- China’s PMIs for November missed economist expectations

- The data will undoubtedly intensify chatter about the need for policymakers to deliver more stimulus to the economy

- Market reaction has been muted ahead of US PCE inflation and a speech from Jerome Powell

Chinese economic activity is nearing stall speed with the government’s purchasing managers indexes (PMIs) falling further in November, surprising markets to the downside for a second consecutive month. But as is so often the case when China’s economy is underperforming, the result will only add to speculation that policymakers need to deliver more meaningful stimulus measures.

Manufacturing activity contracted at a faster pace than October, declining to 49.4 from 49.5, below the 49.7 level expected. Non-manufacturing recorded the weakest expansion this year, slowing to 50.2. That was down from 50.6 and a big miss on the 50.9 number forecast by economists.

For those who have not come across PMIs before, a 50 readings signals activity levels were unchanged from a month earlier. Any figure below 50 indicates activity levels declined while a print above 50 suggests activity levels improved. The further away from 50, the greater the breadth of the decline or expansion in activity.

While China’s manufacturing PMI has spent plenty of time below 50 in the past, reflecting the nation’s transition to a more services-based economy, the non-manufacturing PMI has not, falling into contractionary territory for the first time during the coronavirus pandemic. That suggests that outside of extreme events, the 50.2 figure for November is arguably one of the weakest on record.

The November surveys conflict with remarks from Pan Gongshen, Governor of the People’s Bank of China (PBOC), who suggested earlier that there were green shoots emerging in China's PMIs. These results are more akin to withering rather than green shoots, painting a picture of extreme sluggishness in the Chinese economy as it attempts to move away from construction-led growth that acted to juice economic growth for decades until recently.

The reaction in Chinese and China-aligned markets has been negligible following the data, only acting to reinforce the belief more stimulus measures will be forthcoming. There are arguably more important data events ahead with US core PCE inflation, jobless claims, a speech from Federal Reserve of New York President John Williams and inflation figures from the eurozone released later in the session.

AUD/USD dipped marginally in response to PMI, sandwiched between horizontal support around .6600 and downtrend resistance located near .6660.

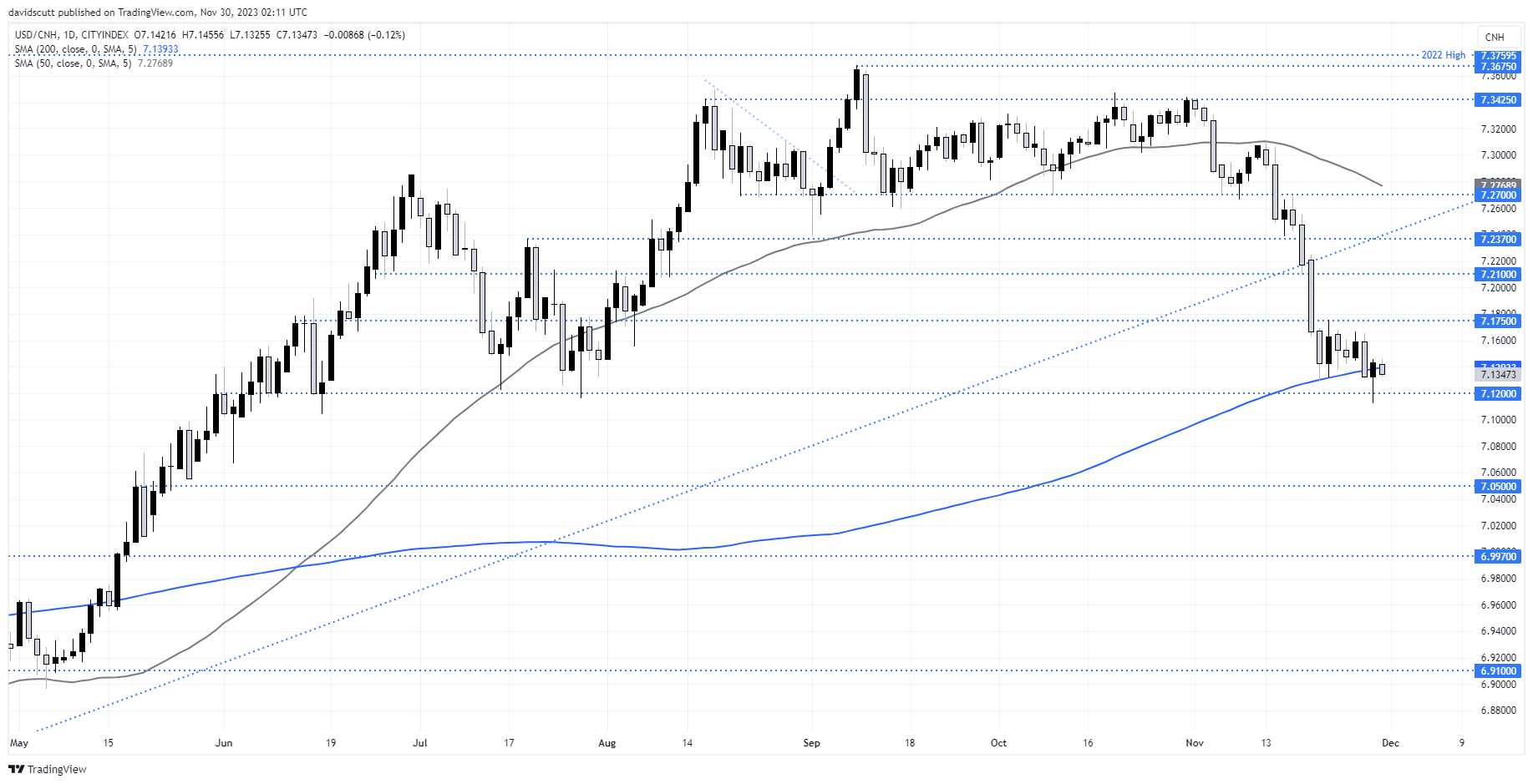

USD/CNH barely flickered in response, with markets more attune to shifts in US bond yields which are continuing to grind lower in Asia, putting Treasuries on track to record the strongest monthly gain dating back to the 1980s, according to Bloomberg’s aggregate index.

USD/CNH attempted to break horizontal resistance on Wednesday having cleared the 200-day moving average, although the dip was quickly bought resulting in a bullish hammer candle. The pair remains wed to the 200DMA for the moment.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade