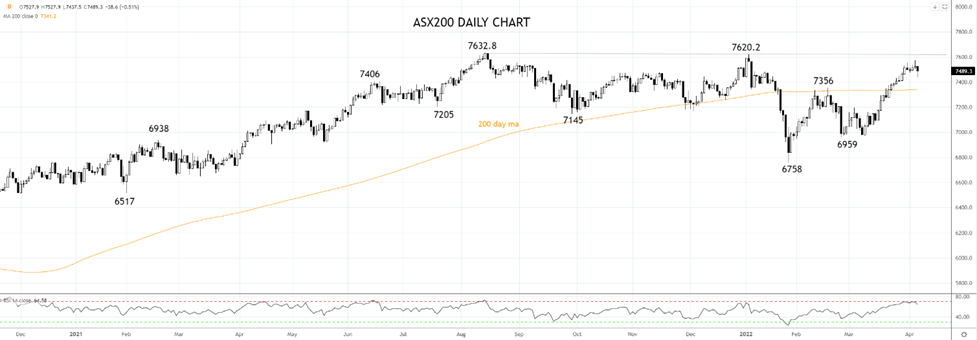

The ASX200 closed 38 points lower this afternoon at 7490 after dip buyers emerged mid-morning to take advantage of a sharp 90-point sell-off shortly after the open.

The early sell-off came following hawkish Fed speak overnight, this time from the usually reliable dove Fed Governor Brainard, ahead of the release of March FOMC Minutes tomorrow morning.

Brainard’s hawkish comments saw US 10-year Treasury yields surge by 15bp to 2.55%, their largest one day rise since March 2020, after being as low as 1.66% just one month ago.

The rally in yields has continued during the Asian session, causing problems for the local IT sector. Afterpay owner Block (SQ2) fell 6.88% to $178.27, Life 360 (360) fell 5.52% to $5.48. Zip Co (Z1P) fell 4.53% to $1.48, Megaport (MP1) fell 3% to $13.67. While Xero (XRO) fell 2.9% to $104.88.

The prospect of the EU phasing out Russian coal imports after war atrocities in Ukraine has sent local coal stocks soaring. New Hope Coal (NHC) added 6.92% to $3.71. White Haven Coal (WHC) added 5.53% to $4.39.

A lockdown affected softer China PMI print has weighed on the big miners. BHP Group (BHP) fell by 1.04% to $51.41, Rio Tinto (Rio) fell by 1.16% to $118.85. Fortescue Metals (FMG) fell by 0.28% to $21.66. Mineral Resources (MIN) added another 1.14% to $60.35 in response to surging global lithium demand.

The big banks have continued to ride the wave of higher interest rates. Commonwealth Bank (CBA) added 1.35% to $105.71, National Australia Bank (NAB) added 1.18% to $32.56. ANZ added 1.18% to $27.36, Westpac (WBC) added 0.79% to $24.24. Bucking the trend Macquarie Bank (MQG) fell 0.93% to $205.14.

Oil stocks have fallen as crude oil fell holds around $102.00 p/b after the American Petroleum Institute (API) reported a surprise build this week in crude oil inventories. Santos (STO) fell by 1% to $8.02, Woodside Petroleum (WPL) fell by 0.56% to $33.74, Beach Energy (BPT) closed flat at $1.59.

Lithium miners were under the pump again today. Avz Minerals (AVZ) lost 6.53% to $1.15, Liontown Resources (LTR) fell 5.78% to $1.88. Pilbara (PLS) lost 5.63% to $3.35, while Iluka Resources (ILU) lost 3% to $12.04.

The AUDUSD is trading at .7592, about 20 points above its intraday low after testing and holding key support .7555 area.

Source Tradingview. The figures stated are as of April 6th, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade