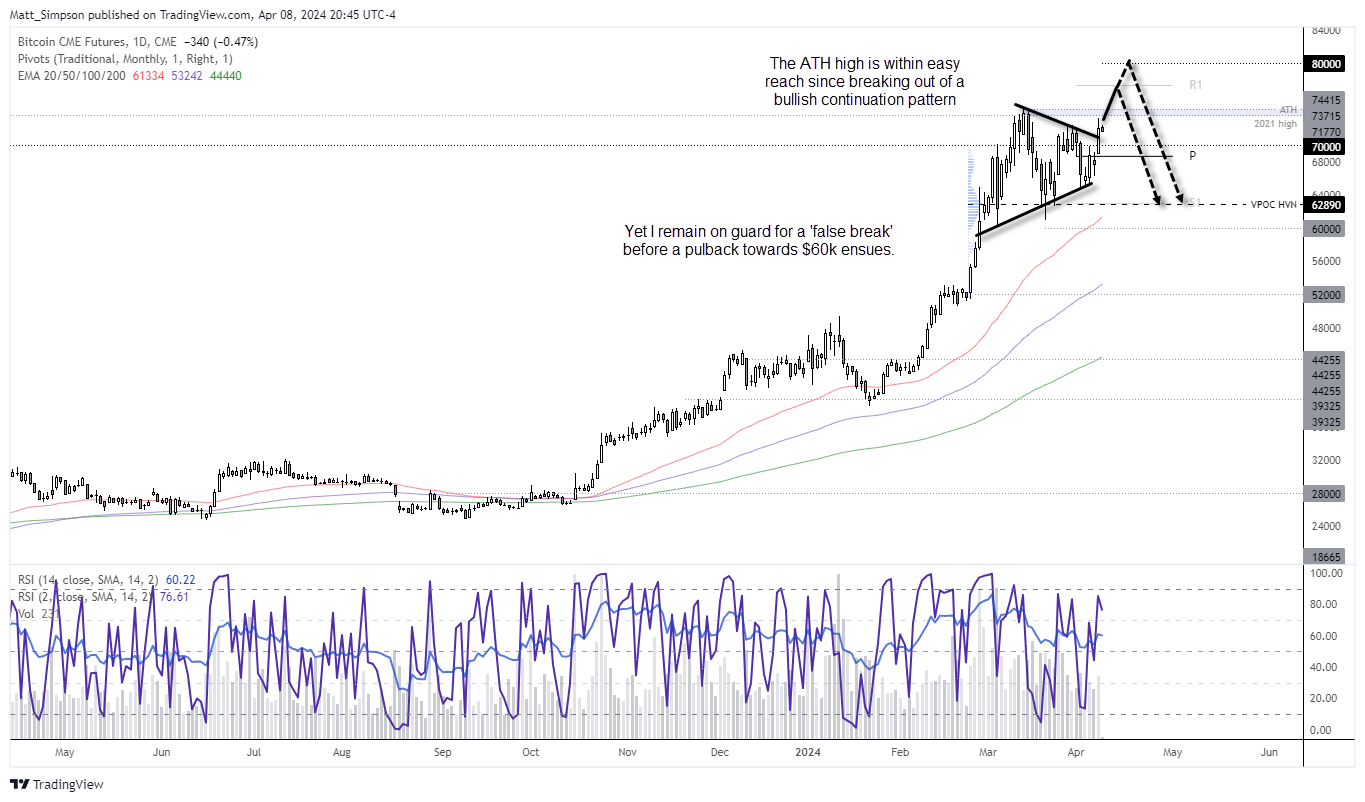

Bitcoin futures technical analysis (daily chart):

The daily chart shows a bullish continuation pattern, which was confirmed with Mondays bullish range expansion candle. It trades less than a day away from the ATH set in March, and I suspect a real possibility it might be challenged and broken to the upside. Bulls will clearly have $80k in their sites, and if bullish momentum is sustained then I see no real point fighting the trend.

However, given Bitcoin’s history of ‘chop at the top’ around $70k, the bias remains for any such bullish breakout to be a ‘last hurrah’ and false move, before a move down to $60k.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade